Skip navigation

- Births, Deaths & Marriages

- Crime and Justice

- Social Conditions

- Information Society

- Housing and Households

- Labour Market

- Agriculture

- Building and Construction

- Digital Economy

- Enterprise Statistics

- International Enterprises

- People in Business

- Retail and Services

- Small and Medium Enterprises

- Technology and Innovation

- Tourism and Travel

- International Accounts

- National Accounts

- Government Accounts

- External Trade

- Key Economic Indicators

- IMF Summary Data Page

- Agri-Environment

- Ecosystem Accounts

- Environment Accounts

- Water and Waste Water

- General Statistical Publications A-Z of Releases and Publications Hubs & Dashboards

- Trust & Transparency

Tourism Information

What is tourism.

Tourism encompasses most short-term travel away from a persons normal place of work or residence and includes not just holiday, leisure and recreational travel, but also travel for the purposes of visiting friends and relatives, business, education, religious, health or other reasons.

The United Nations World Tourism Organisation (UN-WTO) defines 'tourism' as the activities of persons travelling to and staying in places outside their usual environment for not more than one consecutive year for leisure, business and other purposes not related to the exercise of an activity remunerated from within the place visited.

- Why is Tourism important?

Tourism is an important measure of the economic activity of the country. It helps to drive employment in a number of sectors such as hospitality and food, particularly in the locations and visitor attractions that are very popular with tourists. The revenue generated by both domestic and foreign visitors during their trip contributes to both the balance of payments and national accounts data. Organisations such as Tourism Ireland and Fáilte Ireland have a role in marketing Ireland as a holiday and business destination for both our overseas and domestic visitors.

- What does Tourism and Travel Section do?

The Tourism and Travel Section of the Central Statistics Office is the major source for tourism statistics in Ireland. Irish tourism can be categorised into three distinct markets:

- Inbound tourism (foreign tourists coming to Ireland)

- Outbound (Irish tourists going abroad)

- Domestic tourism (Irish tourists staying in Ireland)

Tourism and Travel Section collects tourism data on an ongoing basis through 3 surveys:

- Country of Residence Survey (CRS)

- Passenger Card Inquiry (PCI)

- Household Travel Survey (HTS)

Both the CRS and PCI are conducted by CSO interviewers on a continuous sample survey of incoming and departing passengers at major air and sea ports. Information provided by the CRS is published in the form of a rolling three month release titled Overseas Travel. Information provided by the PCI is published in the form of a quarterly release titled Tourism and Travel. Information provided by the HTS is published in the form of a quarterly release titled Household Travel Survey.

- What is the Country of Residence Survey (CRS)?

The Country of Residence Survey is used to provide an analysis of arriving and departing (overseas) passengers by country of residence. This survey allows the CSO to measure the number of non-Irish residents travelling into the Republic of Ireland and the number of Irish residents travelling abroad.

- What is the Passenger Card Inquiry (PCI)?

The Passenger Card Inquiry provides information on the reason for journey, area of residence, length of stay, expenditure and fare costs of visitors to Ireland and Irish visitors overseas. Type of accommodation used is also recorded for overseas passengers. The results are combined with the overall visitor estimates from the Country of Residence Survey to provide the overseas tourism and travel estimates.

- What is the Household Travel Survey (HTS)?

The purpose of the HTS is to measure domestic and foreign travel patterns involving overnight stays and associated details (expenditure, purpose of trip, type of accommodation used, average length of stay) of Irish residents. The HTS also covers all non-routine overnight trips, both domestic and foreign. The information is collected via a postal survey which is conducted on a monthly basis. Every month, over 4,600 households (or approximately 0.3% of all private households) are randomly selected from the Electoral Register, where the selection is stratified by District Electoral Division.

- What about Confidentiality?

The details given in the surveys are strictly confidential. This is guaranteed by law, under the Statistics Act, 1993. Individual details cannot be given in an identifiable form to any person or organisation.

- Who uses Tourism and Travel Statistics?

The data collected by Tourism and Travel Section is used by:

- Irish government departments

- The European Union

- Macro-economists

- Analysts and researchers with an interest in economic trends

- Other special interest groups

- Internal producers of macroeconomic estimates

- Related Information

Further information is available as follows:

- Releases, Publications and Tables

- Surveys and Methodology

Alternatively, you may contact:

Information Section Tel: +353-21-4535000 Email: [email protected]

Tourism and Travel Section Email: [email protected] .

Principal Statistics

Related links.

- What is Tourism?

Central Statistics Office Skehard Road, Cork T12 X00E, Ireland

- © 2024

- Copyright and Re-use Policy

- Freedom of Information

- Accessibility

- Data Protection & Transparency

- Privacy Statement

You can count on a rewarding career with the CSO.

Learn about our variety of roles and the benefits of working with the CSO.

Irish tourist 'is sexually assaulted before having €8,000 Rolex ripped from her wrist' in Italy

The man claims he stole the Rolex because he has an addiction to the luxury watch brand – and even has one tattooed on his wrist

- 18:00, 25 AUG 2024

Get daily headlines and breaking news alerts for FREE by signing up to our newsletter

We have more newsletters

A young Irish tourist is recovering after a teenager allegedly sexually assaulted her – and then ripped an €8,000 Rolex from her wrist.

The accused, who is just 18, has already admitted robbing the watch from the victim who was holidaying in northern Italy – but denies sexually assaulting the woman.

And he claims he stole the Rolex because he has an addiction to the luxury watch brand – and even has one tattooed on his wrist.

READ MORE - These are the shocking scenes of vehicles on fire and attempted ramming of patrol car after Dublin funeral

READ MORE - Teenage boy dies in single vehicle horror crash in Donegal as seriously injured man is rushed hospital

“I am addicted to them,” he told cops after he was arrested – and informed them where he had buried the watch.

The woman was attacked while holidaying in northern Italy in recent days.

The victim, who is 26, was targeted in the resort of Milano Maritima, 25kms south of Ravenna on the east coast on Wednesday of last week.

Reports say she had been out clubbing in the resort with her sister and friends when she was attacked as she headed back to her accommodation.

The attack happened at around 4am as the woman bent down to unlock a bicycle she was using to return to her hotel.

Cops say the teen - who has no previous convictions and comes from a well off family in the Lombardy region of northern Italy that includes Milan and Bergamo – followed the victim from the club for several minutes before pouncing on her.

Police allege that the teen grabbed the woman, sexually assaulted her and then grabbed the watch from her wrist before fleeing.

The victim was thrown to the ground during the attack and had to spend several days in hospital.

Pals of the victim quickly raised the alarm with a Carabinieri police patrol and they began to scour the streets for him.

The Italian cops soon found another teenager who had been with the suspect before the attack – and he led them to the accused.

He was then detained and the victim and her pals identified him.

The teenager quickly admitted his guilt – and showed officers the area of land at his own hotel where he had buried the watch.

"I'm addicted to Rolexes, I even have them tattooed on me," he told officers.

He was then arrested and spent a day in custody before being released on bail after a court hearing on Thursday.

The teen has admitted attacking the victim and stealing the Rolex – but denies sexually assaulting her.

His father, who owns a restaurant, was with him when he appeared in court on Thursday.

The accused was released on bail conditions including that he signs on at a police station daily.

He is due back in court in October and is preparing to offer his victim compensation for her ordeal.

Sign up to the Irish Mirror's daily newsletter here and get breaking news and top stories direct to your inbox.

- Most Recent

- Travel, Tourism & Hospitality ›

- Leisure Travel

- Distribution of travel and tourism spending in Ireland 2019-2023, by tourist type

International visitors account for the highest share of travel and tourism spending in Ireland. In 2023, inbound travelers generated 78.9 percent of the total travel and tourism expenditure in the country. This figure shows an increase of 0.7 percentage points compared to 2019.

Distribution of travel and tourism spending in Ireland in 2019 and 2023, by type of tourist

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2019 and 2023

Other statistics on the topic

Travel, Tourism & Hospitality

- Travel and tourism's total contribution to GDP in Ireland 2019-2034

- Number of domestic tourist trips in Ireland 2012-2022

- Travel and tourism's total contribution to employment in Ireland 2019-2034

Art & Culture

- Most visited paid tourist attractions in Ireland 2021, by attendance

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in Ireland "

- Distribution of travel and tourism expenditure in Ireland 2019-2023, by type

- Tourism spending in Ireland 2012-2019

- Average daily expenditure on tourism in Ireland 2019, by tourist type

- Industry revenue of “travel agency, tour operator, reservation service“ in Ireland 2012-2025

- Estimated impact of the COVID-19 pandemic on tourism revenue in Ireland 2020

- Estimated impact of COVID-19 on tourism revenue in Ireland 2020, by sector

- Estimated number of tourism jobs lost due to COVID-19 in Ireland 2020, by sector

- International tourism receipts in Ireland 2011-2023

- Number of overseas travel arrivals in Ireland 2019-2021, by mode

- Number of inbound tourist visits to Ireland 2012-2019

- Number of inbound tourists in Ireland 2018-2019, by country

- Number of overseas tourist visits in Ireland 2019, by region

- Inbound tourism spending in Ireland 2012-2019

- Overseas vacationers in Ireland 2019, by age

- Share of overseas tourists in Ireland in 2019, by month of arrival

- Domestic tourism spending in Ireland 2012-2022

- Number of outbound tourist trips from Ireland 2013-2022

- Outbound tourism expenditure in Ireland 2013-2022

- Share of people intending to travel in Ireland April 2021, by destination and period

- Industry revenue of “accommodation and food service activities“ in Ireland 2012-2025

- Industry revenue of “accommodation“ in Ireland 2012-2025

- Industry revenue of “hotels and similar accommodation“ in Ireland 2012-2025

- Number of travel accommodation establishments in Ireland 2011-2021

- Number of rooms in accommodation premises in Ireland in 2019, by type

- Number of hotels and similar accommodation in Ireland 2006-2019

- Number of hotel rooms in Ireland 2010-2021

- Hotel bedroom occupancy rates in Ireland 2012-2019

- Number of overseas travelers engaging in outdoor activities in Ireland 2019

- Preferred activities by domestic vacationers in Ireland 2019

- Most visited free tourist attractions in Ireland 2021, by attendance

Other statistics that may interest you Travel and tourism in Ireland

- Basic Statistic Travel and tourism's total contribution to GDP in Ireland 2019-2034

- Basic Statistic Distribution of travel and tourism expenditure in Ireland 2019-2023, by type

- Basic Statistic Distribution of travel and tourism spending in Ireland 2019-2023, by tourist type

- Premium Statistic Tourism spending in Ireland 2012-2019

- Premium Statistic Average daily expenditure on tourism in Ireland 2019, by tourist type

- Basic Statistic Travel and tourism's total contribution to employment in Ireland 2019-2034

- Premium Statistic Industry revenue of “travel agency, tour operator, reservation service“ in Ireland 2012-2025

COVID-19 impact

- Premium Statistic Estimated impact of the COVID-19 pandemic on tourism revenue in Ireland 2020

- Premium Statistic Estimated impact of COVID-19 on tourism revenue in Ireland 2020, by sector

- Premium Statistic Estimated number of tourism jobs lost due to COVID-19 in Ireland 2020, by sector

- Premium Statistic International tourism receipts in Ireland 2011-2023

Inbound tourism

- Premium Statistic Number of overseas travel arrivals in Ireland 2019-2021, by mode

- Premium Statistic Number of inbound tourist visits to Ireland 2012-2019

- Premium Statistic Number of inbound tourists in Ireland 2018-2019, by country

- Premium Statistic Number of overseas tourist visits in Ireland 2019, by region

- Premium Statistic Inbound tourism spending in Ireland 2012-2019

- Premium Statistic Overseas vacationers in Ireland 2019, by age

- Premium Statistic Share of overseas tourists in Ireland in 2019, by month of arrival

Domestic and outbound tourism

- Premium Statistic Number of domestic tourist trips in Ireland 2012-2022

- Premium Statistic Domestic tourism spending in Ireland 2012-2022

- Premium Statistic Number of outbound tourist trips from Ireland 2013-2022

- Premium Statistic Outbound tourism expenditure in Ireland 2013-2022

- Premium Statistic Share of people intending to travel in Ireland April 2021, by destination and period

Accommodation

- Premium Statistic Industry revenue of “accommodation and food service activities“ in Ireland 2012-2025

- Premium Statistic Industry revenue of “accommodation“ in Ireland 2012-2025

- Premium Statistic Industry revenue of “hotels and similar accommodation“ in Ireland 2012-2025

- Basic Statistic Number of travel accommodation establishments in Ireland 2011-2021

- Premium Statistic Number of rooms in accommodation premises in Ireland in 2019, by type

- Basic Statistic Number of hotels and similar accommodation in Ireland 2006-2019

- Basic Statistic Number of hotel rooms in Ireland 2010-2021

- Basic Statistic Hotel bedroom occupancy rates in Ireland 2012-2019

Tourist activities and visitor attractions

- Premium Statistic Number of overseas travelers engaging in outdoor activities in Ireland 2019

- Premium Statistic Preferred activities by domestic vacationers in Ireland 2019

- Premium Statistic Most visited free tourist attractions in Ireland 2021, by attendance

- Premium Statistic Most visited paid tourist attractions in Ireland 2021, by attendance

Further related statistics

- Basic Statistic Travel and tourism direct contribution to GDP in Poland 2017, by tourist type

- Premium Statistic Impact of tourism on the economy in Poland 2018

- Premium Statistic Impact of tourism on jobs in Poland 2018

- Premium Statistic Seniors' tourism in comparison with younger people in Poland 2018

- Basic Statistic Travel and tourism direct contribution to GDP in Hungary 2017, by tourist type

- Basic Statistic Travel and tourism direct contribution to GDP in Poland 2017, by spending type

- Basic Statistic Travel and tourism direct contribution to GDP in Hungary 2017, by spending type

- Basic Statistic Travel and tourism's contribution to GDP in Denmark in 2017, by visitor origin

- Basic Statistic Share of tourism expenditures in Portugal 2019-2020, by travel purpose

- Basic Statistic Travel and tourism's contribution to GDP in Sweden in 2017, by spending type

- Premium Statistic Tourism coverage in Bahrain 2009-2020

- Premium Statistic Inbound tourism as a share of goods exports Bahrain 2008-2018

- Premium Statistic Inbound tourism as a share of services exports Bahrain 2008-2018

- Basic Statistic Travel and tourism direct contribution to GDP in Germany 2015-2017, by spending type

- Basic Statistic Travel and tourism direct contribution to GDP in Croatia 2015-2017, by spending type

- Premium Statistic Number of outbound Thai travelers who used travel agencies Thailand 2017-2019

- Premium Statistic Share of overnight stays in Romania 2021, by hotel star rating

Further Content: You might find this interesting as well

- Travel and tourism direct contribution to GDP in Poland 2017, by tourist type

- Impact of tourism on the economy in Poland 2018

- Impact of tourism on jobs in Poland 2018

- Seniors' tourism in comparison with younger people in Poland 2018

- Travel and tourism direct contribution to GDP in Hungary 2017, by tourist type

- Travel and tourism direct contribution to GDP in Poland 2017, by spending type

- Travel and tourism direct contribution to GDP in Hungary 2017, by spending type

- Travel and tourism's contribution to GDP in Denmark in 2017, by visitor origin

- Share of tourism expenditures in Portugal 2019-2020, by travel purpose

- Travel and tourism's contribution to GDP in Sweden in 2017, by spending type

- Tourism coverage in Bahrain 2009-2020

- Inbound tourism as a share of goods exports Bahrain 2008-2018

- Inbound tourism as a share of services exports Bahrain 2008-2018

- Travel and tourism direct contribution to GDP in Germany 2015-2017, by spending type

- Travel and tourism direct contribution to GDP in Croatia 2015-2017, by spending type

- Number of outbound Thai travelers who used travel agencies Thailand 2017-2019

- Share of overnight stays in Romania 2021, by hotel star rating

An Irish Tourism Strategy for Growth

18th September 2023

A report by the irish tourism industry confederation, 2. executive summary.

3. TOURISM IN IRELAND A Success Story

4. THE FUTURE A New Way Forward

5. THE ROAD AHEAD Challenges & Opportunities

6. THE SUSTAINABILITY IMPERATIVE

7. ambitious growth trajectory.

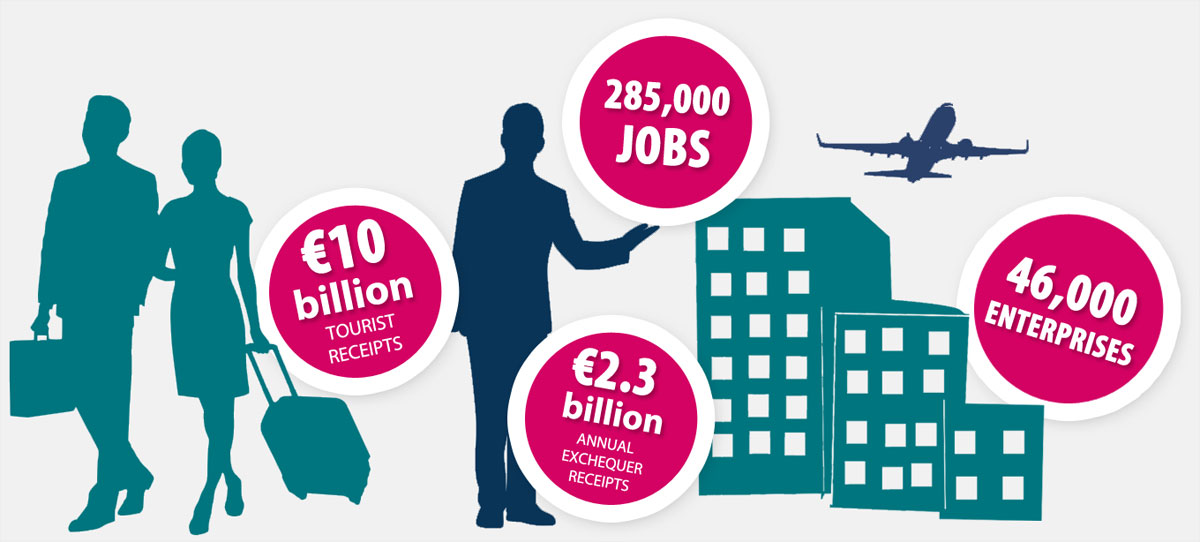

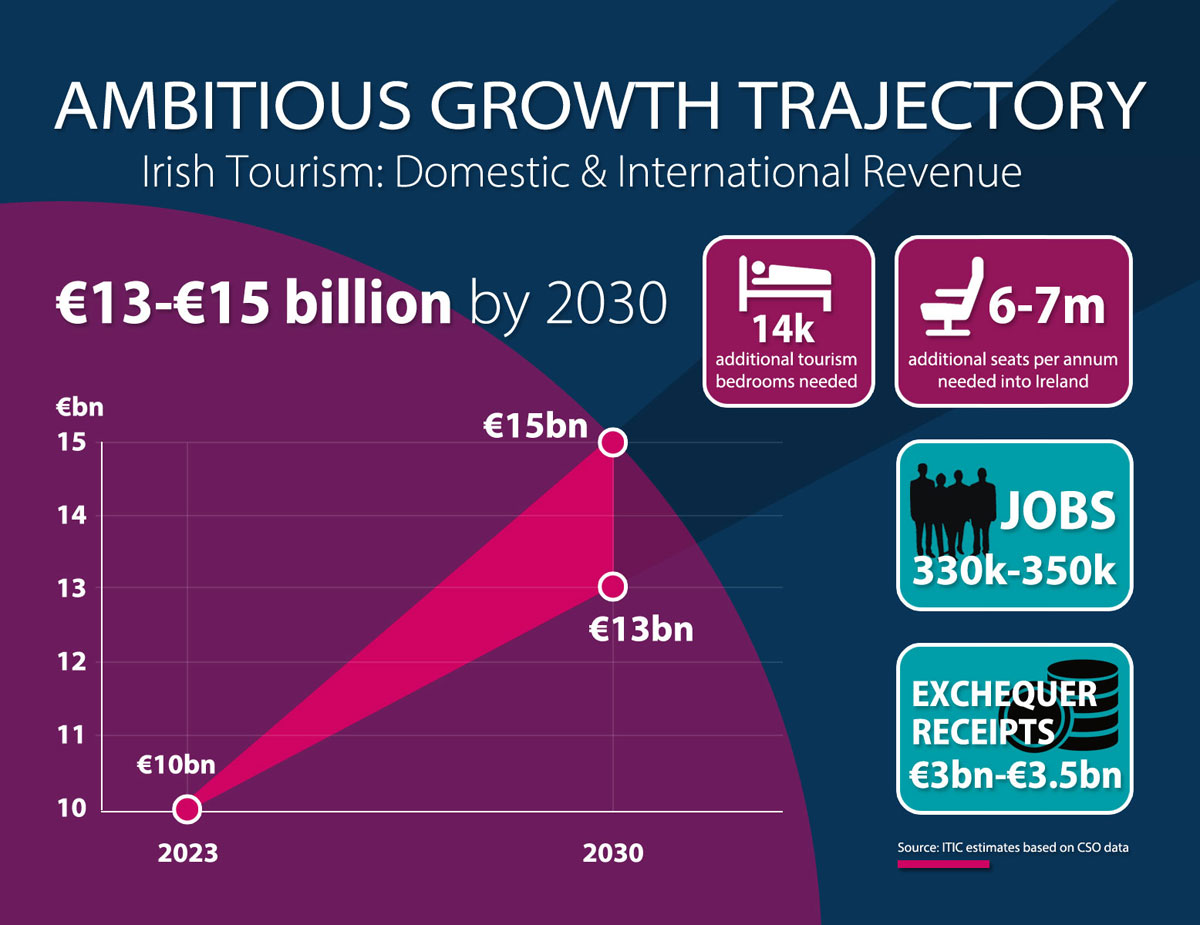

Ireland’s tourism industry can be ambitious about its future whilst delivering on its environmental sustainability obligations. That is the vision outlined in this strategy by the Irish Tourism Industry Confederation (ITIC) – by 2030 the industry can be worth €15 billion to the national economy, can employ up to 350,000 people across the country, and will be delivering €3.5 billion tax receipts to the exchequer each year. In parallel to this, the carbon footprint of the sector can be significantly reduced. That is the potential for Irish tourism, the country’s largest indigenous industry and biggest regional employer. But to achieve this industry needs to be innovative and dynamic, Government policy needs to be pro-tourism and pro-enterprise, and state agencies will need to provide enabling support and resources.

We are at a critical juncture for Irish tourism. Profoundly damaged by pandemic restrictions, the industry – with generous Government support – survived the crisis and in the last 18 months has made strides of real recovery. However challenges abound, some traditional such as competitiveness and investment, some new such as the impact of artificial intelligence and a war on the European continent.

It is timely that this key report by ITIC, the representative group for the broad tourism and hospitality sector, sets out the business case for the sector out to 2030, identifies opportunities and challenges, and articulates 38 key actions that industry, Government and Agencies need to take responsibility for. This report is the result of extensive consultation with ITIC members, tourism stakeholders, and the broader Irish business community. A full list of ITIC member organisations can be seen at the end of this Preface and this strategic report was steered by the ITIC board and strategy sub-committee, names of whom are also available below.

It is our view that by 2030 Ireland will have become one of Europe’s preferred destinations for sustainable nature, culture and hospitality-based tourism experiences; will exceed the expectations of its widening customer visitor base; and will be a destination renowned for its hospitality that is delivered by well trained and rewarded career professionals.

This report is a clear articulation by industry of tourism’s potential for the betterment of business, country and society. It is anticipated that Government will publish a new national tourism policy in the coming months and it is ITIC’s expressed wish that the sentiments and recommendations within this report are duly reflected.

The size of the prize in terms of tourism’s full recovery is significant.

Let’s grasp it.

Elaina Fitzgerald Kane Chairperson

Itic member organisations.

Aer Lingus AIPCO – Association of Irish Professional Conference Organisers ATGI – Approved Tourist Guides of Ireland AVEA – Association of Visitor Experiences & Attractions B&B Ireland Irish Caravan & Camping Car Rental Council of Ireland The Convention Centre Dublin CIE Tours International CTTC – Coach Tourism & Transport Council of Ireland daa DoDublin Bus Tours Dublin City Tourism Unit Emirates Fáilte Ireland The Guinness Storehouse IAAT Ireland’s Blue Book Irish Boat Rental Association Irish Ferries Irish Hotels Federation Iarnród Éireann – Irish Rail ISCF – Irish Self Catering Federation Irish Heritage Trust ITOA – Incoming Tour Operators Association – Ireland Jameson Distillery Visitor Centres Kildare Village Kerry Tourism Industry Confederation LVA – Licensed Vintners’ Association Planet Payment RAI – Restaurants Association of Ireland Stena Line The Shannon Airport Group Tourism Ireland TU Dublin Trinity College Dublin VFI – Vintners’ Federation of Ireland Waterways Ireland

Eoghan O’Mara Walsh CEO

Itic board and strategy sub-committee.

Elaina Fitzgerald Kane , Chair of ITIC and Director Woodlands House Hotel in Adare Niall MacCarthy , Deputy Chair of ITIC and MD Cork Airport Ruth Andrews , CEO incoming Tour Operators Association Donal Moriarty , Chief Corporate Affairs Officer Aer Lingus Brendan Kenny , CEO Ireland’s Association for Adventure Tourism Anne O’Donoghue , CEO Irish Heritage Trust Darren Byrne , MD Abbey Group Adrian Cummins , CEO Restaurants Association of Ireland Nick Mottram , Irish Ferries Paul O’Toole , Chair B&B Ireland Catherine Flanagan , CEO Association of Visitor Experiences & Attractions Maurice Pratt , ex Chair of ITIC Paul Gallagher , ex Chair of ITIC Eoghan O’Mara Walsh , CEO ITIC Arlene Woods , Office Manager ITIC

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

Ireland’s tourism industry is currently a €10 billion indigenous industry composed predominantly of regionally dispersed SMEs and employed almost 300,000 pre-pandemic according to the CSO. Up to 2020 tourism had been one of country’s best performing sectors, returning eight consecutive years of rapid growth. The Covid crisis hit the industry particularly hard but, with generous Government support, the sector managed its survival and has bounced back from the economic ravages of the pandemic. Demand from overseas and domestic markets is reported as making a resilient recovery in 2023. Tourism has long been one of Ireland’s success stories with an established worldwide reputation for hospitality. Forecasts for renewed growth in international travel are positive despite the current geopolitical situation, including the war in Ukraine, and economic headwinds.

Vision 2030: An Industry Strategy for Tourism Growth , prepared by the Irish Tourism Confederation (ITIC) following extensive consultation across the business community, presents a pathway to an exciting and ambitious future for the sector. The industry is confidently positive about the future, as witnessed by the scale on ongoing capital investment commitments by the private sector. This is despite current cost and staffing pressures and significant supply bottlenecks facing businesses. Tourism can positively contribute to meeting Ireland’s commitments on climate change and delivering on the UN Sustainable Development Goals.

2030 will see Ireland as a leader in sustainable tourism growth, delivering a unique visitor experience which delivers regional economic growth based on value over volume, while respecting environmental, social and community values.

An Ambitious Growth Trajectory

Tourism earnings in 2030 could rise to €15 billion, employing up to 350,000 people, and yielding up to €3.5 billion annually to the Exchequer.

The projection of a 50% increase in the value of the sector with the volume of domestic and international visitors growing by circa 24% with a significant growth in the share of holiday visitors, including new value-added segments to boost revenue, together with an improved spread of demand throughout the year.

It is estimated that increased capacity to cater for the growth in demand would require 14,000 additional tourist accommodation rooms and up 7 million additional seats on air and sea transport. Initiatives by industry, combined with State support in terms of resources and enabling policies, can see tourism’s carbon emissions reduce significantly.

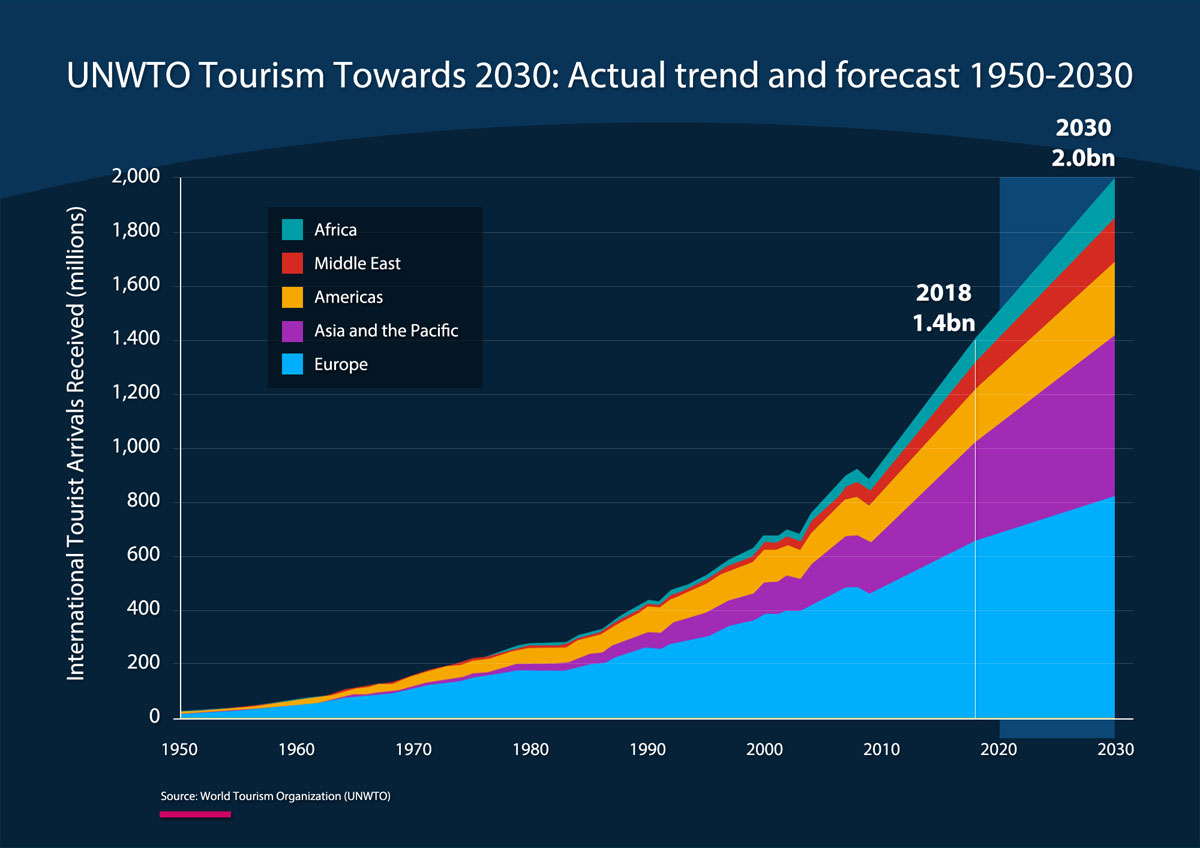

The Opportunities

Growth in global international travel is forecast to reach 2 billion trips by 2030, compared to 1.4 billion in 2018, according to the UN World Tourism Organisation (UNWTO), representing over 11% of the global economy. The pandemic has reinforced an enduring desire to travel, with some emerging trends in people’s travel motivations and behaviour, despite current cost of living pressures. Greater emphasis on personalised travel experiences is amongst the discernible trends, together with a greater emphasis on value rather than price, in keeping with a growing respect for actions to address environmental issues.

Tech-enabled travel is empowering the consumer, with adaptation levels accelerated by the pandemic. Customisation of the travel experience is being driven by the tech giants delivering more products for frictionless access to personalised options. The evolution of augmented and virtual reality technologies is fast changing the way consumer plan and experience travel.

Ireland is well positioned to successfully exploit the changing market opportunities:

- the appeals and attractions of Ireland are well aligned with the increasing focus on unique immersive experiences based on nature, culture, heritage, and people;

- a highly competitive network of access routes by airlines and ferry companies, led by major Irish carriers;

- a proven broad source market portfolio, together with emerging added value prospects.

The Challenges

Realisation of the tourism opportunities is not without its challenges. The top challenges facing the industry, include:

A threat to competitiveness: Ireland as high cost economy competes on value rather than price in the international marketplace. However, the recent rate of inflation in business input costs, coupled with the high VAT, excise and other tax rates, seriously threatens the competitiveness of the Ireland tourism product and the ability of business to deliver what the overseas visitor rates as good value for money.

A staffing crunch: Tourism and hospitality is a labour intensive business with the quality of personal service a key determinant of value. Ireland’s tight labour market has accentuated the recruitment, retention, and skill development of personnel. The result for many businesses has been an enforced limit on trading. The industry is crucially aware of its responsibility to improve the attractiveness and career opportunities on offer.

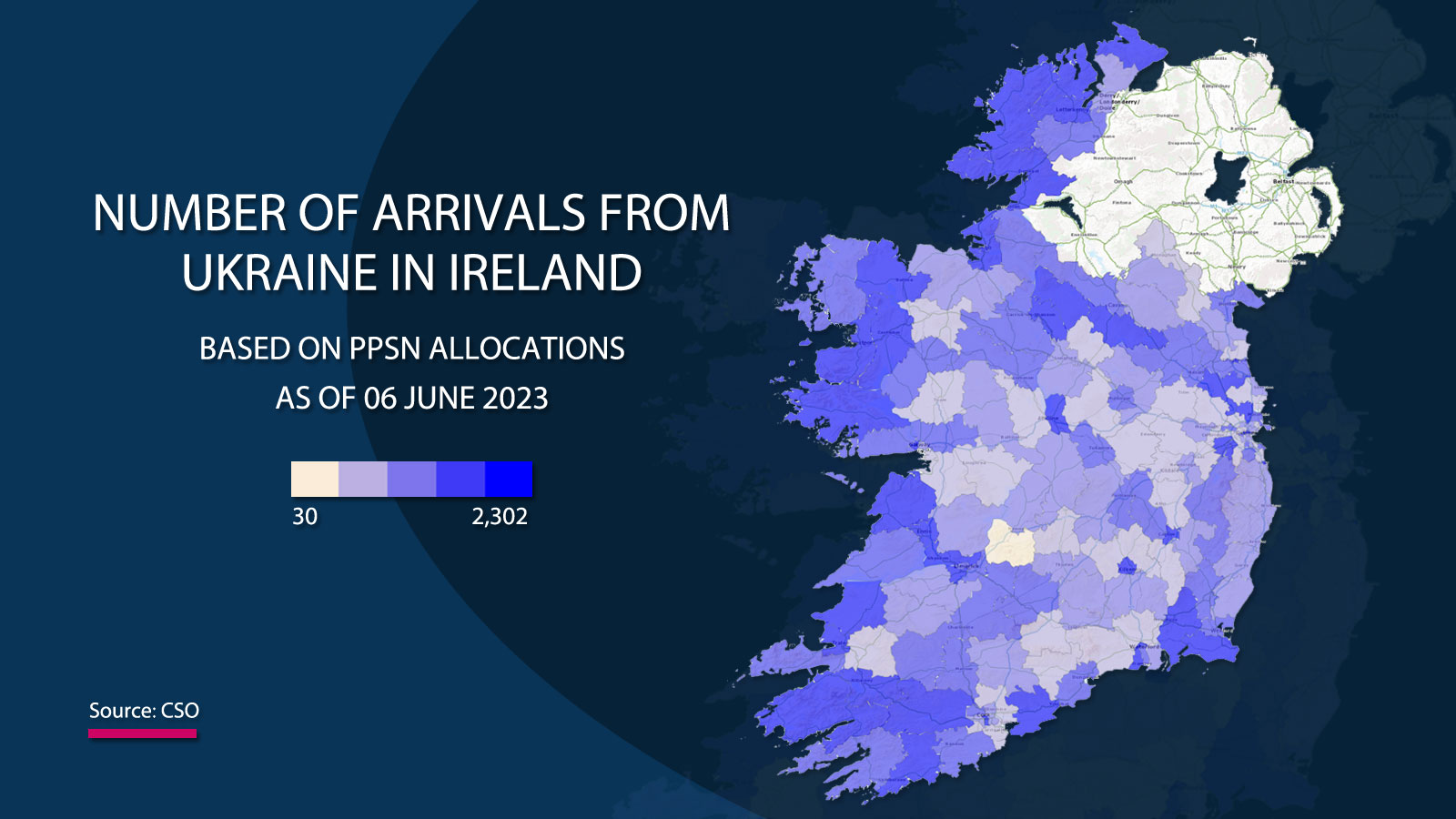

Supply side constraints: The primary constraint is on guest accommodation supply. Latest estimates indicate that at least 20% of the country’s tourist accommodation stock is currently under Government contract to provide housing for those seeking refugee from the conflict in Ukraine and arrivals from other troubled areas seeking International Protection. As tourist accommodation is designed or suitable for long stay living, the Governments over reliance on tourist accommodation to meet its humanitarian obligations is not sustainable.

The Sustainability Imperative

The pandemic and global warming are reshaping consumer values with an increasing focus on ensuring the sustainability of the planet. Improving societal and environmental conditions while delivering economic benefits are central to sustainability. Sustainability is forecast to be a big segmentation factor for winner and losers in tourism.

Sustainability is expected to at the core of the Government’s new national tourism policy is due by year end. Sustainable tourism, as defined by the UNWTO includes economic, social and environmental sustainability and co-existence of all three pillars can be difficult. The industry is very conscious of its responsibilities in delivering on environmental objectives, with a number of innovations already underway. The challenge is real with many tourism and hospitality enterprises falling under the commercial buildings and built environment sectors which has a 40%-45% target of reduced emissions by 2030.

Action-led Outcomes

An analysis of the challenges leads to a number of conclusions and recommended actions to enable the industry to capitalise on the opportunities to achieve sustainable growth, and to deliver the ambitious economic projections by 2030. The key actions centre around 7 pillars namely: Sustainability, Competitiveness, Connectivity, Skills & Careers, Supply Constraints, Investment, and Policy & Support Framework. The 38 actions within these pillars can be seen here and collaboration across Industry, Government and State Agencies will be key to success.

3. TOURISM IN IRELAND: A Success Story

Tourism – a cornerstone of the economy.

Tourism, Ireland’s largest indigenous industry, was one of the fastest expanding sectors of the economy pre-pandemic. Tourism spending in 2019 reached €10 billion, on back of 6.8% (CAGR) annually growth over a five year period. The industry is a critically important employer, providing almost 1 in 8 jobs, more than agriculture and construction combined, and almost equal to FDI employment. Tourism is the driver of economic prosperity, jobs, income and well-being of many towns and rural areas across the country. As 70% of tourism expenditure takes place outside of the capital region tourism is a major driver of regional development.

Tourism, an international traded service with a very low import content, sustains over 40,000 locally owned and operated SMEs across the country, has an exciting future as international tourism rebounds and is set for future growth at a rate outpacing economic growth.

€10 billion: Tourist receipts (73% inbound visitors + 27% domestic trips) 285,000 direct jobs *: over 350,000 when non-specific tourism businesses included 46,000 enterprises : predominantly SMEs, spread across all regions 4.4% GVA share : €13.5bn final consumption €2.3 billion : annual Exchequer receipts

Source: Irish Tourism Sector 2019 (Tourism Satellite Account) CSO publication July23, 2023) Note: * employment = full time equivalent jobs

Ireland’s strong visitor appeals and reputation

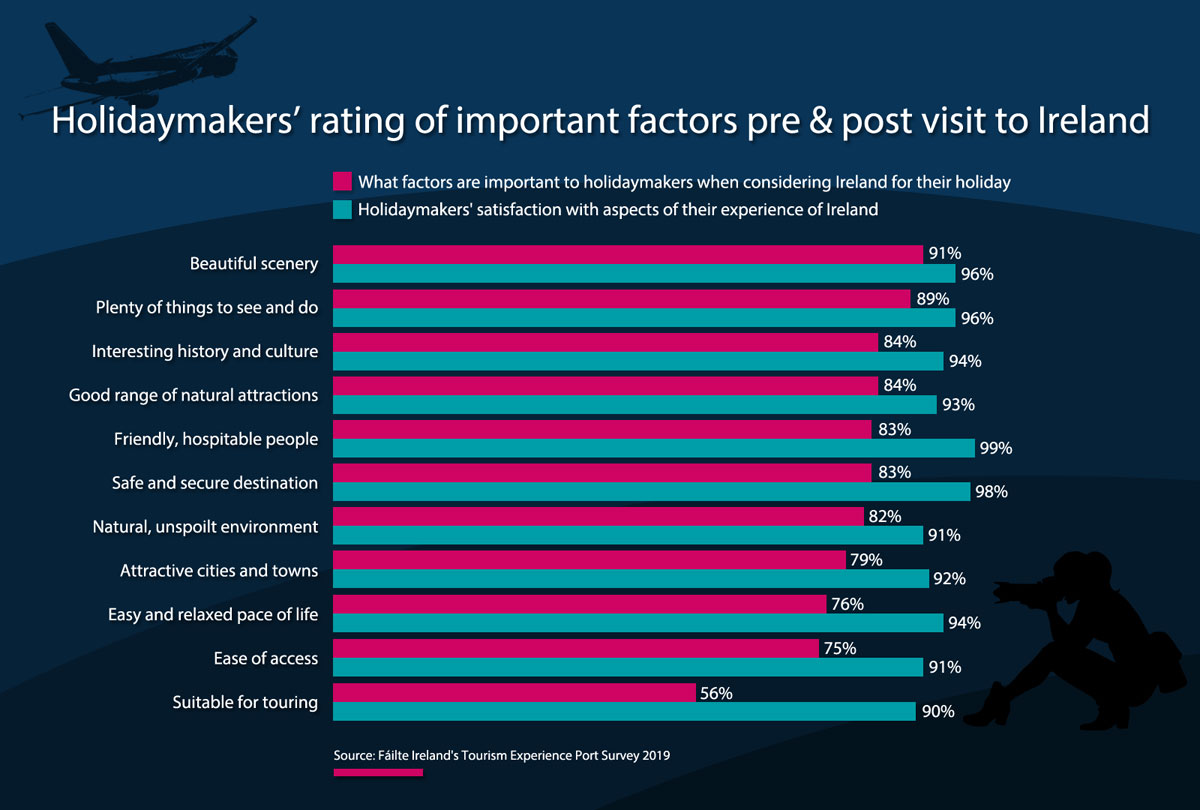

Ireland has established a strong positioning in its main source markets thanks to investment by businesses and the state over many decades. The appeals which draw holiday visitors are primarily scenery and natural attractions, interesting history and culture, with lots “to do and see”. Following the experience of a visit to Ireland feedback consistently shows visitor satisfaction is topped by the friendliness and hospitality of the Irish people. Research shows that a holiday in Ireland exceeds expectations on all important factors for visitors. The relaxed pace of life, ease of travel and the range of experiences on offer combine to record a high rating for the holiday experience. Recent in-market surveys confirm that Ireland’s appeal remains strong with an encouraging level of intent to visit.

COVID- a disproportionate impact on tourism

Public health and travel restrictions over a two year period brought international travel to a halt and severely curtailed domestic travel. The sector lost an estimated €12 billion in sales between 2020 and 2022. Adjusting for €6 billion in government COVID business supports, the net loss to businesses in the sector was close to €6 billion. Widespread business failures were averted by a unprecedented range of Government financial supports to sustain enterprises and employment – tourism was the single biggest beneficiary of the Employment Wage Subsidy Scheme (EWSS). However, extended closures depleted cash reserves and impaired balance sheets. The sector, characterised by SMEs, saw many businesses emerge with an increased debt burden, having depended on Revenue’s warehousing scheme. The impact on the sector was most recently apparent from the business failure data for the 12 months to June 2023, from PWC’s Insolvency Barometer. The arts, culture, entertainment and recreation sector had the highest failure rate across the enterprise economy at almost three times the national average, with the hospitality sector, the next highest, at 60% above the national average.

Tourism recovery underway but facing an uncertain future

As the pandemic receded in early 2022, the industry was confronted with the economic and social fall-out from Russia’s invasion of Ukraine. International travel has rebounded, driven by pent-up demand and accumulated savings. However, the recovery is uneven across the world as economic slowdown and geopolitical instability slows the pace and scale of a sustainable recovery.

Ireland’s tourism industry received a major boost with the speedy reinstatement and expansion of air and ferry services which drove a quicker-than-anticipated recovery of inbound tourism over the past 18 months as travel restrictions were lifted. Tourism businesses have shown exceptional resilience in coping with the post-pandemic reopening.

Visitor arrivals to Ireland suggest that Ireland is on track to recover to pre-pandemic volumes by 2025/26, while domestic trip volumes appear to be close to 2019 levels.

Latest data from the Central Statistics Office (CSO) reports that 619,900 tourists came to Ireland in June with a total of 1.65 million visitors for the 3 months of Q2. The April to June period saw an expenditure of nearly €2 billion by tourists to Ireland with the North American market the most valuable accounting for a spend of €827 million. Q2 traditionally accounts for 30% of annual tourism volume and is a key period of the industry calendar. Unfortunately due to methodology changes in the collection of data by the CSO, direct comparisons with 2019, the last full year pre-pandemic, are difficult to make.

However it is clear that the full recovery of Irish tourism is still well off where it was pre-pandemic and where it needs to be. Airport traffic is inflated by Irish people travelling abroad, hotel occupancy is inflated by Government contracts for refugees and asylum seekers. The actual number of international tourists coming to Ireland is still some way off full recovery.

Domestic tourism

Domestic travel is a vital component of Ireland’s tourism industry. Demand from Irish residents underpins most tourism businesses across the country. Domestic demand accounts for more than half of receipts in many tourism and hospitality businesses, sustaining year round trading in accommodation, hospitality, activity and attraction businesses.

Irish residents took 13.3 million domestic trips in 2022, spending a total of €2.9 billion. Average trip length was 3.0 nights, a total of 34.2 million nights. Half of all domestic overnight trips (50%) were for holiday or leisure purposes, while over one third (34%) were visits to friends or relatives. In addition, an estimated 16.2 million day trips were taken in 2022, spending €856 million. Demand for domestic travel has made a rapid recovery, with the number of trips in 2022, exceeding pre-pandemic levels.

Demand appears to remains strong, despite the economic pressure on disposable incomes, with the latest data reporting a 15% increase in trips in Q1’2030 compared to the same period in 2019.

The outlook for domestic tourism is projected to be strong, based on the population growth, almost full employment, increasing leisure time and opportunities. The primary determinant of the rate of growth are expected to include the economy, increasing awareness of the leisure and event opportunities combined with aggressive marketing, innovative and attractive pricing propositions. A conservative projection would suggest average volume growth of close to 3% per annum over the period to 2030.

4. THE FUTURE: A New Way Forward

An enduring desire to travel driving global tourism growth.

Long term forecast for international tourism is very positive, with demand predicted to grow, on average, at 5.8% per year over a ten year period, outpacing the growth in the overall economy. International visitor demand is expected to reach 2 billion by 2030, up from 1.4 billion in 2018, with further growth to 3 billion by 2050, according to the World Tourism Organisation (UNWTO). The fastest growth in demand is forecast to come from emerging and developing markets in Asia and South America, beyond the core traditional markets of the West. China is forecast to displace France as the world’s top tourism destination by 2030, as well as becoming the largest source market for international travel.

The global tourism body – The World Travel & Tourism Council (WTTC) – is forecasting that the sector will grow its GDP contribution to $15.5TN by 2033, representing 11.6% of the global economy, employing around 12% of the world’s workforce.

Global international tourism is well on its way to returning to pre-pandemic levels, with twice as many people travelling in Q1 23 than in the same period in 2022. Tourist receipts across Europe, having reached 87% of 2019 levels in 2022, are on course to top 2019 in current terms this year, according to estimates from the World Tourism Organisation (WTO). The recovery has been driven by strong intra-regional demand, and the reopening of intercontinental travel. Many countries are expected to recover to 2019 levels this year.

The post pandemic bounce driving travel demand continues despite the consumers facing higher costs of living, rising interest rates and an uncertain economic outlook. The pandemic has reinforced an enduring desire for travel, with some emerging trends indicating changes in people’s travel motivations and behaviours.

Macro trends influencing travel demand around the world include population growth, an expanding middle class concentrated in urban areas, changing work and leisure patterns. Furthermore, the consumer is increasingly empowered by the expansion of online access to worldwide travel options.

Two recent studies on pan-European tourism, from the EU’s Joint Research Centre and the European Travel Commission (ETC), suggest that tourists are starting to seek out destinations with milder climates, in response to extreme temperatures and wildfires. Such consumer behaviour may benefit the more temperate climates of Northern Europe, including Ireland.

The Consumer of the Future

A number of discernible trends in travel provide an insight into the consumer of the future. These trends identified from global research include:

- Wellness tourism, eco-tourism and remote working are enabling people to travel with purpose and stay longer;

- Consumers are increasingly using new technologies to benefit from easier and more convenient stress free travel experiences, including late bookings;

- Personalised travel experiences are increasingly been sought after;

- Demand for premium travel is on the rise as travellers are willing to pay more for better quality tourism experiences.

Ireland prime target segments are likely to want to explore the destination in a more immersive and experiential way, while being conscious of the economic, environmental and social impact of tourism. Customers of the future are likely to be more value conscious, with higher expectations of service providers.

Post pandemic trends shaping future demand

Macro-economic outlook.

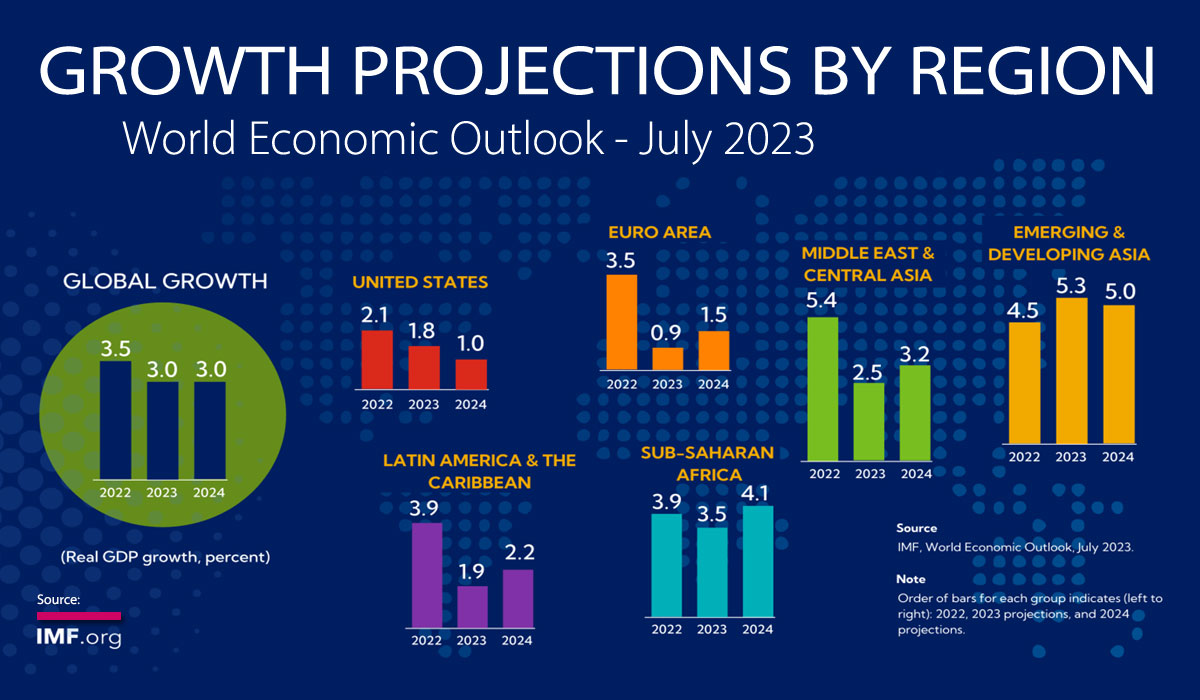

The global economy remains in a precarious state amid the protracted effects of the overlapping negative shocks of the pandemic, the Russian Federation’s invasion of Ukraine, and the sharp tightening of monetary policy to contain high inflation. Most recently new of the economic clump in China, the world’s second-largest economy, is further depressing the outlook for the global economy.

In July the International Monetary Fund has raised its 2023 global growth estimates slightly given resilient economic activity in the first quarter, but warned that persistent challenges were dampening the medium-term outlook. Despite inflation coming down the balance of risks facing the global economy remained tilted to the downside and with credit remaining tight. A five year outlook for real GDP growth at close to 3%, is a significant slowdown compared to pre-Covid years.

Sustainability to define winners and losers in tourism

The pandemic and global warming are reshaping consumer values with an increasing focus on ensuring the sustainability of the planet. Sustainability is the starting point, not just reducing the carbon footprint and energy consumption but also improving societal and environmental conditions while delivering economic benefits. The demand for sustainability encompasses a range of factors including protection of the environment, a reduction of transport’s carbon footprint, materials used in construction, the way the food is sourced, processed and served, employment conditions, and benefits to the local community.

Sustainability is forecast to be a big segmentation factor for winners and losers in tourism. Experts confirm that those destinations and businesses which focus on innovation and sustainability will be most likely to the more successful in the future. Recent research by Accor, one of the biggest hospitality businesses in the world and Europe’s largest hotel operator, found that 65% of travellers would respond positively if presented with more sustainable travel choices. A sustainable approach to future tourism will be key in driving economic benefits for Ireland.

A new national tourism policy is due from the Irish Government by year-end and will have sustainability at its core – the industry will need to deliver on its sustainability responsibilities.

Tech-enabled travel empowering the consumer

The pandemic has accelerated the adoption of new customer-facing technology by, probably, a decade in the course of a couple of years. Digitisation and the emergence of new technologies are fast changing the industry as we know it. Connectivity will continue to grow between suppliers, distributors and customers together with seamless connectivity between online and offline channels.

Customers are becoming more empowered though greater choice and control in the process of planning, booking and experiencing travel. Customisation of the travel experience is evolving as the tech giants continue to design products for frictionless access to personalised options.

Further developments, and lowering of cost, in augmented and virtual reality technology will provide new ways of previewing experiences and opportunities as well as delivering more immersive experiences across the tourism journey.

DiscovAR Dublin

DiscovAR Dublin is an exciting innovative application in the use of AR technology in tourism. The result of a partnership between Dublin City Council and Google, enables App users to open a 3D map of the city on their device and explore it, by blending data from Google Maps with 3D technologies. The visitor by interacting with video and audio elements can experience selected attractions and locations in the city. It is reported to make the capital ‘first city in the world’ to use AR technology for tourism.

Technology increasingly offers an opportunity for businesses to improve efficiency and productivity while improving the quality of the customer’s experience.

Tourism in context of Ireland’s Sustainable Development Goals (SDGs)

Ireland has adopted a whole-of-Government approach to the SDGs, adopted its first SDG National Implementation Plan in March 2018, including an ambitious 2030 Vision for Ireland, to fully achieve those goals and to support their implementation around the world. While governments hold primary responsibility for achieving the SDGs, partnership responsibility also rests with businesses and communities.

In addition to a significant alignment between the tourism industry’s vision for 2030 and the strategic goals as set out in the National Planning Framework, tourism can directly contribute to 6 of the 17 goals of the UN Sustainable Development Goals. Namely, climate action, regional development, sustainable cities and communities, economic growth, reduced inequalities and innovation.

5. THE ROAD AHEAD: Opportunities & Challenges

As part of ITIC’s consultation for this strategy numerous meetings were held with tourism leaders and stakeholders. This included a workshop in June 2023 with ITIC members who outlined their views for the medium to long term vision for Irish tourism. Such consultations helped develop this strategy with ITIC members highlighting the need for a greater focus on value in line with sustainability goals, the need for a shift in market as new opportunities open up, and the need to explore attracting major international events to our shores and lengthening the tourism season. Many of the recommendations within the report are on the basis of meetings and input from ITIC members and other travel, tourism and hospitality businesses. Throughout the last 4 months as deliberations and discussions took place with tourism professionals a number of opportunities and challenges were identified.

THE OPPORTUNITIES

The prospects for growth in tourism remain strong, based on demographics and macroeconomic projections together with the post-pandemic evidence of the desire to travel. Airlines, transport and hotel operators across the globe continue to invest in future growth.

1. A confident forward facing industry

Despite the devastating impacts of the pandemic, and the current pressing economic challenges, Ireland’s tourism businesses are confident of a full recovery and sustainable future growth. An industry pulse of ITIC members over recent months, in surveys and workshops, confirm an industry with confidence that the current challenges can be overcome with appropriate policy supports to enable Ireland to capture an increased share of an expanding market for tourism. This confidence is evident from the level of interest, and recent, investments in the sector by indigenous and external enterprises.

2. The Ireland tourism experience

The fundamentals of the appeals and experiences of Ireland’s tourism are well aligned with the increasing focus on unique immersive experiences, natural attractions and the outdoor activity environment, cultural and heritage attractions, combined with a welcoming personal interface with local residents.

Professionalism within the sector has increased significantly in recent years, with many businesses at the cutting edge of delivering a quality service across all functions of the travel and hospitality experience.

Ireland’s reputation is well established with research showing a high level of interest and intent to visit, including a healthy level of repeat visitors. The success, and creativity, of destination marketing cross social and traditional media channels has received international recognition and continues to extend the reach into new potential demand segments. The major demand trends point to an increased demand for the potential of Ireland’s tourism experience in the international and domestic marketplace.

3. International connectivity

Airline and ferry connectivity has been a critical driver of Ireland’s tourism growth over many years. Ireland benefits from a highly competitive network of access routes by airlines and ferry operators, including successful Ireland-based carriers. Up to 90% of visitors arrive by air, and a thriving airline industry is critical to Ireland’s continued success.

Aer Lingus and Ryanair rapidly reinstated service post COVID – in summer 2023 Aer Lingus are operating an expanded transatlantic network, while Ryanair capacity is up 22% on short haul routes, compared to pre-pandemic levels. In addition, capacity offered by other airlines is almost back to 2019 levels. Ferry capacity is up on pre-pandemic levels, with a significant expansion of travel options and capacity on routes to/from mainland Europe post Brexit. Airline and ferry companies, air and sea port operators continue to invest heavily in fleets and infrastructure to deliver sustained growth in Ireland’s connectivity.

4. Market development opportunities

Ireland‘s tourism is still facing headwinds in its post-Covid recovery, with rebuilding expected to continue through 2025. Industry reports indicate that tourists from the United States – Ireland’s highest spending leisure visitors – lead the way, as demand for travel to Europe has bounced back strongly. Airlines are already announcing increased capacity for 2024 to Europe including Ireland.

Historically Ireland has drawn its visitors from four main source market groups – Britain, mainland Europe, North America, and Australia/New Zealand. Over time the balance of demand has shifted as a result of lessening of dependence on VFR visitors and increasing share of holiday visitors, with mainland Europe and North America the source of increasing numbers of tourists. In economic terms growth in tourism receipts, regional distribution of visitors, and demand spread widely across business sector, Ireland has become more dependent on the US market. Recent growth rates from the closer-in markets – Britain and mainland Europe – have been more modest, despite Ireland attracting a relatively low share of outbound tourism, and has been more in line with demand patterns of maturing markets. The composition of demand of inbound tourism to Ireland over the past decade shows only modest diversification of source markets when compared with competitor destinations across Europe, including Britain. The latter appear to have been more successful in attracting high spending inter-continental tourists from Asia, the Middle East and Latin America. Increasing numbers of leisure travellers to Europe from emerging travel markets would point to an opportunity for Ireland.

With an increasing focus on sustainable growth the time is opportune to reassess how best to successfully optimise tourism growth opportunities across source market and segments, based on robust market research and investment. Within established short haul markets targeting of shoulder and off-season demand would significantly contribute to sustainability and improve the utilisation rate and profitability of businesses.

THE CHALLENGES

Despite the positive opportunity outlook realisation of the potential is not without its challenges.

1. Ensuring a competitive tourist offering – delivering good value

Ireland a high cost economy

The cost of doing business is higher than in many of its European neighbours. For example, Ireland’s minimum wage is more than 70% above the EU average, while electricity (+14%) and cost of credit (+50%) have historically been well above the European norm. Tourism is a labour, energy and capital intensive industry – these high cost inputs feed directly into higher prices for the visitor. In addition, the prices visitors pay reflects the cost of living within the country. Ireland was the most expensive European country to live in, at 46% above the EU average, with only Switzerland, Iceland and Norway having a higher cost of living in 2022.

Inflation hit tourist prices

Typically almost 80% of the expenditure by tourists in Ireland is on accommodation, food and drink, and internal transport. Pre-pandemic, Ireland was ranked in the top 5 most expensive destinations in Europe for the main items consumed by visitors. Recent research has shown, that while the cost of getting to Ireland is highly competitive due to very attractive airfares on offer, visitors encounter markedly higher costs in Ireland compared to many other competitor destinations.

Prices in hotels and restaurants have been rising above the rate of overall inflation in Ireland. In 2022 hotel and restaurant prices in Ireland were found to be 26% above the average across the Eurozone; alcoholic beverages and tobacco prices almost double; and transport services at 26% more expensive. Compared to the UK, Ireland’s main competitor in most source markets, prices of holiday components of accommodation, food and drink in Ireland were at between 23% and 30% higher. Latest data from the CSO shows that the annual rate of inflation for accommodation services, predominantly hotels, while slowing was at 6.2% to July 2023. Over the past year admission prices to cultural venues increased by 7.3%, while public transport costs decreased.

While there are identifiable underlying costs and supply factors to explain the high rate of increase in prices in the accommodation sector, the concern is that the rate of price rise in Ireland has been higher than in many competitor European destinations. Price inflation in the restaurant sector is broadly in line with experience across the EU.

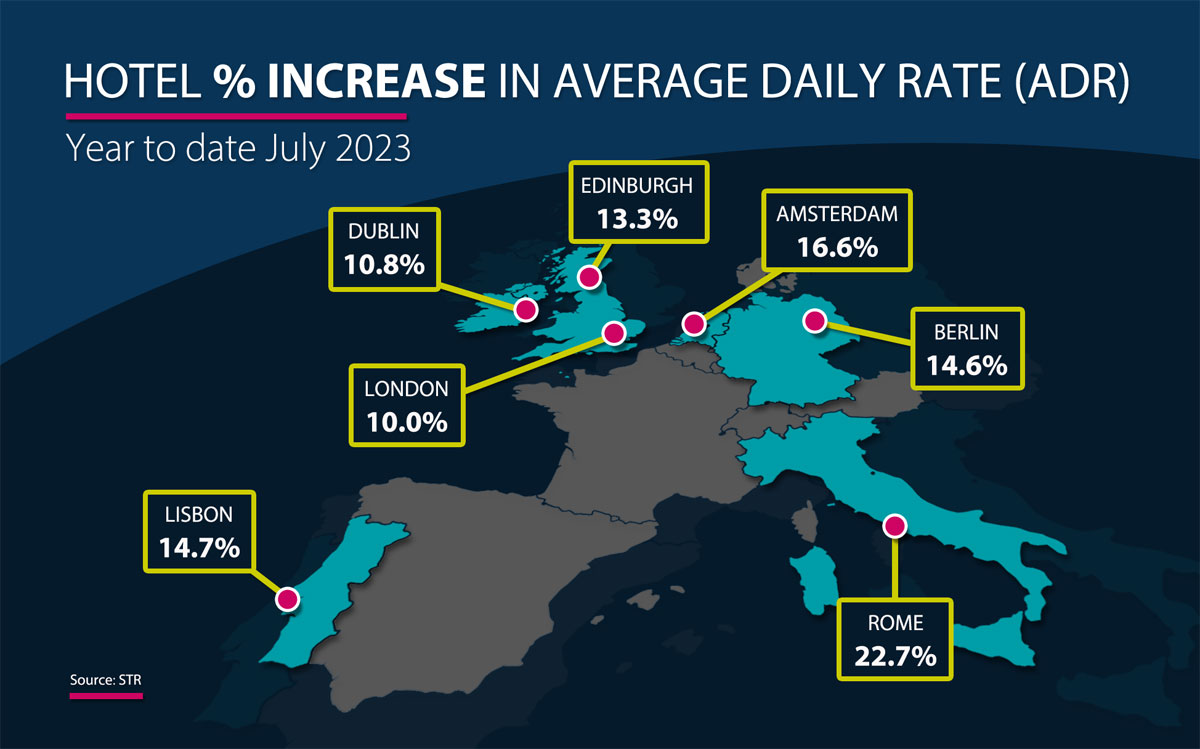

Latest data from Smith Travel Research (STR), a global hospitality analytics practice, shows that the rate of increase in hotel rates in Ireland has moderated over the past year.

VAT on hospitality services

The increase in VAT from the temporary 9% rate to 13.5% from September 2023, will undercut Ireland’s competitiveness. The increase will see VAT on accommodation rise to the third highest Europe, and restaurant food and alcohol ranked amongst the highest rates, compounding Ireland’s high rate of exercise duty on alcohol. The VAT increase will further add to Ireland’s loss of competitiveness at a time when inflation in key visitor components could continue to outstrip rising prices in competitor destinations.

Insurance costs

Despite recent reforms in the insurance sector, annual premiums for liability coverage continue to rise. Increasing premium costs, and a lack of competition in the market, has forced the closure of several tourism related businesses and events over recent years.

Competitiveness / Value imperative

High inflation, in an already high cost economy, coupled with supply side issues runs the risk of threatening the competitiveness of the Ireland tourism offering. The current competitive dynamic presents a set of new challenges for businesses in the sector. While price is not the sole defining factor of Ireland’s competitiveness, value for money is undoubtedly a major determinant of competitiveness. As a tourist destination Ireland has positioned itself as a value experience rather than an inexpensive destination. Close to 60 % of pre-pandemic holiday visitors consistently rated their experience as ‘good or very good’ value for money. With the steep price rises Ireland’s competitiveness is at serious risk of losing its value for money positioning in the international marketplace.

2. Loss of tourist accommodation stock

The provision of accommodation for refugees, including people fleeing the conflict in Ukraine and those seeking International Protection, is a moral imperative as Ireland plays its part in the ongoing humanitarian crisis. However, hotel and other tourist accommodation accommodations was not designed for long term housing needs and is far ideal for those seeking refuge. Furthermore, Ireland is an outlier in its dependence on tourist accommodation to provide shelter for refugees and asylum seekers.

At least 20% of tourist accommodation is currently withdrawn from the market and contracted for accommodating refugees. The contraction in the availability of tourist accommodation is most evident in a number of popular west coast popular tourist areas, including Donegal, Mayo, Clare and Kerry. The impact on the tourism economy is higher priced accommodation as demand exceeds supply; a loss of jobs; a decline in visitor footfall in traditional tourism areas, and a threat to the viability of downstream businesses catering to visitors. The extent of frustration of demand, or reputational damage, is as yet unknown.

Legislation to address the housing shortfall has also impacted the supply of tourist accommodation. Providers of short-term holiday lets, in addition to the requirement to obtain planning permission, the proposed Short-Term Tourist Letting Bill, awaiting approval from Brussels, will require such properties to register with Failte Ireland. The short term rental market advertised on line has been estimated at up to 27,000 premises, of which 20,000 are full properties, providing up to 130,000 beds, according to an estimate from Failte Ireland. The impact of the legislation could see a withdrawal of as many as 12,000 premises out of the short term rental market, potentially reducing Ireland’s visitor capacity by at least 50,000 bed spaces.

Longer term the impact of a continued reliance on tourist accommodation to meet the State’s need to house refugees, and the legislative requirements on holiday rental properties, is likely to result in an exit of some tourist accommodation providers from the market. The current situation weakens Ireland’s tourism ecosystem – a complex, highly interdependent and diverse key sector of the economy – and threatens a full recovery and capacity for future tourism growth.

To meet future projected demand new investment in tourist accommodation will be required. A recent ITIC study commissioned with economist Jim Power reported at least 11,500 hotel bedrooms will be required by 2032 to meet projected demand and compensate for hotel attrition rates.

3. A staffing crunch

As the Irish economy is close to full employment, the supply of labour is limited. This has further exacerbated the recruitment situation in hospitality and tourism sector. Staffing shortages has led to a reduction in capacity and opening hours and, in extreme instances, business closures.

Post pandemic tourism and hospitality businesses across the developed world are experiencing difficulty in retaining and attracting staff. Recent data from Eurostat shows that construction trades, transport drivers, and cooks are the top shortages across Europe.

Seasonally adjusted employment in tourism industries is reported at 215,700 in June 2023, with recovery lagging behind other sectors of the economy. In Ireland a tight labour market, with the lowest unemployment rate in over two decades – 4.1% in July 2023 – sees the sector struggling to attract and retain staff. Tourism businesses compete in a highly competitive marketplace for labour. Despite Ireland having one of the youngest, and fastest growing, populations in the EU, economic growth will continue, in part, to rely on attracting labour from outside the country to fuel economic growth. From a customer perspective the result has been a reduction in choice and/or the quality of the experience. This coupled with higher prices runs the risk of more serious longer term reputational damage and a limitation on growth.

Tourism and hospitality is a labour intensive business, with the quality of personal service a key value. With effective full employment levels, the tourism and hospitality industry is facing an existential challenge, with an urgent need to address recruitment and skills development. Increased investment by businesses will be required to attract, train and providing more attractive career opportunities in a well paid environment. Sustained growth in tourism earnings will depend on the capacity to meet visitors’ expectations of a top class guest experience.

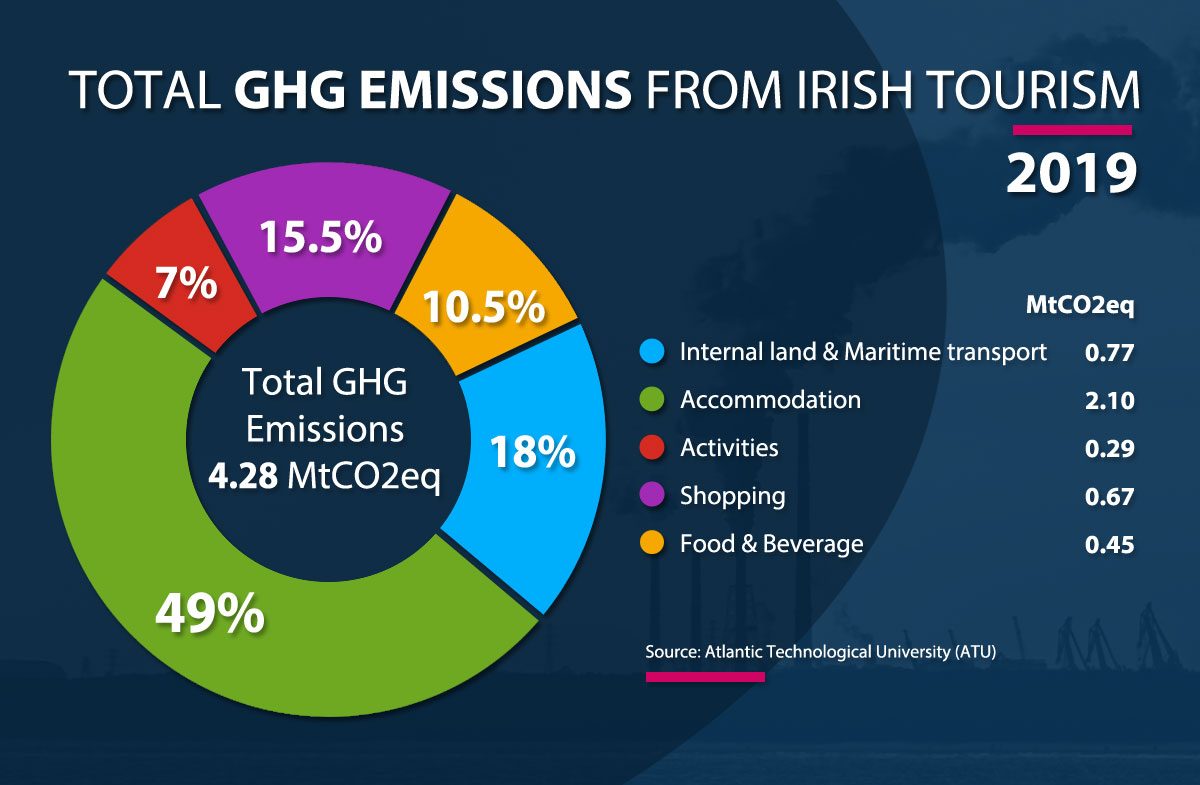

4. The Sustainability Challenge

The worsening effects of climate change have made decarbonisation a top priority for many industries. The World Travel & Tourism Council estimates that global travel and tourism accounts for between 8 and 11 percent of the world’s emissions. If nothing is done, the sector’s carbon emissions will only rise as it grows. Ireland’s tourism industry is estimated to be responsible for over 4 MtCO2eq (million tonnes of carbon dioxide equivalent) excluding international transport, or over 11 MtCO2eq when international transport is included, based on 2019 data, excluding emissions from outbound tourists and cruise ship passengers. Overseas visitors are responsible for 87% of emissions. [Atlantic Technological University (ATU)]

Fáilte Ireland leading tourism sustainability

To lead the development of a tourism industry that is on its way to making an even bigger and more sustainable contribution to Ireland’s economy, environment, society and culture than it did in 2019.

Ireland will seek to be amongst the world-leaders in sustainable tourism practices.

5. New Border entry procedures

Entering Europe and the UK will soon change for many travelling on a non-EU passport two new border control schemes come into operation.

European Travel Information and Authorization System (ETIAS): Travelers from outside the EU, who do not require a visa, will soon be required to apply for advance authorisation to enter member states. Implementation is awaiting the initiation of the EU’s biometric Entry/Exit System (EES) based on new IT infrastructure at border entry points across the EU – a system which Ireland is not participating. Entry for travellers from third countries currently governed by visa entry will remain in place – with separate application required for entry to Schengen area (30 countries), the UK, and Ireland.

UK’s new Electronic Travel Authorisation (ETA) will be required from 2024 for all international visitors. While Ireland and UK residents enjoy a restriction free Common Travel Area (CTA), the new requirement could discourage dual UK & Ireland visits from non-residents, and limit all island itineraries.

State Policy and support architecture

Exploiting the opportunities and minimising the challenges as articulated above are dependent on pro-tourism policies and supportive state architecture. In that context the horizontal cross-cutting nature of the sector represents a challenge as to the optimum placing of political and administrative responsibility for tourism within national government structures. While transport, heritage, culture, the natural environment, and sports each have a contributory role in the visitor experience, a review of international best practice shows that in more than half of OECD member states responsibility for tourism now resides within an economic ministry.

“While frequently destination marketing and promotion is identified as the key role of government but on closer examination it is apparent as a country’s tourism industry matures that more successful destinations focus primarily on enterprise policy and strategies.” (OECD: SME and Entrepreneurship Policy in Ireland, 2019)

The scale of the opportunity for Irish tourism warrants the integration of tourism in a national enterprise policy and strategies in pursuit of shared economic goals. Tourism has the potential to deliver a greater contribution to economic growth, particularly in respect of spatial distribution, regional economic, social and environmental development. A medium to longer term policy framework would improve the prospects for investment in the sector. Furthermore the tourism sector requires a new set of metrics to meet data gaps and measurement challenges to improve the monitoring of performance with a focus on measuring the economic contribution, including the further development of national and regional Tourism Satellite Account (TSA), together with real time performance indicators.New mobile technology based data tools, such as remote sensors and big data management systems, are revolutionising visitor tracking. Ireland has yet to exploit the opportunities presented by data sources, including mobile telecommunications and payment systems, to monitor visitor flows and behavioural patterns.

“Tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities”

In 2015 the UN developed a set of 17 Sustainable Development Goals in order to frame the UN member states’ agendas and policies up to 2030. Following this in 2018 the Irish Government set out how Ireland intends to implement the 17 Sustainable Development Goals (SDG) through development of actions and targets around each goal. It is incumbent upon all Government Agencies and Departments to ensure these actions and targets are adhered to and that each sector contributes to Ireland’s realisation of these goals. Specifically there are four Sustainable Development Goals (8, 12, 14 & 17) that have targets relating to tourism. The most relevant SDG is Goal 12 namely “Develop and implement tools to monitor sustainable development impacts for sustainable tourism that creates jobs and promotes local culture and products.”

ITIC and Irish tourism businesses have taken a leadership position on sustainability for some time and a seminal report by ITIC was published 18 months ago calling for clear metrics to be put in place so that industry would know against what to measure its performance in this critical space.

Opportunities & Challenges

There are both opportunities and challenges within Irish tourism’s journey to a more sustainable future.

Becoming sustainable is simply a “must do”. Implementing transformational change will be good for the planet and, if done correctly, also good for businesses’ bottom line as well as supporting the communities within which tourism is embedded. In an Irish tourism context successful implementation of sustainable tourism practices should deliver metrics that will help to establish a better understanding of carbon and financial costs and help mitigate against both. It has long been recognised that collaborative agendas are necessary to ensure that tourism can be a force for sustainable development and Government, the tourism agencies and the tourism industry must commit to working together to ensure that the sustainable tourism agenda is a central part of the thinking for practitioners, policy makers and visitors.

It has been shown that building a sustainable business promotes longevity and more interaction with key stakeholders. Prior to the pandemic there had been a growing realisation among individual tourism operators that sustainable practices were not necessarily a cost. Changing consumer preferences has led to many enterprises taking steps to make their offering more sustainable and generating more business as a result. It is clear that industry needs to continue moving in a sustainable direction – both because of the benefits to the environment and communities, but also to individual businesses. Over time, sustainability must become the norm rather than the best practice exception.

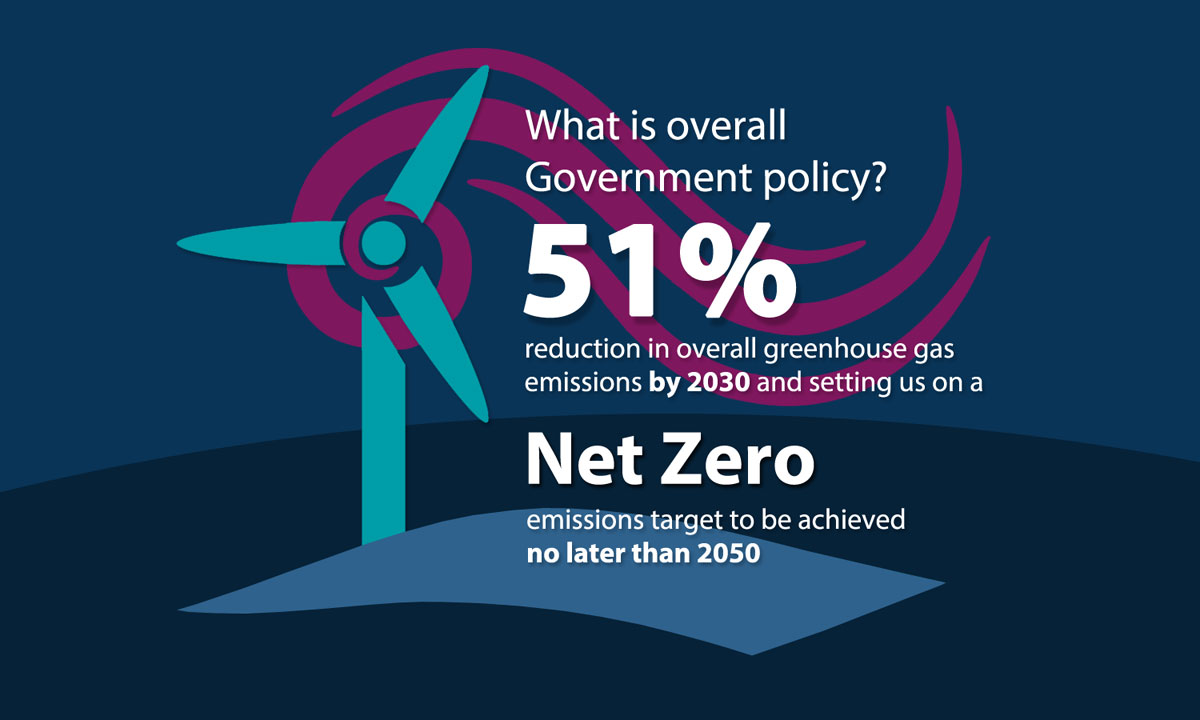

As tourism aims to recover lost ground from the pandemic and grow into a €15 billion industry as articulated in this strategy, Ireland’s climate action commitments must always be central. Ireland’s tourism industry will play its full part and has made great strides in the right direction already. Irish tourism will be leaders and not laggards in helping the country reduce its green house gas (GHG) emissions by 51% by 2030 and being carbon neutral by 2050.

The Just Transition Funding of €68 million received from the EU and earmarked for tourism capital investment in the Midlands is a very exciting development for Irish tourism. To be spent by 2026 the money is expected to kick-start the tourism economy in the region and develop a key economic engine to replace the phasing out of peat production.

A note on aviation

Maintaining and growing international air connectivity is of fundamental importance and critical to the future success of tourism in Ireland. 75% of Ireland’s tourism economy is made up of international visitation and as an island nation air and sea access is vital. The Government’s own Climate Action Plan, published last year, refers to action being taken at an EU and international level to address emissions from these sectors and Ireland and its tourism industry will support appropriate measures taken at this supranational level.

ITIC welcomes the commitments of the Aviation industry to net zero carbon emissions by 2050. Recognising that new technology aircraft and cleaner fuels will be the key drivers to reach this goal, ITIC strongly supports greater use of Sustainable Aviation Fuel (SAF) as a key mitigation lever for the decarbonisation of aviation. In addition to mandates currently being considered within the ReFuel EU Directive at European level, there is also a requirement for incentives to significantly increase the production and supply of SAF in Europe.

ITIC welcomes the ongoing investments by Irish Aviation in new technology aircraft which are more fuel and noise efficient and also the commitments made by Irish airlines to powering at least 10% of their flights with Sustainable Aviation Fuels (SAF) by 2030. These commitments can only be achieved with the right policy frameworks at both regional and global levels, with essential support for SAF.

A note on a circular Irish tourism off-setting project:

To meet the ambitious goal of a reduction by 51% of GHG within just 8 years innovative medium-term solutions will be required. Accredited carbon offset schemes to which businesses and visitors could contribute located on the island of Ireland may have a role to play here. We recognise that our landscape is a key driver for tourism. Offset schemes that reduce GHG emissions, improve biodiversity, engage local communities, and create the potential for employment would have the added benefit of improving the broader tourism product. They could act as an engine of sustainable growth for the tourism sector, particularly in the midlands and west of the country. The state should consider actively developing such schemes, specifically for the sector, given its extensive landholdings through semi-state companies in areas of high amenity and scenic value. In addition a communications strategy targeting domestic and international visitors is required with the aim of creating awareness of actions being taken by the sector to mitigate climate change and biodiversity loss.

A note on sustainable tourism certification – why do it?

Sustainable tourism certifications, which are guided by the UNWTO definition of sustainable tourism, are a crucial tool in the efforts of the Irish tourism industry to evolve into a truly good force in Irish society – environmentally, socially and economically.

Sustainable tourism certifications enable tourism organisations to understand what they are doing right and can also help them identify key areas of sustainability management where they are weaker. Certifications require that policies are put in place, check if they have been implemented, and measure the impact of those policies. They enable in-depth analysis of process and practice.

Credible sustainable tourism certifications, which use independent auditors, help tourism businesses and organisations to:

- Establish best practice systems for measuring and managing impacts (positive and negative) on both the community where they are based and the environment (energy, waste, food waste, water etc).

- Map out a clear plan for businesses to make step-by-step changes to lessen their impacts and to continuously improve.

- Understand and avoid greenwashing – either intentional or unintentional.

- Communicate and market their credible sustainability credentials to customers, the local community and all stakeholders a visible and verifiable way.

- Gain a competitive edge and improve the positive reputation of a business/organisation/destination as customers (both B2B and B2C), stakeholders and government bodies are increasingly demanding sustainability credentials.

- Save money and resources but implementing systems and process that promote efficiency.

Growing evidence shows that sustainable companies, or those with good Environmental Social Governance (ESG) and certification, deliver better financial performance, and investors now value them more highly.

The worsening effects of climate change have made decarbonisation a top priority for many industries. The World Travel & Tourism Council estimates that global travel and tourism accounts for between 8 and 11 percent of the world’s emissions. If nothing is done, the sector’s carbon emissions will only rise as it grows.

Ireland’s tourism industry is estimated to be responsible for over 4 MtCO2eq (million tonnes of carbon dioxide equivalent) excluding international transport, or over 11 MtCO2eq when international transport is included, based on 2019 data, excluding emissions from outbound tourists and cruise ship passengers. Overseas visitors are responsible for 87% of emissions. [Atlantic Technological University (ATU)]

Shaping a sustainable future for tourism

Key policy issues which need to be addressed to take account of changing consumer values and deliver a sustainable future for the sector have been identified by the OECD. These include:

- a paradigm shift in perceptions and metrics of tourism success – across all levels of government and stakeholders, with a greater focus on environmental and socio-cultural pillars of sustainability in addition to economic benefits;

- integrated policy approach with industry and communities – to grow tourism within the wider context of national regional and local development strategies;

- mainstreaming sustainable policies and practices – a transition to a green, low-emission and climate resilient tourism economy;

- more sustainable tourism business models – business have a key role to play in adopting eco-responsible practices and advancing technologies across the transport and tourism sector to better deliver a positive impact on sustainability;

- better measurement for better management – improved, robust, timely and disaggregated system of tourism statistical metrics.

The drive to more sustainable tourism

Aviation: The European aviation industry was the first in the world to commit to the realisation of a net-zero goal for all departing flights by 2050. The use of Sustainable Aviation Fuels (SAF) will play a decisive lead role in the decarbonisation, together with aircraft technological advancement and air traffic management. Irish airlines are making significant capital investment in more energy efficient aircraft while committing to use of Sustainable Aviation Fuel (SAF).

Europe’s aviation leaders recently called on member states to confirm the ReFuel EU Aviation Regulation and enable Europe to become a leader in SAF production worldwide. There is significant opportunity in tying the production of SAF with the increased use of hydrogen to reduce the use of biofuels for SAF. The decarbonisation of aviation requires industry and government to work together in establishing production facilities to ensure reliable supply together with ensuring the price differential versus traditional aviation Jet Fuel is significantly reduced.

Ferry and Cruise: Switching to ‘net’ zero carbon fuels is the long-term solution to shipping’s decarbonisation. This transition is being driven forward by the economic performance of zero-emission vessels, environmental considerations, and the development and implementation of international regulations and policies. Operators in the sector are investing in ships fuelled by LNG (liquefied natural gas) – a fuel which emits virtually no sulphur dioxide, nitrogen dioxide or particulate emissions, as well as reducing carbon dioxide output by 25%.

Key focuses around sustainability onboard ships include investment in exhaust gas cleaning systems that minimise sulphur emissions, use of innovative, non-toxic, anti-fouling hull paints to reduce resistance, and the potential use of bio-fuels which can be up to 86% less carbon intensive than fossil fuels.

An interesting approach to promoting responsible consumption is Irish Ferries’ selection of crew uniforms, which now contain 95 percent recycled polyester recovered from plastic bottles. In 2022, the parent company purchased close to 1,000 garments, equating to 42,000 plastic bottles being recycled and prevented from reaching the oceans or landfill sites.