- Argentina

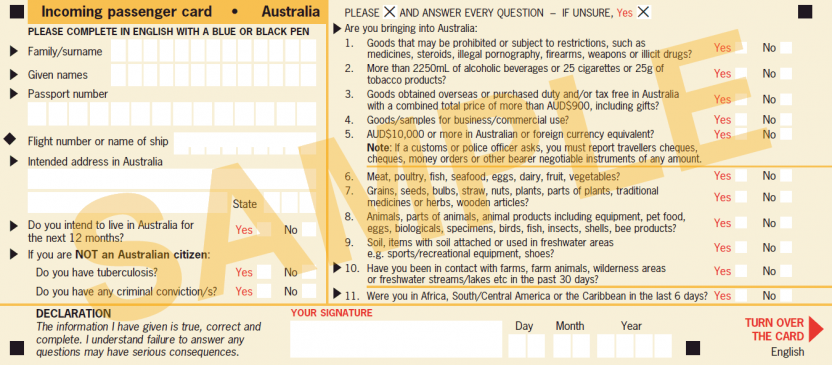

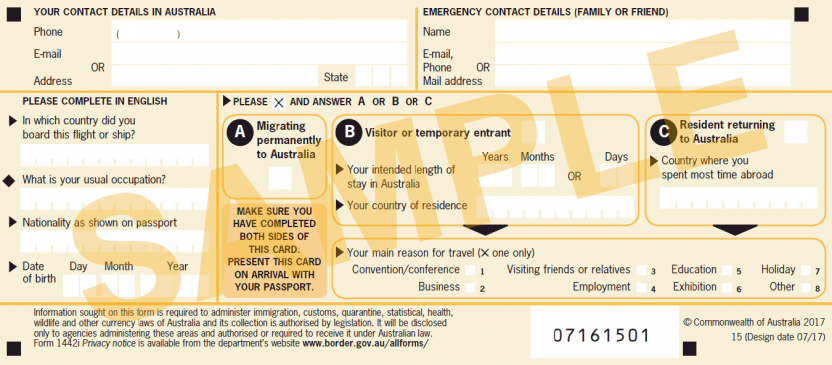

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Best Travel Cards for Australians Heading Overseas in 2024

We compare the best travel money cards including prepaid cards, debit cards and credit cards. Whether you want ease of access to money at any cost or no-frills or fees cash, find the best money solution when you travel overseas.

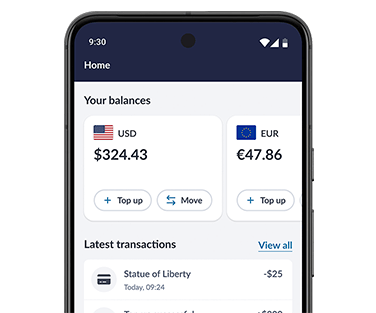

Wise - our pick for travel card

- No annual fee, hidden transaction fees, no exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR), Canada (CAD) and New Zealand (NZD)

- Available in the US, UK, Europe, Australia, Singapore, Japan and New Zealand

Find out more about the Wise card .

With this card:

- It's very easy to set up and order

- You can receive foreign currency into a multi-currency account linked to the card

- Pay with your Wise card in most places overseas where debit cards are accepted

- Get the mid-market rate for currency conversion

Go to Wise or read our review .

It's not all good news though

- There is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

How do I pick the best travel card for me?

Fed up with ATM charges when you travel overseas? Or running out of money when you need it the most? You probably brought the wrong card with you.

It can be tricky to choose the best travel card to use when you travel overseas. The best one for you will really depend on what you need from the card you're using.

You will generally use travel cards to make purchases online, in-stores and to withdraw money at ATMs. All travel cards have these basic capabilities. This means what you should really compare between travel cards are the following:

Exchange Rates and Fees

Compare exchange rates and fees

Conditions and limits

Spending conditions and max/min limits

Make sure your money is secure

Best Travel Cards for Australians Travelling Overseas

Wise is our pick for travel debit card.

- You can transfer money to a bank account overseas

- Currency conversion using the mid-market exchange rate

Click here to see the full list of cards and how Wise compares

Read the full review

- No annual fee, hidden transaction fees, exchange rate markups

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR) and New Zealand (NZD)

- It takes 7-14 business days to receive the card

- Can't always access local technical support depending on where you are

- Free cash withdrawals limited to under $350 every 30 days

- Only currently available in the US, UK, Europe, Australia and New Zealand

Revolut - multi-currency travel card

- No purchase fee, load fee, reload fee, exchange rate margin or minimum balance requirements

- Unlike other Travel Cards, its free and easy to use the balance of your currency or convert it back to AUD

- Mid-market exchange rate, they add a mark-up for currency conversion during weekends

- For the free Standard account, there is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- The premium account costs $10.99 a month, which can really add up if you are not using it often

Click here to see the full list of cards and how Revolut compares

- Very easy to use app

- Free to set up

- No hidden fees or exchange rate mark-ups (except on weekends)

- You can use it to transfer money to a bank account overseas

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

- Ongoing subscription fee for Premium and Metal cards

Citibank Saver Plus - bank travel card

The Citibank Plus Everyday Account - bank debit card. With this card you can:

- withdraw money for free at over 3000 ATMs Australia-wide and overseas

- take advantage of no foreign transaction fees, monthly fees, or minimum opening balance

- transfer money to friends and family anywhere in the world for free

We think this is the ideal debit card whether you're staying local in Oz or travelling to destinations in Asia or Europe.

- No international ATM or transaction fees

- Fee-free international money transfers to any account worldwide

- SMS notifications through Citi Alert

- Cash deposits available within 24-48 hours

- Can't have two cards active at the same time

- $5 account closure

28 Degrees Platinum Mastercard - travel credit card

28 Degrees Platinum Mastercard - travel credit card. With this card:

- There are no annual fees

- No overseas purchase fee or currency conversion fee

- You get 55 days interest free on purchases

- Access to free 24/7 concierge service

- Emergency card replacement worldwide

The 28 Degrees Platinum Mastercard has additional benefits including shoppers and repayments benefits cover. For more information read our review .

- Can have 9 additional cardholders

- No overseas purchase fee, or currency conversion fee

- No foreign transaction fee

- Free Replacement Card

- High interest rates after the initial 55 days

- Minimum credit limit is $6000

- No introductory offers or rewards

Learn more about the 28 Degrees Platinum Mastercard

Travelex money card - prepaid travel card.

Travelex Money Card - prepaid travel card. With this card:

- There are no ATM fees so you can withdraw cash at no extra cost

- You can access Travelex's online rates

- You can lock in your initial loading cross currency rate

- Ideal for the organised traveller.

- Can load up to 10 currencies including AUD, USD, EUR, GBP, NZD, CAD, THB, SGB, HKD and JPY.

- Smartphone App & Free Wifi Cross

- $0 overseas ATM fees (Australia excluded)

- 24/7 Global Support

- Limited Currencies

- 5.95% currency conversion rate

- $100 minimum initial load

- 2.95% Australian ATM withdrawal fee

Learn more about the Travelex Money Card

What are the other travel card options.

Check our travel card comparison table for a comprehensive list of fees and features for different travel debit and credit cards available for Australians travelling overseas.

*ATM operators will often charge their own fees.

** Up to 5 ATM fees and unlimited currency conversion costs may be rebated if you deposit $1,000 and make 5 purchases per month.

***Account fee waived if you meet eligibility criteria, including depositing $2,000 per month

What are the different types of travel card in Australia?

There are 3 popular travel cards you can take with you on your trip:

Prepaid Travel Card

Travel Debit Cards

Travel Credit Card

1. Prepaid Travel Card

For prepaid travel cards, you're able to load the card with a set amount of money in the currencies you need. Ideally you do this before your trip, but often you can reload them as well.

Most prepaid travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

With prepaid travel cards you need to be careful, as they can have numerous fees and charges which can make it more expensive than other options. But if you're organised and travelling to multiple cities a prepaid travel card is a good option. Read more of how to find the best travel card with no foreign transaction fees .

If you need more flexibility or you don't want to pay the multiple fees associated with prepaid travel cards, the HSBC and Citibank global accounts are better options.

- Exchange rate margins when you load your card

- Exchange rate margins when you close the card

- Flat or percentage-based fees to load the card

- ATM withdrawal fees

- Exchange rate conversion fee when you use the card

- Reloading fees

- Closing fees

Prepaid travel cards are best if:

- You want to lock in a rate

- You want to stick to a budget

- You lose it/it's stolen

Prepaid travel cards are not great if:

- You want the absolute best rates

- You need to hire a car, make payments on a cruise ship, or pay for a hotel

2. Travel Debit Card

An international card or your bank card offers the convenience of a credit card, but work differently. They draw money directly from your bank's everyday transaction account when you make a purchase. It's designed for everyday money transactions and means that you're not accumulating debt.

A debit card could make you stick to your travel budget, because you can't overdraw money from your account. And for daily purchases, we think a debit card can help you stick to your travel budget, because you can't overdraw money from your account.

We recommend bringing both a debit card and credit card for safety, flexibility and convenience on your trip.

- Currency conversion fee for overseas debit transactions

- Flat fee or percentage-based ATM withdrawal fees

- Foreign ATM owner fees

- Flat fee or percentage fee for debit card purchases via EFTPOS

Debit cards are best for:

- When you have time and you're happy to open a bank account to get one

- Fee-free cash withdrawals from ATMs

Debit cards are not great if:

- You switched from a better account to get one

- Or if you want to switch, but pick a costly travel debit card instead

3. Travel Credit Card

Credit cards have obviously been around for a long time. But now there are specialised travel credit cards. Generally, these cards give you longer to pay back what you've spent but the interest rates after this time can be quite high.

The main advantage with credit cards are the reward points you get in return for your customer loyalty when you spend. But it only works if you pay off the balance in full each month.

Credit cards are great to use for car hire, restaurants and accommodation - larger expenses that are easier for you to pay back over time. Some services only take credit cards to hold purchases so they can definitely be handy while you're travelling.

- Annual and reward scheme fees

- Cash advance fees

- Interest charges

Travel credit cards are best for:

- Getting the best spending rates

- If you have decent credit score and are legible for the credit card

- Frequent flyer points to help you get discounted or free flights

- Low or zero international transaction fees

- Complimentary travel and/or medical insurance offered with a lot of cards

Travel credit cards are not great if:

- Your credit score is poor

- You won't repay in full every month

- Can't afford high minimum credit and annual fees

- Want additional card holders (usually an extra cost)

- Your monthly salary minimum isn't high enough

- For some travel credit cards you have to be a permanent Australian resident

Best travel money card tips

Before you decide which travel money card will best suit your needs, it’s worth comparing a few, bearing in mind these handy travel money card tips:

- Exchange rate - check what rate is used to convert your dollars to the currency needed for spending in your destination. A card which uses the mid-market rate or as close as possible to it is usually the best value

- Coverage - make sure your card covers the currency you’ll need in your destination, as fees may apply if it doesn’t. Picking a card which covers a large number of currencies can also mean you’re able to use your travel money card on future trips.

- Safety - check the card’s safety features. Most cards are linked to an app which allows you to view transactions, check your balance and freeze or unfreeze your card if you need to

- Fees - read through all the possible fees associated with your card before you sign up. Costs may include a foreign transaction fee when spending an unsupported currency, ATM fees, a cash out charge or inactivity fees if you don’t use your card often for example

- Rewards - some travel money cards also offer some nice extras, like ways to earn rewards or discounts, or free wifi when you travel. Travel credit cards in particular have lots of rewards on offer, although you may have to pay an annual fee to get them

Travel card fees

The fees you pay for your travel money card will vary depending on the type of card you select, and the specific provider.

Travel prepaid cards fees can include:

- Fees when you get your card in the first place

- Load or top up fees

- An exchange rate margin when topping up foreign currencies

- Foreign transaction fees if you spend a currency you don’t have in your account

- ATM charges at home and abroad

- Cash out, close or inactivity charges

Read more about prepaid cards here

Travel debit card can include:

- Card delivery fee

- International ATM fees

- Currency conversion charges

Read more about travel debit cards here

International credit card fees can include:

- Annual fees to hold the card

- Cash advance fees if you use an ATM

- Foreign transaction fees

- Interest if you don’t repay your bill in full

- Penalties if you don’t pay your bill on time

Read more about credit cards here

Conclusion - What is the best card to use while travelling?

There’s no single best travel money card - which works best for you will depend on your personal preferences and where you’re heading.

Using a multi-currency debit card which supports a large range of currencies can keep your costs low and allow you to skip foreign transaction fees . Plus you’ll be able to use your card for online shopping in foreign currencies, or for your next trip abroad, with no ongoing fees to worry about.

Prepaid travel money cards are safe and easy to use , and you can often pick one up instantly if you’re in a hurry. You’ll be able to add travel money before you leave or top up as you travel, although it’s worth converting to the currency you need in advance, and looking for a card with mid-market exchange rates to avoid extra costs.

Generally using a credit card will come with the highest overall fees - but you’ll be able to spread out the costs of your travel over a few months if you need to, and you may also be able to earn rewards or cash back as you spend. Use this guide to compare different card types and options, and pick the perfect one for your needs.

Frequently Asked Questions - Best travel cards to use overseas

Which is the best travel card for use in australia.

The Citibank Plus Everyday Account is the best travel debit card for use in Australia. It works as a normal debit account, with no ATM fees at 3000 ATMs across Australia and has no account minimums.

Which travel card is best for Europe?

The best travel card for Europe is Wise . Not only do you get a great rate when spending in Euros, You get a set of bank account details with which you can recieve EUR transfers, as if you were a local.

Which high-street bank has the best travel card?

The best travel card from an Australian high-street bank is either the Citibank Plus Everyday Account or the CommBank travel money card . While Citibank's card offers more as a travel card (fee-free ATM withdrawals and excellent exchange rates), CommBank has far more in-person branches in Australia if you're someone who prefers doing your banking in person.

What is the best card to use while travelling?

There’s no single best travel money card - which is best for you will depend on your personal preferences. Usually having a few different ways to pay is a smart move, so packing a travel debit card or prepaid card, your credit card and some cash can mean you’re prepared for all eventualities.

Which bank travel card is best?

Australian banks offer travel credit cards, and some also have travel debit or prepaid card options which can be worth considering. Which is best for you will depend on the type of card you’d prefer, so comparing a few options from banks - and from specialist providers like Wise or Revolut - can help you find the best deal for your needs.

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

Travel Money Card Comparison

How to find the best card for your next overseas trip.

- Credit cards

- Frequent flyer

- Credit score

- Money management

- Sustainability

In this guide

Travel money card comparison

What is a travel money card, the pros and cons of different options, what are the travel money card fees i should know about, how to find the best travel money card, top travel money tips, australian travel statistics, faqs about prepaid travel money cards.

Travel Money Cards

Key takeaways

- The most important features to compare are the foreign transaction fees, exchange rates and usability.

- If you want to withdraw cash, a prepaid travel card or debit card will likely be cheaper than a credit card.

- It is a good idea to have several travel money options in case of loss, damage or theft.

A travel money card is a prepaid card which you can add multiple foreign currencies onto to use while you're travelling overseas. You can use it to make purchases and withdraw cash from ATMs.

Prepaid travel cards work similarly to debit cards as you can deposit a certain amount of money into the card and only spend what you've got available in the account. However, unlike a standard debit card, a prepaid travel card allows you to lock-in exchange rates before you travel.

You can also avoid some of the fees that you might be subject to if you were to use your normal bank card. Many transaction accounts have international transaction fees or other limitations, so getting a travel money card can save you money there. It can also feel safer to have a travel money card, avoiding the risk of losing your money if something were to happen to your bank card.

Prepaid travel money cards

Advantages of a travel money card.

- Pre-load your funds. Depositing your money on the card in advance can help you to stick to a budget, though you can always reload if needed.

- Multiple currencies. You can convert Australian dollars into several supported currencies (great for a multi-country trip) and avoid currency conversion fees.

- Locked-in exchange rates. Funds are converted based on the exchange rate at that time, so you avoid any exchange rate fluctuations while travelling. Caveat: this can be an advantage or a disadvantage.

- Frequent flyer points. The Qantas Pay prepaid card means you'll earn frequent flyer points for your spending both overseas and in Australia.

- ATM fees. Many travel money cards don't charge overseas ATM fees.

Disadvantages of a travel money card

- Additional fees. Some card charge additional fees including ATM, reloading, account closure and inactivity fees.

- Reload delay. Some cards may take a few days for the funds to be available.

- Acceptance. Travel money cards are not as widely accepted as debit or credit cards in some countries.

Newcastle Permanent Everyday Account

There is no universal best travel money card as your options vary from country to country and person to person. In saying that, some of favourable features of travel cards include:

- No additional fees: including ATM fees, reloading fees and card closure fee

- The option to lock in exchange rates before you leave

- The option to add multiple currencies onto the one card

- Digital wallet compatibility so you can add the card to Apple Pay or Google Pay

- Low or no additional cost to convert your left-over money back to AUD

- Security, including card pin

You should also consider exchange rates, conditions, limits and safety.

Here are our top travel money tips:

- Pay for your purchases in the local currency. This will help avoid any currency conversion fees.

- Keep an eye on your transactions . It's always a good idea to regularly check your transaction history to make sure there's no unauthorised transactions - and if there are, you should report them to your bank immediately.

- Always take more than one travel money option. You don't want to be left stranded if you lose your card or it gets stolen. Consider bringing 2 forms of travel cards to avoid being left cashless in a foreign country.

- Keep your travel money in a few different places. Having all your foreign cash and cards in a wallet means you'll have no backup if you lose your wallet. Instead, consider keeping some of your travel money in a separate place. For example, you could keep most of your cash in a hotel safe or a locked part of your luggage.

- Inform your bank. If you're using your regular debit or credit card, let your bank know. You wouldn't want your card to be cancelled due to a 'suspicious transaction' while you're overseas because your bank thinks you're still in Australia.

How do you top up travel money cards?

You can top up your travel money card if you need more money while you're on your trip. Depending on your specific travel money card, you can reload your card online, using BPAY, through your bank's app or via your bank's branch. Look into the card you are topping up because some methods do incur fees e.g. the Qantas Pay Card has an instant reload fee of 0.5% while its BPAY and bank transfers are free.

Can you get your money back if you don't spend it all?

You can generally get your money back if you don't end up spending it all while overseas. However, you might encounter fees to get the remaining money back into your regular bank account.

What should I do if my travel money card is lost or stolen?

The first thing you should do upon discovering that your card is missing is call your card provider. Reporting the theft or loss immediately will help protect the funds on your card.

Most of the card companies provide 24/7 customer service emergency numbers. Some even accept reverse charges, so it can be as simple as dialling the operator to connect your collect call. If you dial the number directly, you may be charged for the call.

- CommBank Travel Money Card: +61 2 9999 3283

- Cash Passport Platinum Mastercard: +44 207 649 9404

- Qantas Pay Card: +61 1300 825 302

- Travelex Money Card: 1800 303 297

- Revolut: +61 1300 281 208

What are the travel money card exchange rates?

Travel credit cards typically use the Mastercard or Visa network and use the daily exchange rates that the networks provide. You can find out the daily exchange rate by going to the Mastercard or Visa website. Prepaid travel cards allow you to lock in the exchange rate beforehand, so if you find a favourable one you can lock it in and not have to worry about fluctuations while you're away.

What is a cross currency conversion fee?

A cross currency conversion fee is charged when you use your Australian card with Australian dollars to make a purchase in a foreign country. The money is exchanged from Australian dollars into the local currency electronically. You can avoid this fee by choosing to pay in the local currency.

When are inactivity fees charged with prepaid travel cards?

If you have a travel card that charges an inactivity fee (a fee that's charged every month when your account is inactive for a period of time), you will lose any remaining funds on the card, but your account won't go into a negative balance. Once the card has a zero balance, this fee will not be charged.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full bio

Read more on this topic

The Wise Travel Money Card supports over 40 currencies, with free loading by bank transfer and an instant, virtual card. Here’s how its other features compare.

Revolut offers virtual and physical Visa cards, support for over 30 currencies and other travel perks – plus 3-month Premium trial with this offer.

Use finder's interactive world map to learn about variations in beer prices globally. Find out where in the world you'd pay a whopping $15.10 for a pint.

Discover the travel money options available for young people and how to prepare for a trip overseas.

The Travelex Money Card lets you load and spend in 10 currencies, with fee-free ATM options and overseas Wi-Fi. Check out its other features here.

Want to avoid fees and charges when using your card overseas? This guide explains the most common pitfalls when using travel cards.

Use this guide to understand foreign currency exchange and discover how to get the best deal.

Learn about your travel money options for Japan and the cards which will cost you less to use.

Spend in up to 13 major currencies, lock in exchange rates and manage your account with the CommBank app when you use the Commonwealth Bank Travel Money Card.

With Qantas Pay Card (previously Qantas Travel Money Card), you can carry multiple currencies using a single card and earn rewards points.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

320 Responses

When travelling from Australia to Switzerland is it best to exchange money at Australia Post from AU dollars to Swiss Franc in advance rather that change on arrival in Switzerland.

Hi Marjorie,

If you exchange your money at an airport or at a kiosk once you’ve arrived overseas, you may pay a hefty commission – it’s hard to know what charge in advance. Banks and licensed currency exchange outlets are likely to offer the best rates overseas but again, its hard to know what fees you’ll pay.

AustPost exchange is conveneint but it is not always the cheapest. Today, if you exchange $1000: – At AustPost, you’ll get CHF541.80 – The same transfer with Travelex is CHF550.80 – With Wise, you get CHF572.05

It pays to shop around and compare to find the best value.

Hope this helps!

I want a good all-rounder card, locked in FX, no maintenance charges, ATM fees , no withdrawal fees. What card is best ?

Hi Charles,

The comparison table in this guide includes details of ATM fees, load and re-load fees that can help you compare different options. For example, currently the Wise Travel Money Card and Revolut standard card both offer $0 ATM withdrawal fees for the first $350 per month, with charges for further ATM withdrawals. The Travelex Money Card also offers $0 ATM withdrawal fees.

All of these cards also let you lock in FX rates for supported currencies, but may charge fees when you’re spending in a currency that’s not loaded on the card. So it’s a good idea to consider which currencies you plan to spend, as this could have a big impact on the overall costs and help you choose a card that’s suitable for you. You can also view more details on potential costs for each card on Finder’s review pages. I hope this helps.

I am going to the Uk in 2019. Confusions is supreme. I see there is information about conversation currency fees, however on individual travel card sites they claim 0 fees. If I have a facility with my current domestic bank that charges no fees to transfer money to another facility and I use a travel card that states they have 0 fees for upload and currency conversation fee, am I correct in believing that there will be no cost to me to upload AUD to GBP. I am traveling for about 3 months and with a budget of around AUD 20,000. What cards should I consider compared to using my domestic Credit and Debit cards. I have tried using your search engine for best card for country but it is not uploading.

Thanks for getting in touch.

Sorry to hear about your confusion as to which card you would bring to the UK and apologies as well if you’re having a hard time uploading our page. Nevertheless, to help you narrow down your options, you can refer to our guide on travel money to the UK . From the page, you’d be able to compare your options for pre-paid, debit, and credit cards, and even foreign cash. Just click on the tabs to see the list. Once you have chosen a particular travel card, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with your application or get in touch with their representatives for further assistance.

With regard to the cost, usually, there’s no cost in loading AUD to the prepaid travel cards. If the currency is supported by the card, say GBP, it’s also free.

I hope this has helped.

Cheers, May

Hello, just wanted to let you know that unless I’m mistaken, the Qantas Cash card has differing information on your website. On one page it says that there is a 1% reload fee and on another that there is 0%. That said, thanks for offering unbiased easy to understand information, much obliged…

Thank you for your inquiry.

There are actually two ways to reload your Qantas Cash Card. The first option is via bank transfer or BPAY which has 0% fee and the second option through Direct Debit that charges 1% of the total amount. As a sample, this is how Direct Debit works:

If you wish to load or reload 200 AUD onto your card using Debit Card Load, you will be charged a fee of 1% of the load amount being AUD 200 x 1% = AUD 2. This means you will be required to pay AUD 202 to complete your Debit Card Load transaction.

Please also note that you may be charged other fees by third parties in relation to the Debit Card reloading transaction like the fees charged by your financial institution.

I hope this information helps.

I am traveling to South Africa and wanted to take a prepaid debit card but do not know who to contact for something like that. I talked to Travelex but they do not deal in South African currency. Any suggestions?

Thank you for contacting Finder .

Our Travel money guide to South Africa will provide you some options that may suit your needs. On the page, is a comparison table for a list of travel debit cards and prepaid travel money cards. You can use the table to help narrow down your options. Once you have selected one, you may proceed by clicking the green “Go to Site” button.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps.

Cheers, Danielle

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Australia Post Travel Platinum Mastercard®

A prepaid travel card with 11 currencies to load from, giving you confidence when spending overseas.

- About Australia Post Travel Platinum Mastercard

- Fees & limits

- Get started

- Support & FAQs

The ideal prepaid card for overseas travel

Travel smarter with our Australia Post Travel Platinum Mastercard, a reloadable, multi-currency prepaid card that’s accepted wherever Mastercard is, worldwide 1 . Easily swipe or tap in-store, use online and withdraw money from ATMs 2 .

Load up to 11 currencies. Easily switch between USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD, AED and AUD on your travels.

Lock in your exchange rates. Know exactly how much you have to spend online or in-store with locked-in exchange rates 3 .

Travel safely. With no link to your bank account and Mastercard’s Zero Liability 4 protection against fraud and other unauthorised transactions.

Total control. Manage and load your prepaid travel money card on the go via ‘ My Account ’ or the Australia Post Travel Platinum Mastercard app.

24/7 global assistance. Card lost or stolen? Call for a replacement anytime. You may also be eligible for emergency funds assistance 5 .

Managing your travel money just got easier

Our Australia Post Travel Platinum Mastercard app makes managing your travel money faster and easier. Check your balance, reload in-app, track your spending and switch between currencies.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 254kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

View the Target Market Determination (PDF 88kB) for this product.

If you click on links to Australia Post Travel Platinum Mastercard you will be leaving the Australia Post site and be directed to a third-party site to place your order and complete your purchase. Please see the terms and conditions of the third-party site for further details.

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card

2 Some ATM operators may charge their own fees and set their own limits.

3 Lock in your exchange rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

4 Further information relating to Zero Liability card protection can be found at the Mastercard website .

5 T&Cs apply. Customers must contact Customer Service to report lost or stolen cards. Emergency cash can be arranged up to the balance of your Australia Post Everyday Mastercard, subject to availability of funds at the approved agent location.

Australia Post Travel Chance To Win 2024 competition winners

Congratulations to our winners of the Australia Post Travel ‘Chance To Win’ competition:

- KATHERINE JANE SHARLEY

- ADRIAN BROCKLEHURST

- GRANT FEREY

For a full list of Fees & Limits, refer to the Product Disclosure Statement (PDF 258kB) .

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 254kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Travel smarter with our prepaid travel money card

Buy your Australia Post Travel Platinum Mastercard® at a participating Post Office or online .

Register / Activate

Register your prepaid travel money card online.

If you purchased your card online, you’ll need to activate it.

Load your card anytime online through ' My Account ', the Australia Post Travel Platinum Mastercard® app or at any participating Post Office .

Use your card wherever Mastercard is accepted 1 .

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card.

More information

- Product Disclosure Statement (PDF 254kB)

- Financial Services Guide (PDF 72kB)

- Target Market Determination (PDF 88kB)

Can't find an answer below? Call Card Services on 1800 549 718 within Australia or +44 207 649 9404 internationally for help 24/7.

If you have a transaction on your card that doesn't seem right, download the disputed transaction form .

Frequently asked questions

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

- Travel Money Card

Get our best rates on the award winning Travelex Money Card.

- Top Up Card

- Our best rates

- No commission or hidden charges

- Free Click and Collect

- Next day home delivery

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

- Manage your balance 24/7 through the Travelex Money App

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Already have a card?

The travelex money card.

An award-winning prepaid travel card that can be used wherever Mastercard is accepted online or in-store at millions of outlets around the world, conveniently allowing you to tap & go worldwide with your card and phone via Google Wallet™. 5☆ Canstar rating: 2016, 2017, 2018 2019, 2020 and Mozo best prepaid travel card winner 2022, 2023 & 2024.

Travel money card benefits

Easy to use.

- No fees when you buy online

- Unlimited FREE overseas ATM withdrawals 1

- Convenient Travelex mobile app

- Shop at millions of outlets and websites wherever Mastercard prepaid is accepted

- Award winning travel money card

- Tap & go with your Android phone via Google Pay™ and Google Wallet™

Save on fees & earn cashback

Our award-winning, reloadable, multi-currency, prepaid card allows you to save on a range of fees.

- $0 Eftpos fees

- $0 ATM fees 1

- $0 Currency conversion fees 2

- $0 Online shopping fees 3

- $0 Free delivery to your home

- Earn cash rewards with Mastercard® Travel Rewards 6

Safe & supported

- Your bank account is not linked to the Travelex card

- Receive access to emergency funds 4

- Stay protected with Mastercard's Zero Liability 5

- Dedicated 24/7 Mastercard Global Support

- Temporarily lock your card if lost or stolen

$25 welcome bonus

Use code: welcome25 at checkout for a $25 bonus.

Load AUD on your Travelex Money Card and save when spending in the below currencies:

- Purchase a new Travelex Money Card with AU$2,000+ in foreign currency equivalent to get a AU$25 bonus

- Exclusively available online or via the Travelex money App

- Don't miss out, bonus offer ends Thursday 26 th Sep at 11:59pm AEST. T&C apply

How does a Travelex Money Card work?

It’s fast and easy to get a Travelex Money Card.

1 | Order your travel card

Order your Travelex Money Card online or in-store (passport or driver's license required).

Collect from a Travelex store or delivered FREE to your home (allow up to 7 business days from when payment is received).

2 | Download the app and register

Download the app from the Google Play and Apple app stores.

Simply activate your card by registering your account via the app or online.

3 | Spend & top-up

Manage and check your balance online and on your mobile.

Top-up via the app or online.

Travel Card Exchange Rates & Currencies

Choose from 22 currencies

Currency to currency conversion calculator

Use our handy currency to currency conversion calculator to estimate the indicative exchange rate which will be applied when spending using an unsupported currency not on the Travelex Money Card.

$0 Currency Conversion Fee

when spending a currency not on your travel card:

No currency conversion fee will be charged when transacting in a local currency that is unsupported or insufficiently loaded on your card. The applicable Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions 1

The below calculator is a handy tool to help you estimate the applicable exchange rate for your transaction 2 :

Spend Calculator

You can use this calculator to see what your spend would look like for your trip. It will help you estimate the applicable exchange rate for your transaction.

Fees and limits

No fees online.

No initial charges for card purchase and no currency conversion fees^.

Free replacement card

Enjoy peace of mind with our free replacement card service, available if your card is lost, stolen, or damaged or access to emergency cash.

Flexible ATM withdrawal limits

Withdraw the equivalent of $3,000 AUD from ATMs worldwide within a 24-hour period.

Generous maximum card balance

Hold up to $50,000.00 AUD at any one time, easily accommodating all your travel plans.

Fees & limits disclaimer: The following fees and limits apply. Fees and limits are subject to variation in accordance with the terms and conditions. Unless otherwise specified, all fees will be debited in AUD currency.

If there are insufficient funds in AUD Currency to pay such fees, then we will automatically deduct funds from other currencies in the following order of priority: AUD, USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD.

Terms and conditions

Additional important information.

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this The Product Disclosure Statement ; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this The Product Disclosure Statement . Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

Save with AUD

- IDR, AED, FJD, PHP, MYR, TWD, KRW, KHR, VND, CNY

- Free online AUD load and top-ups

- $0 International ATM fees 1

What our customers say

Find out why our community trust in Travelex

Download the Travelex Money App

- Top-up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

Travelex travel card currency information

Lorem ipsum dolor sit

Travelex Money Card FAQ

Important note about purchasing a travelex money card.

When purchasing foreign currency and travel money card online, the name on the order details must match the name on the payer’s bank account, debit or credit card. For this reason, Travelex Money Card cannot be bought as a gift for someone else.

You can only hold one card in your name at any one time .

Help & support contact numbers

Mastercard card services and Travelex customer support centre are here to help.

Find who to contact here (local and international numbers).

Travelex Money Card top-up tips

Top-up via the Travelex website

- Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

Move currencies on your card, instantly!

- If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via BPAY:

- Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. You must make payment using your own account.

- MasterCard Biller Code: 184416 Reference No: your 16 digit Travelex Money Card number

- Funds will be allocated to your default currency. To check your default currency login to your account. Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

What is the best prepaid travel card for Australians?

The best travel money card for Australians is the one that caters to the currencies available at your destination, removes ATM withdrawal and foreign purchase fees, and has the best exchange rate.

Find our exchange rates for all major currencies and plan your holiday today. The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel card by Mozo two years in a row.

Are Travelex Money Cards worth it?

- Locking in fixed foreign currency exchange rates and avoiding foreign transaction fees before you travel

- The ability to load multiple currencies onto one card, similar to a travel debit card

- The ability to spend money conveniently and comfortably overseas

- No overseas ATM withdrawal fees 1

- No fees when making online purchases

Money travel cards can be ordered online and topped up via a convenient mobile app.

What is a travel money card?

A travel money card is a global currency card that allows you to load several foreign currencies into a personal account at a prevailing exchange rate . Like debit and credit cards, a travel money card can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling. You can buy currencies and add or reload them into your travel money card account via a mobile app whilst abroad. One of the best ways to use the Travelex Money Card is with the Travelex Money App. The Travelex Money App makes ordering, transferring, and checking currencies quick and simple on your travel card. You can also use the Travelex travel exchange rate tracker to check currencies in real time. You can order a travel money card online or purchase one directly from a Travelex store. Find a store near you.

How long does it take to get a travel money card?

- Travel money cards can be ordered online and collected in store next day (when paying by debit/credit card).

- Just walk in store. Cards purchased and loaded in-store are active and ready-to-use on the spot. We will automatically transfer funds between currencies complete your card transactions.

- Home delivery within 5-7 business days (from when payment is received).

Travelex Money Cards ordered online and picked up in-store, or those purchased directly in-store do not require activation.

Do you get charged for using a travel money card?

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Can I withdraw money from my travel card?

Similar to any bank account, you can withdraw money from your travel money card at ATMs worldwide. When withdrawing cash, select the “credit” option on the ATM machine screen to access funds. You will not be charged credit card fees by selecting this option. If the “credit” option does not work, try selecting “debit” or “savings”. The maximum withdrawal amount is 3,000 Australian dollars each 24 hour period. Bear in mind that some ATMs may also have their own ATM fee, adding a cost to your withdrawal.

Where can I use travel cards?

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

Travelex stores abroad: good to know

Travelex stores abroad cannot provide balance enquiries or offer cash-out as they do not have access to your Australian issued Travelex Money Card details.

- For balance enquires, you can check it on the Travelex Money App or call us on 1800 440 039 .

- Cash-out may be offered in local shops that provide this service.

How much does a Travelex Money Card cost?

The initial card fee is free, subject to minimum load amounts. Please see the fees and limits section for more information.

There are fees associated with the way you use your card e.g. the type of transaction, the currency you use, and when you move currencies on your card. Limits also apply to top up amounts and method of top up.

Please see more information on applicable fees and limits section.

How secure is the Travelex Money Card?

Activity on your Travelex Money Card is monitored every day to detect unusual behaviour, and if something is spotted you'll be contacted to check your transactions.

There are also things you can do to help keep your travel money secure:

- Sign your card as soon as you receive it

- Check your transactions regularly and report anything unusual to Card Services immediately

- If you print statements from the internet, keep them safe and shred them when you've finished using them

- Never give your personal details to someone on the phone

- Don't give out your details in response to unsolicited email

- Be wary of anyone who asks for common security details like your mother's maiden name, passwords, date of birth, or information about your work

- Never give your PIN to anyone, even if they claim to be from your card issuer

- Don't let yourself get distracted when using cash machines or point of sale terminals - somebody may be trying to find out your PIN

Still have questions?

Explore our support categories for more help.

Basic information about the Travelex Money Card.

Getting started

Details on obtaining and eligibility for the card.

Information about you Pin.

Managing your Travelex Money Card account.

Using the card

Card usage, currencies, and topping up.

Your card and ATM usage.

Details about adding your card to a Google Wallet.

Information on fees and limits.

Support for lost/stolen cards.

Contact details for further assistance.

- 1 Please be advised that although Travelex do not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using

- 2 A foreign exchange ‘Spend Rate’ rate will apply to foreign exchange transactions in accordance with The Product Disclosure Statement .

- 3 Transacting via some online merchants may incur a surcharge.

- 4 Customers must contact Mastercard Customer Service to report lost or stolen card. Emergency cash can be arranged up to the balance of your Travelex Money Card, subject to availability of funds at the approved agent location.

- 5 As a Mastercard holder, Zero Liability applied to your purchases made in store, over the phone, online, or via mobile device and ATM transactions. You will not be held responsible for unauthorised transactins if you have used reasonable care in protecting your card from loss or theft, and you promptly report loss or theft. For more information, please visit the Mastercard Zero Liability Terms and Conditions page.

- 6 Terms and Conditions apply for the Mastercard Travel Rewards program. Please see the Mastercard Travel Rewards terms and conditions . This rewards program is available on the Travelex Money Card until the 31st of December 2024 or may be extended or withdrawn and you may receive prior notice where it is reasonably practicable to do so.

- Google Pay and Google Wallet are trademarks of Google LLC. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au, before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

- Find a Store

- Join our Mailing List

- Price Promise

- About Travelex

- Best Ways to Buy Foreign Currency

- Travelex Money App

- Currencies Available to Buy

- Currency Converter

- Rate Tracker

- Sell Your Currency

- Travelex Travel Hub

- Australia Post

- Become an Affiliate

- Other Services

- International SIM Cards

- Travel Insurance

Travelex Info

- Business Services

- Product Disclosure Documents and Terms & Conditions

- Website Terms of Use

- Privacy Policy

- Fraud & Scams

- Modern Slavery Statement

Join the conversation

Customer support.

Online Order Queries:

- Tel.: 1800 440 039

- Email: [email protected]

- Map: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel Money Card

Travel Money Card

Lock in exchange rates and load up to 16 currencies on one account to easily access your money while you’re travelling.

Features & benefits

$0 card issue fee.

Order a Travel Money Card for free in branch or online (search 'Travel Money Card' in the CommBank app or log into NetBank ).

Lock in exchange rates

Load up to 16 currencies on one card before your trip, so you know how much you have to spend, no matter how the Australian Dollar moves.

Spend anywhere in the world

Shop online, in-store, or over the phone wherever Visa is accepted, plus get access to Visa ® travel offers .

Easily manage your travel budget

Manage your holiday money and track your spending via the CommBank app or NetBank.

Your purchases, covered

Lost or stolen personal belongings? We may be able to cover the cost to repair or replace them up to 90 days after purchase. 2

Extra card security

Lost, misplaced or stolen card? Lock it and report it in the CommBank app or NetBank.

- Currency converter

Exchange rates

Load up to 16 currencies on one account

Lock in exchange rates and load up to 16 currencies easily on one account – wherever you are in the world – through NetBank or the CommBank app:

- United States Dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Australian Dollars (AUD)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

- Fijian Dollars (FJD)

- Indonesian Rupiah (IDR)

- Indian Rupees (INR)

No load or reload fees

You can load up to 16 currencies on your Travel Money Card with no load or reload fees. The exchange rate is the CommBank Retail Foreign Exchange Rate at the time of the conversion.

When you’re ready to pay for something, we will always try to complete the transaction for the country you are in. Make sure you have enough of the correct currency for the country you’re in on your card to avoid additional fees. If you don’t have enough of the local currency, we’ll use the next available currency instead, so long as there’s enough of it loaded on your card.

If you load multiple currencies on your Travel Money Card, you can change the order (the next available currency) anytime online.

Rates & fees

See all fees and charges

Who can apply

To get your Travel Money Card, you’ll need to:

- Be at least 14 years old;

- Be registered to use NetBank, or register online New to CommBank? Sign up to NetBank at your nearest branch ;

- Provide a valid email address; and

- Have an Australian residential address

How to apply

Before your trip.

- Order a Travel Money Card in the CommBank app (search 'Travel Money Card'), NetBank , or at your nearest branch .

- Load at least AUD 50 or the foreign currency equivalent to get started

- Once you’ve got your card, activate and set your PIN online in NetBank, or under Cards in the CommBank app

- Lock-in the exchange rate by loading currency on your card in NetBank or the CommBank app

How it works

During your trip.

- The local currency will be automatically applied when you pay for something, as long as it’s loaded on your card and you have sufficient funds

- Reload in real time , fee-free if your balance gets low

- Stick to daily transaction limits

- The maximum value of purchases per day is unlimited, however no more than your available balance

- The maximum amount you can withdraw from ATMs per day is AUD 2,500 or the foreign currency equivalent. Keep in mind most ATM operators have a limit on how much you can withdraw from an ATM per transaction

- The maximum amount for over-the-counter withdrawals per day is AUD 2,500 or the foreign currency equivalent.

When you’re home

- Got leftover currency? Exchange it for another currency or back into your CommBank account from NetBank or the CommBank app

- Top up your Travel Money Card (it’s valid for 4 years) in preparation for your next trip

- Donate your foreign (and local) currency to any CommBank or Bankwest branch and every cent will go to UNICEF

- How to manage your Travel Money Card

You’ve got your new card – here’s how to get the most out of it.

Find detailed info on getting started, loading and reloading currencies, setting a currency order, checking your balance and tracking your spend. Plus, info on Purchase Security Insurance Cover and access to Visa ® travel offers .

Manage your Travel Money Card

Need foreign cash? Have it ready before you travel

If you’re a CommBank customer, you can buy or sell up to 9 foreign currencies at selected CommBank branches in exchange for Australian Dollars.

You can also order foreign cash in over 30 currencies online – even if you’re not a CommBank customer.

Discover Foreign Cash

Planning an overseas trip?

Discover travel tips to help make the most of your European summer holiday.

See travel tips

Emergency support & tools

What to do if you’ve lost your card or it’s stolen.

If you’ve lost your Travel Money Card, or you think it might’ve been stolen, we can have an emergency replacement card sent to you anywhere in the world.

You may also be eligible for an Emergency Cash Advance, giving you access to cash within 24-48 hours (often on the same day).

Call us in an emergency on:

- 1300 660 700 within Australia

- +61 2 9999 3283 from overseas (reverse charges accepted).

When calling from overseas using your mobile, standard roaming charges may apply. To avoid roaming charges, call the international operator in the country you’re in from a landline and give them our reverse charges number +61 2 9999 3283.

Tools & calculators

- Saving calculator

- Budget planner

- Managing multiple currencies on your Travel Money Card

- Travelling overseas: 10-step money checklist

- Beginners guide to exchange rates

- Online banking while overseas

- Planning an overseas holiday

We can help

Your questions answered

Get in touch

Visit your nearest branch

Things you should know

1 The cash withdrawal fee will not apply to cash withdrawals made in Australia.

2 For more information relating to the complimentary Purchase Security Insurance refer to Travel Money Card Complimentary Insurance Information Booklet (PDF) .

As this advice has been prepared without considering your objectives, financial situation or needs, you should before acting on this advice, consider its appropriateness to your circumstances. The Product Disclosure Statement and Conditions of Use (PDF) issued by Commonwealth Bank of Australia ABN 48 123 123 124 for Travel Money Card should be considered before making any decision about this product. View our Financial Services Guide (PDF) .

To raise a dispute related to your Travel Money Card please complete the Travel Money Card Dispute form (PDF) .

Any withdrawal or balance enquiry fee will come from the currency for which you are using your card. If this currency is not loaded on your card, the fee will be taken from the first (or sole) currency loaded on your card. Any SMS balance alert fee will come from the first (or sole) currency loaded on your card.

The target market for this product will be found within the product’s Target Market Determination, available here .

Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Travel Card for Australians

By Will Ellis

When you spend money abroad, the fees can quickly make the trip more expensive, especially when using your regular debit card and bank account. T

here are usually foreign currency fees and additional fees when you withdraw money and the exchange rates, too. Using a travel card can reduce the cost of fees when you use one for spending money outside of Australia.

There are three types of travel cards: prepaid travel money cards, travel reward credit cards, and travel debit cards. In this article, you’ll learn all about travel cards, and we’ll introduce you to the best ones on the market.

Table of Contents:

- What Is a Travel Card

- Travel Cards: Pros and Cons

- 1. Travelex Money Card

- 2. Australia Post Travel Platinum Mastercard

- 3. Qantas Money Travel Money Card

- 4. Wise Travel Money Card

- 5. Revolut Travel Money Card

- 6. HSBC Everyday Global Account Debit Card

- 7. Bankwest Breeze Platinum Credit Card

- 8. ING Orange One Low Rate Credit Card

- 9. 28 Degrees Platinum Mastercard

- The Verdict

What Is a Travel Card? 💳️

A travel card is a card that is specifically to be used when someone is planning to travel outside of their home country. Travel cards allow you to spend money abroad with lower fees than expected with your everyday bank account . Most travel card providers will tell you about the currency conversion fee, interest rates and other fees before you make a transaction so you know exactly how you could spend abroad on fees.

You can use different types of travel cards; each will depend on your spending needs and financial situation. Before diving into the best travel cards on the market, we’ve provided a list of all three types of travel cards.

There are three types of travel cards:

- Prepaid travel card: A prepaid travel card is a card you load money onto. You can use a prepaid card wherever Mastercard is accepted. You can use it like your everyday debit card, but it helps you shop safely and stick to a budget, as you can’t spend more than the balance allows. You can load more than one foreign currency onto the card, so it’s perfect for travelling overseas. You simply need to bank transfer money across to the prepaid debit card.

- Travel debit card: A travel debit card is part of a travel bank account, usually known as a multi-currency account; you can use it just like your everyday bank account, but it’s for travelling. If planning a long trip, you may benefit from opening a travel bank account.

- Travel credit card: Travel credit cards are similar to credit cards you can apply from your main bank provider. However, they usually offer better currency conversion fees and reward you with travel points or perks for using the credit card and repaying the balance on time. Travel credit cards typically require a good or excellent credit score.

Travel Cards: Pros and Cons ➡️

You may be unsure if a travel card is the right option, so we’ve compiled a list of all the pros and cons of using one for travelling overseas.

- Cheaper foreign transaction fees: Travel cards typically have lower foreign currency conversion fees. Plus, you won’t be charged as much as you were if you used your everyday bank account.

- Easy access: You can apply for and access your travel money card online. Most prepaid cards allow you to reload money onto the card via an app on your phone.

- Hold multiple currencies: When you have a travel debit card, you will get a multi-current account, which allows you to hold multiple currencies on one account. You can use this bank account for spending abroad; currency conversion fees are usually the lowest with these types of accounts. Prepaid travel cards also allow you to hold and use multiple currencies on one card.

- Earn reward points: When you use a travel credit card, you can earn reward points when you use the credit card for spending. You can use the points for travel perks, discounts, cheaper flights, and lounge access.

- Helps to budget: With a prepaid card, you can only use the balance as there is no credit option. So, if you’re trying to stay on a budget, it’s easier when there is no temptation of an overdraft or credit balance.

- Locked-in exchange rates: Most prepaid cards have a locked-in exchange rate, so you don’t have to worry about fluctuation of exchange rates when transferring money into a different currency. Some companies may use a live exchange rate; always check with the provider about fees before you use your card abroad.

- Use just like a debit card: A prepaid debit card allows you to spend and pay for things like your regular debit card. If you choose a prepaid debit card, it will be attached to a bank account that works like your everyday account.

- Backup card: Most prepaid card providers will send you a backup card if you lose or damage the first one. They will send you two cards together, so keep one separate from the other for safekeeping so you don’t lose them both together.

- Currency conversion: When you use a travel card overseas, especially a travel debit card, the provider will automatically transfer funds into the currency you’re paying with.

- Potential reload delay: Sometimes, there can be a delay in reloading prepaid cards. To prevent potential delays, try to transfer all the money you need before you travel so you don’t have to worry about it whilst you’re away.

- Travel money card fees: A travel money card has its own fees, such as account fees, reload fees, and inactivity fees. Some travel credit cards have monthly fees.