CRA Mileage Rate 2024: Guide to Tax-Free Vehicle Allowances For Business Travel

Cra mileage rate 2024.

Are you an employee, small business owner, or self-employed individual looking to understand the rules and regulations of CRA mileage rate this 2024 ? Canadian taxpayers need to be aware of what they can expense on their taxes as entertainment, such as meals or kilometres travelled in a car.

We will discuss all relevant to ensure you maximize your deductions for businesses travelling while remaining compliant.

Key Takeaways

- 70¢ per kilometre for the first 5,000km driven

- 64¢ per kilometre after that

- 74¢ per kilometre for the first 5,000km driven

- 68¢ per kilometre after that

Changes to the CRA mileage rate for 2024

When reimbursing employees for business travel, the Canada Revenue Agency (CRA) has set out a specific set of rules that employers must adhere to. Canadian taxpayers should be aware of these rules when managing their business expenses to avoid any penalties from the CRA.

The 2024 standard CRA mileage rate per kilometre is currently 70 cents with a 4-cent per kilometre reduction after the first 5,000 kilometres driven yearly.

Here’s the CRA’s Automobile Allowance Rates for the past five years:

You can report any tax-subjected automobile allowances paid to employees or officers on Form T2200 Declaration of Conditions of Employment .

Employers can claim input tax credits based on reimbursements made for these expense claims but must ensure they keep detailed records alongside invoices related to any incurred costs.

Businesses must recognize reimbursement requirements, as failure to comply could result in CRA-implemented fines and other financial penalties, which will financially affect both employers and their staff.

What is CRA mileage allowance and tax-free vehicle allowance in Canada?

The CRA mileage rates are a guide set by the Canada Revenue Agency to reimburse taxpayers for vehicle expenses incurred for business use. They calculate the deductible expenses related to operating a vehicle for business, medical, moving, or charitable purposes. Taxpayers can use these rates to calculate their deductible vehicle expenses when filing their income tax returns.

How to use the 2024 CRA mileage rate and automobile allowance: Salaried workers, Self-employed, and Employers

Mileage reimbursement rules for salaried workers.

Employees may be eligible to claim allowable motor vehicle expenses on their income tax return if they incurred these expenses under the terms of their employment contract. For instance, if an employer agrees to reimburse travel expenses for using one’s personal vehicle for work-related tasks.

However, it’s essential for employees to maintain accurate records and evidence to substantiate that the kilometers claimed were indeed for business purposes.

Mileage Reimbursement Rules for Self-employed

Self-employees can also deduct business-related vehicle expenses. This also applies to personal cars used for business purposes such as purchasing supplies for your businesses, meeting with clients, attending conferences, or visiting customers. Other expenses may also include:

- License and registration fees

- Fuel and oil expenses

- Insurance fees

- Maintenance and repairs expenses

- Leasing costs

- Capital cost allowance

The allowance will be deducted in the annual tax returns. But remember, self-employees must keep receipts and invoices in order to get deductions. Expenses incurred for personal use of their personal vehicle will not be eligible for coverage under the allowance.

Mileage Reimbursement Rules for Employers

There is no law mandating that employers must compensate employees for using their personal vehicles for business purposes – this depends on individual company policies or contracts.

Nevertheless, implementing a mileage allowance using Canada Revenue Agency (CRA) standards can make a job offer more attractive to potential employees, as it compensates for their personal vehicle usage.

With a CRA mileage allowance, employers are obliged to cover employees’ work-related vehicle expenses. This reimbursement also provides a tax benefit for the company. To qualify as legitimate and tax-deductible, the reimbursement should:

- Cover the yearly amount of kilometres driven solely for business purposes

- Be based on a reasonable per-kilometre rate or slightly lower than the official CRA vehicle allowance rates

- Be for the employee who hasn’t already been reimbursed for the same use of their vehicle.

If these conditions are met, the mileage reimbursement is considered a non-taxable benefit for employees.

Eligibility For CRA Mileage Rate 2024 And Tax-Free Vehicle Allowances

The CRA provides rules and regulations for claiming tax-free vehicle allowances and mileage rates when travelling for business purposes.

You are also eligible if you use your car to attend conventions, seminars or meetings, and other activities with work-related purposes away from home. But travelling from your home to your normal place of work is not considered business-related driving.

The type of transportation used is essential—employees using public transport, such as buses and subways, do not qualify for any reimbursements. At the same time, those who choose personal cars will receive a predetermined per-kilometre rate (according to the CRA standard mileage rate as shown above).

4 Types Of Business Travel Eligible For CRA Mileage Rates And Tax-Free Vehicle Allowances

- Regular Work Locations

- Temporary Work Locations

- Home Office as a Regular Work Location

- Commuting to Work

Whether travelling for regular work locations, temporary work locations, home office or commuting to work, you’ll find everything you need to know about the CRA mileage rates and tax-free vehicle allowances here.

Canada Revenue Agency (CRA) defines regular work location as any workplace that the employee visits at least once a week on a sustained basis for a purpose related to their employment.

It includes both long-term and short-term job positions or assignments. The employer must be able to provide sufficient proof of attendance; records such as timesheets should help demonstrate this.

In addition, travel expenses associated with these locations are only eligible for reimbursement if they are located more than 80 km (one way) from the primary place of business or residence of the employee.

For example, an accountant who works in Toronto but travels to Ottawa each weekend would likely qualify for CRA mileage rate reimbursements since it’s more than 160 km one way between cities—even if he has not been assigned there permanently yet.

Any work location other than an employee’s regular place of employment is considered a “temporary” work location and would be eligible for mileage rate and tax-free vehicle allowances.

According to CRA guidelines, temporary locations last up to four weeks or have been pre-approved by the employer in writing. Considering all surrounding circumstances, the employer must demonstrate why the travel was reasonable.

Any expenses related to this travel, such as lodging, meals, allowance and specific motor vehicle rates, can be deducted from income if proven to be necessary business or relocation expenses incurred during that journey.

- Home Office As A Regular Work Location

Home offices may qualify for either CRA mileage reimbursement or tax-free vehicle allowance when it is determined to be a regular work location.

To qualify as a regular work location, the home office must be used for working with clients or customers more than 50% of the time each month and must meet specific criteria, such as having private entrances, separate telephone lines and an exclusive portion of the residence dedicated solely for business activities.

- Commuting To Work

Commuting expenses incurred while travelling to and from work regularly are usually not eligible for mileage rate or tax-free vehicle allowance benefits under the CRA.

However, Canadian taxpayers can claim certain commuting expenses for business activities associated with their job or profession that require them to travel and attend industry events or other such engagements away from their workplace.

To be eligible, the primary purpose of this travel must be generating income by performing duties related to your job/profession rather than commuting between home and work.

LEARN MORE: How to Find the Best Tax Accountant Near Me

Mileage Reimbursement Implications

Tax implications.

In Canada, tax deductions are available to businesses for business travel expenses, including mileage and car allowances. Mileage allowance paid to employees or officers is treated as a taxable benefit subject to the employer’s income tax withholding at source.

If an employee is provided with the use of a company car, this will be presented as part of their salary, and taxes will be deducted accordingly. For employers, eligible expenditure on providing car allowances to employees may also qualify for input tax credits if applicable according to prevailing rules in each province or territory.

Accurate tracking and record-keeping are essential when claiming CRA mileage rates and tax-free vehicle allowances for business travel. Recent changes have been implemented regarding the supporting documentation that employers must keep to claim certain deductions from their business’s income taxes relating to these types of expenses (e.g., a detailed log that includes the date of travel, route taken, and distance travelled).

If you need clarification about the tax implications, you can always consult a tax accountant who can help you with personal and corporate tax matters.

External Influences

- Economic Conditions : Rates might be adjusted to align with prevailing economic conditions.

- Cost of Fuel: Fluctuations in fuel prices may cause the allowance rate to increase or decrease.

- Inflation Rates: General inflation can affect the cost of vehicle maintenance, repairs, insurance, and other related expenses. CRA might adjust the mileage allowance accordingly.

- Policy Changes: Any new regulations regarding business expenses and reimbursements might necessitate changes to the allowance.

- Technological Advancements: The increase in electric and hybrid vehicles can affect the per-kilometre cost calculation regarding vehicle expenses, which could potentially impact the CRA mileage allowance.

3 Tips For Managing Business Travel Expenses and Mileage Tracking

– Provide clear guidelines for employees to follow when tracking and recording business travel expenses, such as keeping detailed records and utilizing technology.

1. Keep Detailed Records

Keeping detailed records of business travel expenses is essential for Canadian taxpayers. It helps to accurately calculate CRA mileage rates and tax-free vehicle allowances and avoid potential issues during an audit from the Canada Revenue Agency (CRA). Taxpayers need to keep records such as:

• Gas receipts

• Oil changes

• Car maintenance & repair costs

• Insurance payments

• Any other related out-of-pocket expenses

By keeping these mileage records, Canadian taxpayers can easily track their business travel expenses and ensure everything is accounted for correctly. Further, it provides evidence that any vehicle deductions are legitimate, so there are no problems or additional costs associated with CRA audits. Technology can also help Canadians monitor their spending by using various automatic mileage tracking tools, such as Driversnote’s expense reimbursement system and tracking tool – perfect for managing business trips abroad or just around town!

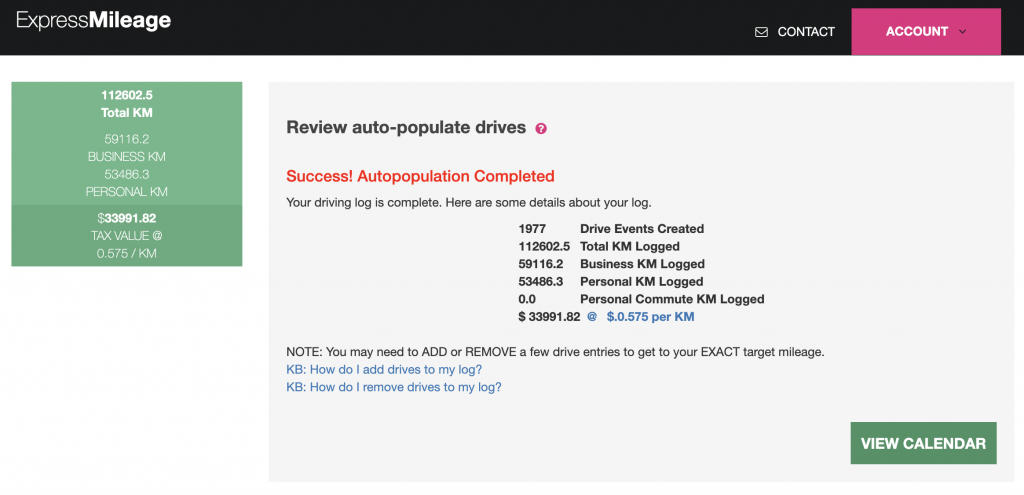

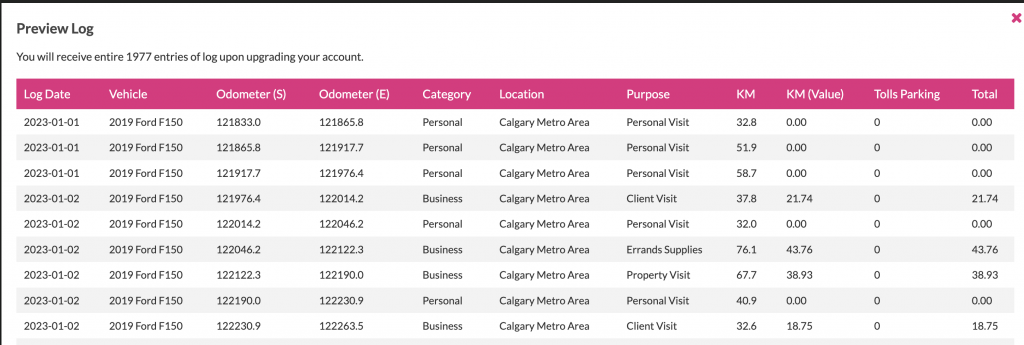

2. Use Technology To Track Vehicle Expenses

Technology can be a valuable tool for managing business travel expenses associated with CRA mileage rates and tax-free vehicle allowances. Mileage tracking apps and other tools can enable accurate record-keeping and precise calculations, which can help taxpayers claim total tax deductions. Keeping a detailed log of trips is still necessary, but using technology reduces the need for manual tracking of odometer readings while adding convenience.

Examples of mileage tracking apps include TripLog , MileIQ , QuickBooks Self Employed , etc. Additionally, businesses may install GPS units on employee vehicles to keep track of automobile-related expenses for various purposes, including deduction claims at year-end taxes or providing client billing information when required.

Using these apps or tools can make managing business travel expenses in different locations within Canada easier by automatically tracking all drives based on time spent driving as per kilometre rate set by the CRA standard mileage allowance (SMA). It saves time to manually enter odometer readings every time an individual travels between two points, ensuring that no detail remains unaccounted during tax filing or claiming expenditures from bosses/employers, respectively.

DISCOVER: Free Resources

3. Reimburse Employees Promptly

Employers must ensure that employees are reimbursed promptly and accurately for travel expenses on business trips to avoid any potential complications or legal ramifications.

Promptly reimbursing employees helps maintain employee morale and makes them feel empowered and valued, primarily if the employer guides them in navigating the expense system. Hence, they know exactly what to do when their reimbursements will be delivered and why it’s crucial.

According to Canadian tax laws, employers who provide an automobile allowance must maintain documents clearly outlining this arrangement and documenting all claims made by employees against it via an expense reimbursement form.

Furthermore, failure to automate the process in some way may lead to delays with repayment — another aspect that should be addressed in such arrangements.

- Understanding Provincial/Territorial Allowances and Mileage Rates in Canada

Canadian taxpayers are responsible for understanding the differences between federal and provincial/territorial allowances when claiming expenses related to business travel.

The CRA has a standard mileage rate of $0.70 per kilometre for the first 5,000 kilometres driven each year; however, some provinces or territories might have additional tax-free vehicle allowance amounts based on their accommodations, cost of living or other particular circumstances that could increase the amount an individual can claim up from CRA’s base rate.

CRA Mileage Rate 2024 Conclusion

As business travel can be complicated and expensive, understanding the CRA mileage rates and tax-free vehicle allowances is essential. Following the rules prescribed by the Canada Revenue Agency (CRA) can save time, money, and energy when preparing your taxes.

The key takeaway from this article is to keep records of all your travels—including destinations, distances travelled, and dates—and submit accurate expense reports for CRA mileage reimbursement or claim for a business vehicle allowance as per eligible criteria as soon as possible.

Common questions related to CRA Mileage Rates this 2024 And Tax-Free Vehicle Allowances For Business Travel relate to eligibility criteria for claiming deductions on taxes relating to business trips; applicability of different rates in various provinces/territories; use of technology tools for tracking expenses; etc., all of which have been addressed throughout this article.

It’s also essential to remember that expenses must adhere to guidelines set forth by the Canada Revenue Agency’s prescriptions for deductions to apply on personal income tax filings.

1. What are the CRA mileage rates for business travel?

The Canada Revenue Agency (CRA) sets a mileage rate for business travel for automobile and bicycle use. Currently, the kilometric rate is set at $0.70/km (2024)for taxis, cars or vans leased or owned by employees.

2. How do you calculate vehicle allowances provided by employers through CRA?

To calculate vehicle allowance amounts provided by employers using the CRA mileage rate, multiply an employee’s total business kilometres driven during a given tax year with the corresponding kilometric rate of ($0.70 per km 2024 for the first 5,000km and $0.64 thereafter). This amount should be included in Box 14 on their T4 slip from the employer to declare it as income when filing taxes every year unless the allowance meets certain criteria and is considered “reasonable.”

3 . Are car expenses covered under my prescribed mileage rates allowance?

Yes – once you met CRA’s conditions, reimbursed car expenses such as insurance costs and eligible lease payments are intended to be covered by your prescribed mileage rates allowance according to CRA guidelines.

Are you looking for assistance with your personal or corporate taxes? Look no further than CPA Guide. Our network of top accountants and accounting firms in Canada will help you find the best CPA to suit your needs. Get started today with CPA Guide .

2024 Automobile Allowance Rate as per CRA, full explanation by an example

Automobile allowance rates.

The Canada Revenue Agency (CRA) establishes the annual maximum automobile allowance rate for personal automobiles used for business purposes within corporations. But what does this entail? Essentially, corporate owners utilizing their vehicles for business activities in the corporation are eligible for an allowance based on the kilometres driven for the company.

To qualify for this allowance, individuals must diligently maintain a logbook detailing the kilometres driven for corporate (business) purposes. This documentation ensures adherence to CRA regulations, allowing for the calculation of a reimbursement allowance, with the rate capped at the specified maximum allowance rates.

CRA Vehicle (Automobile) Allowance Rates for 2024:

- 70¢ per kilometre for the first 5,000 kilometres driven

- 64¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

Example for Automobile Allowance Rate

In the year 2024, consider an employee in Alberta who utilizes their vehicle for corporate purposes covering a distance of 3,000 kilometres. In this scenario, the corporation has the flexibility to provide a maximum allowance of $2,040, calculated as 3,000 km multiplied by the rate of $0.68 per kilometre.

Now, let’s take another employee facing a similar situation but covering 7,000 kilometres for the corporation. The maximum allowance for using the vehicle for corporate purposes is determined by the following calculation:

(5,000 km * $0.68) + (2,000 km * $0.64) = $3,400 + $1,280 = $4,680. Hence, in this case, the employee can receive a maximum allowance of $4,680.

And if it was on the Northwest Territories, Yukon, and Nunavut, the total amount would be: (4 cents more than the normal rate)

$4,680 + $0.04 * 7,000 = $4,680 + $280 = $4,960.

Here are the CRA Automobile Allowance Rates for other years:

Cra vehicle (automobile) allowance rates for 2023.

- 68¢ per kilometre for the first 5,000 kilometres driven

- 62¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2022

- 61¢ per kilometre for the first 5,000 kilometres driven

- 55¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2021

- 59¢ per kilometre for the first 5,000 kilometres driven

- 53¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2020

Cra vehicle (automobile) allowance rates for 2019.

- 58¢ per kilometre for the first 5,000 kilometres driven

- 52¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2018

- 55¢ per kilometre for the first 5,000 kilometres driven

- 49¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2016 and 2017

- 54¢ per kilometre for the first 5,000 kilometres driven

- 48¢ per kilometre driven after that< In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

CRA Vehicle (Automobile) Allowance Rates for 2015

- 49¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel. For CRA page rates please check this link.

At Abraham Accounting we provide tax filing services for personal and corporates in Canada.

Share this:

Related posts.

How do I file a zero corporate tax return in Canada? 2024 version.

What is the deadline for filing T2 return?

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

- @achenhenderson >

- /AchenHenderson >

What is the 2024 CRA per-kilometer Allowance Rates?

2024 cra per-kilometer allowance rates.

The Canada Revenue Agency (CRA) has adjusted the per-kilometer rates for vehicle allowances, varying by year and location. Here’s a breakdown of the recent revisions:

2024 Automobile Allowance Rates:

– $0.70 per kilometer for the initial 5,000 kilometers.

– $0.64 per kilometer beyond the first 5,000 kilometers.

– In the Northwest Territories, Yukon, and Nunavut, an additional 4 cents per kilometer is permitted for travel.

2023 Automobile Allowance Rates:

– $0.68 per kilometer for the first 5,000 kilometers.

– $0.62 per kilometer after the initial 5,000 kilometers.

– Additional allowance of 4 cents per kilometer for travel in the Northwest Territories, Yukon, and Nunavut.

2022 Automobile Allowance Rates:

– $0.61 per kilometer for the initial 5,000 kilometers.

– $0.55 per kilometer beyond the first 5,000 kilometers.

– An extra 4 cents per kilometer was allowed for travel in the Northwest Territories, Yukon, and Nunavut.

How to Manage Automobile Interest and Operating Costs?

Aside from capital or leasing expenses, vehicles entail additional costs that can be expensed within the company. These include fuel or electricity, insurance, repairs, maintenance, interest (subject to CRA limits), and license and registration fees. Such expenses are typically fully expensed in the corporation where the vehicle is owned or leased, with proper record-keeping required to support the claims.

How to Maintain Records?

To substantiate deductions, individuals or companies must maintain records of total kilometers driven and those driven for business purposes. This can be achieved through a logbook for each business-used vehicle, documenting the date, destination, purpose, and kilometers driven for each trip. Additionally, odometer readings at the fiscal period’s start and end, or upon vehicle changes, must be recorded. Employees and owners may be eligible for a simplified logbook method .

How to Utilize Technology?

Various apps are available to assist with logbook maintenance, such as MileIQ and MileBug , which can export data for accounting purposes. For automobile allowance recipients, maintaining a logbook is sufficient. However, companies or vehicle owners must retain all receipts and invoices for vehicle-related expenses, ensuring they detail the date, amount, expense type, and vendor name.

If you want to discover more insights about How to Claim Motor Vehicle Expenses for Your Business in Canada , click here.

At Achen Henderson , we help entrepreneurs and business leaders build great companies. Do you have questions about how we can help you pay less tax in your corporation? Get in touch today!

Share this article

Join our community today.

Sign up for the “Your Business Unleashed” newsletter.

A Historical Overview of CRA Mileage Rates

Understanding the evolution of Canada's auto allowance rate, and how to use it for yourself

In this guide we will dive deep into the historical journey of the CRA Mileage Rates. Understanding the intricate details of these rates is crucial for businesses and individuals alike. So let’s get right to it. We’ll cover the following:

- Understanding the CRA Automobile Allowance Rate

CRA Mileage Rate History

Fixed automobile allowance rate, variable automobile allowance rate.

- Factors influencing Canadian federal mileage rates

- How to calculate your CRA Automobile Allowance

Understanding the CRA Mileage Rates

Before we delve into the historical aspects, let's ensure we have a clear understanding of what exactly the CRA Mileage Rates are. In simple terms, these rates determine the amount of money you can claim as a deduction for the business use of your vehicle. It's like a roadmap that guides you in navigating the complex terrain of tax deductions.

When it comes to the CRA Mileage Rates, it's essential to recognize that they play a crucial role in not only simplifying your tax filing process but also in optimizing your financial management strategies. By leveraging these rates effectively, you can gain a competitive edge in managing your business expenses and enhancing your overall tax efficiency.

What’s the Automobile Allowance Rate?

The CRA Mileage Rates, also known as the Automobile Allowance Rates, consist of two components: the fixed rate and the variable rate. The fixed-rate represents the cost of owning and operating a vehicle, such as insurance and depreciation. On the other hand, the variable rate reflects the fuel and maintenance costs incurred during your business travels.

Moreover, it's worth noting that the CRA Mileage Rates are updated annually to align with the current economic landscape and reflect the changing costs associated with vehicle ownership and operation. Staying informed about these updates is key to ensuring that you are accurately calculating your deductions and maximizing your tax benefits.

Importance of CRA Mileage Rates

Understanding the importance of these rates is akin to comprehending the significance of having a reliable compass. The CRA Mileage Rates directly impact your bottom line, enabling you to accurately calculate your business expenses and maximize your potential tax deductions. By adhering to these rates, you can steer clear of any navigational pitfalls and maintain compliance with CRA regulations.

Furthermore, by incorporating the CRA Mileage Rates into your financial planning and reporting processes, you can enhance the transparency and accuracy of your business operations. This not only fosters trust and credibility with stakeholders but also positions your business for long-term success and sustainability in a competitive market environment.

Fixed and Variable Rates Table

As we mentioned, the fixed rate represents the cost of owning and operating a vehicle, such as insurance and depreciation. When the CRA issues rates, the fixed rate applies to the first 5,000 kilometres driven.

Once you hit 5,001 kilometres, the variable rate kicks in. The variable rate is there to reflect the fuel and maintenance costs incurred during your business travels.

It’s also worth noting that in the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel, due to the higher cost of operating vehicles in those areas.

Factors Influencing CRA Mileage Rates

Now, let's delve into the factors that influence the CRA Mileage Rates, helping us understand the tapestry of variables that shape these rates.

When we explore the intricate web of influences on CRA Mileage Rates, it becomes apparent that economic factors are a cornerstone in their determination. The ebb and flow of the tides in the economy, such as fluctuations in fuel prices, inflation rates, and overall economic conditions, play a crucial role in guiding the direction of these rates. It's akin to deciphering a complex puzzle where global markets and their movements intricately sway the very fabric of our mileage rates.

Economic Factors

Just like the ebb and flow of the tides, economic factors play a crucial role in determining the CRA Mileage Rates. Fluctuations in fuel prices, inflation rates, and overall economic conditions guide the direction of these rates. It's like understanding the delicate dance between global markets and how they sway the very fabric of our mileage rates.

Moreover, policy changes act as the catalysts that ignite the engine behind the CRA Mileage Rates. Alterations in taxation legislation, environmental regulations, and government initiatives cast a transformative light on these rates. Like a shifting wind, policy changes can set us on a new course, reshaping the way we calculate our deductions.

Policy Changes

Policy changes act as the catalysts that ignite the engine behind the CRA Mileage Rates. Alterations in taxation legislation, environmental regulations, and government initiatives cast a transformative light on these rates. Like a shifting wind, policy changes can set us on a new course, reshaping the way we calculate our deductions.

Furthermore, technological advancements also play a significant role in influencing CRA Mileage Rates. The evolution of electric vehicles, autonomous driving technologies, and the rise of ride-sharing services have introduced new dynamics into the calculation of mileage rates. These advancements not only impact the rates themselves but also raise questions about the future of transportation and its implications on tax deductions.

How to Calculate CRA Mileage Rates

Calculating CRA Mileage Rates involves a detailed understanding of the methodical process that ensures you are on the right financial track. By following these steps diligently, you can navigate the complexities of business expenses with confidence and precision.

Basic Calculation Method

At its core, the basic calculation is like a compass pointing you in the right direction. You multiply the total kilometers driven for business purposes by the applicable mileage rate for your vehicle. This reliable method ensures that you stay on track and avoid any detours in your deduction calculations.

Understanding the basic calculation method is crucial for laying a solid foundation in your journey towards accurate CRA Mileage Rate calculations. It serves as the cornerstone upon which you can build more intricate deduction strategies as you delve deeper into the realm of business expenses.

Advanced Calculation Techniques

For the more adventurous souls looking for precision and finesse, advanced calculation techniques open up a world of possibilities. By recording detailed information about your vehicle expenses such as fuel costs, maintenance, and repairs, you can fine-tune your deduction calculations. Think of it as upgrading your basic compass to a sophisticated GPS system, guiding you through the intricacies of your deductions with utmost accuracy.

Embracing advanced calculation techniques not only enhances the accuracy of your CRA Mileage Rate calculations but also provides a deeper insight into the financial dynamics of your business operations. It allows you to navigate through the twists and turns of deductible expenses with a level of sophistication that sets you apart as a meticulous financial navigator.

Browse the business mileage hub

Business mileage hub home, self-employed mileage guide, employee mileage guide, mileage reimbursement and rates guide for employers, irs mileage rate 2024 | current rates, rules, calculations, and more, irs mileage log requirements, automatic mileage and expense tracking.

Learn more on our Blog

Top 11 best gas mileage cars for 2024.

Discover the top 11 fuel-efficient cars of 2024 that offer exceptional gas mileage, combining eco-friendliness with affordability and advanced features.

Top Dasher Requirements—Everything You Need to Know About DoorDash’s Reward Program

Learn everything about DoorDash's Top Dasher requirements and how to enjoy exclusive benefits and maximize your earnings with Everlance

Uber & Lyft Vehicle Inspections: Locations, Costs, and Tips

Learn where to find Uber and Lyft inspection locations, including free services and Jiffy Lube options. Get tips for passing your rideshare vehicle inspection with ease.

Get Started

MileIQ Inc.

GET — On the App Store

The 2024 CRA Deduction Limits and Mileage Rates

Download MileIQ to start tracking your drives

Automatic, accurate mileage reports.

For 2024, the Department of Finance Canada made some notable changes to the automobile income tax deduction limits and mileage rates, with the initial mileage rate increasing to 70 cents per kilometre for the first 5,000 kilometers driven. Here’s a complete look at how these changes will impact you.

What are the automobile deduction rates for 2024?

The Canadian government made changes to increase the deduction limit and mileage rate. To understand how this will affect you, take a look at the announcements from the DFC:

- In provinces, the limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes will increase by two cents, to 70 cents per kilometre, for the first 5,000 kilometres driven, and to 64 cents for each additional kilometre.

- For the territories, the limit will also increase by two cents, to 74 cents per kilometre, for the first 5,000 kilometres driven, and to 68 cents for each additional kilometre.

- The general prescribed rate used to determine the taxable benefit of employees relating to the personal portion of automobile expenses paid by their employers will remain at 33 cents per kilometre for 2024. For people who are employed principally in selling or leasing automobiles, the rate used to determine the employee’s taxable benefit will remain the same, at 30 cents per kilometre for 2024.

- The ceiling for capital cost allowances (CCA) for Class 10.1 passenger vehicles will increase to $37,000 from $36,000, before tax, in respect of new and used vehicles acquired on or after January 1, 2024.

- The limit on deductible leasing costs will be increased to $1,050 from $950 per month, before tax, for new leases entered into on or after January 1, 2024.

- The maximum allowable interest deduction will be increased to $350 from $300 per month for new automobile loans entered into on or after January 1, 2024.

- The CCA ceiling for Class 54 zero-emission passenger vehicles ($61,000 before tax for new and used vehicles) will remain the same for 2024, as this limit continues to be appropriate.

What vehicle expenses are tax deductible in Canada?

You are eligible to claim many types of vehicle expenses on your taxes. The types of expenses you can claim on “Line 9281 — Motor Vehicle Expenses (not including CCA)” of Form T2125 or Form T2121, or line 9819 of Form T2042 include:

- License and registration fees

- Auto insurance

- Fuel and oil costs

- Interest on money borrowed to buy a motor vehicle

- Maintenance and repairs

- Leasing payments

In addition to the above expenses, you may also claim Capital Cost Allowance (CCA), which entails the business assets that have value, yet depreciate over time. To learn more about the CRA tax return, visit our blog to find useful resources and information on how to file self-employment taxes.

Still tracking miles by hand?

Get Started

Related Blog Posts

Tax Tips for Canadian Musicians

Canadian musicians can claim a number of CRA tax deductions for a better tax refund at the end of the year. This article outlines allowable expenses.

Business Tax Deductions You Can Claim When Starting a Business

You can get business tax deductions for starting a business. Know the CRA rules about how to claim your startup costs on your taxes.

Preparing Your Small Business’ Finances in Canada

Accounting is the financial foundation of a business. Read this article to learn about accounting best practices and software apps for your small business.

CRA Automobile Allowance Rates & Automobile Benefits

The CRA Automobile Allowance rates for travel, moving and medical mean you can get tax relief for certain drives. Learn about the CRA requirements.

How Much is the Canada Child Benefit Amount?

If you have children under the age of 18, you're eligible for the Canada Child Benefit (CCB). Find out more how this cash boost for parents works.

How to Write-Off Vehicle Expenses in Canada

Tips on tax write-offs for cars: what conditions apply, how to claim vehicle expenses as a self-employed worker, sole proprietor, or as a salaried employee.

Professional Guide to Distance Allowance and Deductions in Canada (CRA)

Welcome to ExpressMileage, your comprehensive resource for navigating distance allowance and deductions in Canada. Here, you’ll find a curated collection of articles and resources that will guide you through the regulations on how to claim your distance allowance as an employee or as a self-employed individual. This is your one-stop source for understanding the CRA’s guidelines on motor vehicle logbooks.

With ExpressMileage, effortlessly sharing your motor vehicle logbook with the CRA or your employer is just a click away. To streamline your experience, sign up for ExpressMileage .

CRA Automobile Allowance

Automobile allowance refers to the financial compensation for expenses incurred from using personal vehicles for business activities. Typically, this allowance is provided by employers to cover the cost of business use of a personal vehicle and is given in addition to the employee’s salary. For self-employed individuals, business owners, or independent contractors, vehicle-related expenses can be deducted from your annual tax return.

In Canada, the distance allowance is generally calculated based on a per-kilometre rate, designed to reimburse the costs associated with the ownership and operation of a personal vehicle for business reasons.

Annually, the CRA issues a standard per-kilometre allowance rate that organizations adopt to compensate employees for business travel.

Defining Business-Related Travel

The CRA defines business-related travel as any use of a vehicle directly connected to the fulfillment of one’s work responsibilities. This encompasses:

- Travel between multiple work locations.

- Attendance at business meetings and professional conferences.

- Client visits and customer service calls.

- Conducting work-related errands, such as supply runs.

Please note, commuting from home to your primary place of employment does not qualify as business travel.

CRA Distance Allowance Parameters

The CRA sets a specific per-kilometre rate annually for business-related travel. For the latest rates and detailed analysis, refer to our specialized article on the CRA’s distance rates for 2023 and previous years.

Tax Implications of the CRA Distance Allowance

An allowance is deemed non-taxable when it does not exceed the CRA’s prescribed per-kilometre rate. Should the allowance surpass this threshold, it becomes taxable income.

CRA Motor Vehicle Logbook Reimbursement Guidelines

For Employees: Employers may reimburse you for the business use of your personal vehicle. While not mandated by law, it is customary in Canada to provide this type of compensation. The most prevalent form of reimbursement is based on the official CRA automobile allowance rates, though some employers may opt to cover the actual operational costs of the vehicle for business travel.

Employers typically specify the records required for reimbursement. These records, which form the basis of your motor vehicle logbook, should detail business trips, parking fees, tolls, and other incidental costs incurred during business travel.

For Employers: The CRA regards any payment to employees for business travel as an allowance. Such allowances are taxable unless they align with the CRA’s reasonable per-kilometre rates for the tax year in question.

To qualify as non-taxable, the allowance must:

- Only compensate for the number of business kilometres driven by the employee.

- Utilize a per-kilometre rate consistent with the CRA’s published rates.

- Exclude any other form of employee reimbursement for the same vehicle use.

For Self-Employed Individuals: As a self-employed professional using your vehicle for business, you are entitled to claim CRA distance deductions on your tax return. This includes a comprehensive list of vehicle expenses, from fuel and maintenance to insurance and interest on vehicle loans.

You can choose between two methods for logging business travel:

- Full Logbook Method : Requires meticulous record-keeping for every business trip within the fiscal year.

- Simplified Logbook Method : Involves maintaining a detailed logbook for one base year, after which a three-month sample can be used to estimate business use for subsequent years.

It’s important to retain your motor vehicle logbook records for six years following your tax submission.

By adhering to these guidelines, you can ensure your distance claims and reimbursements are accurately reflected and compliant with CRA regulations.

ExpressMileage

You might also like.

Tips on Tracking Business Miles

I recently got audited . Do you need to show proof of odometer to IRS?

How IRS Mileage Deduction Works

Cra logbook rules simplified.

ExpressMileage Do you need a mileage log for reimbursement or IRS tax purposes? Our online mileage log generator helps you make mileage logs in a matter of minutes.

- How it Works

National Joint Council

- Gen Sec Annual Report - 2022-23

- NJC Labour Relations Training Sessions for the LR Community

- NJC Recognition

- Photo Gallery

- Current Committee Activities

- NJC Constitution

- NJC By-Laws

- NJC Co-Development Process

- NJC Results for Employees

- Organization Chart

- NJC Membership

- NJC Statement of Values

- Disability Insurance Plan

- Public Service Dental Care Plan

- Public Service Health Care Plan

- Coordinators

- Search Decisions

- Information Notice - Change in Grievance Practice

- Grievance Process and Procedures

- Publications

- NJC Communiqués

Appendix A - Lower Kilometric Rates

- Current - July 1, 2024

- April 1, 2024

- January 1, 2024

- October 1, 2023

- July 1, 2023

- April 1, 2023

- January 1, 2023

- October 1, 2022

- July 1, 2022

- April 1, 2022

- January 1, 2022

- October 1, 2021

- July 1, 2021

- April 1, 2021

- January 1, 2021

- October 1, 2020

- July 1, 2020

- April 1, 2020

- January 1, 2020

- October 1, 2019

- July 1, 2019

- April 1, 2019

- January 1, 2019

- October 1, 2018

- July 1, 2018

- April 1, 2018

- January 1, 2018

- October 1, 2017

- July 1, 2017

- April 1, 2017

- January 1, 2017

- October 1, 2016

- July 1, 2016

- April 1, 2016

- January 1, 2016

- October 1, 2015

- July 1, 2015

- April 1, 2015

- January 1, 2015

- October 1, 2014

- July 1, 2014

- April 1, 2014

- October 1, 2013

- July 1, 2013

- April 1, 2013

- January 1, 2013

- October 1, 2012

- July 1, 2012

- April 1, 2012

- January 1, 2012

- October 1, 2011

- July 1, 2011

- April 1, 2011

- January 1, 2011

- October 1, 2010

- July 1, 2010

- June 1, 2010

- April 1, 2010

- January 1, 2010

- October 1, 2009

- July 1, 2009

- April 1, 2009

- January 1, 2009

- October 1, 2008

- July 1, 2008

Effective July 1, 2024

CANADA BUZZ

How Much to Charge Per Kilometer in Canada

Canada buzz editorial.

- June 5, 2021

ADVERTISER DISCLOSURE

Reviewed by

In Canada and several other parts of the world, employees often earn an allowance or mileage reimbursement based on per kilometre rate for use of their vehicle during official assignments. The allowance is not subject to income taxes, Canada Pension Plan (CPP) contributions, or Employee Insurance (EI) premiums.

The Canada Revenue Agency (CRA) states that the reasonable per-kilometre allowances are the amounts prescribed in section 7306 of the Income Tax Regulations.

Although the rates stipulated in section 7306 of the Income Tax Regulations represent the maximum amount that can be deducted as business expenses, employers can simply use them as a guideline when trying to determine allowances payable to their employees.

Essentials of Reasonable Allowance

- The allowance is based only on the number of business kilometers driven in a year.

- The rate per kilometer is reasonable.

- Expenses related to the toll or ferry charges incurred on business trips or supplementary business insurance are reimbursed separately.

- When your employees complete their income tax and benefit return, they do not include this allowance in their income.

Let’s clear up a common confusion.

Mileage allowance vs. Automobile Allowance vs. Car allowance vs. Vehicle Allowance

A mileage allowance is money that you get from your employer for work-related trips. It is often based on distance driven. A common measure used is the number of kilometres driven. You may need to submit a mileage log to claim this payment. The mileage allowance is not taxable.

A car allowance, also known as a flat-rate vehicle allowance, is money an employee receives from their employer; usually as part of their wages. This money is usually meant for vehicle purchase and maintenance. It is taxable.

The CRA uses the broad term ‘Automobile and Motor Vehicle Allowance’ to qualify payment made by an employer to an employee for using their own vehicle in connection with their job.

Automobile Allowance Rates for 2021

CRA Automobile Allowance rates recognized for the year 2021 are stated below.

- CA$0.59¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.53¢ per kilometer driven after the first 5,000 kilometers driven.

However, in the Northwest Territories, Yukon, and Nunavut, there is an additional CA$0.04¢ per kilometer allowed for travel distance.

Past 5 Years Automobile Allowance Rates as Advised by CRA

- Automobile or Vehicle Allowance Rates for 2020:

Territories

- CA$0.63¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.57¢ per kilometer driven after the first 5,000 kilometers driven.

2. Automobile or Vehicle Allowance Rates for 2019:

- CA$0.58¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.52¢ per kilometer driven after the first 5,000 kilometers driven.

- CA$0.62¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.56¢ per kilometer driven after the first 5,000 kilometers driven.

3. Automobile or Vehicle Allowance Rates for 2018:

- CA$0.55¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.49¢ per kilometer driven after the first 5,000 kilometers driven.

4. Automobile or Vehicle Allowance Rates for 2016-17:

- CA$0.54¢ per kilometer for the first 5,000 kilometers driven.

- CA$0.48¢ per kilometer driven after the first 5,000 kilometers driven.

5. Automobile or Vehicle Allowance Rates for 2015:

Is a vehicle allowance taxable income?

A vehicle or automobile allowance will be considered a taxable benefit when an employee is paid:

- At a per-kilometer rate that CRA considers too high or too low and thus not reasonable

- A flat rate motor vehicle allowance that is not based on the number of kilometers driven

- An allowance that is a combination of flat-rate and reasonable per-kilometer allowance that covers the same use for the vehicle

You should also know that taxable vehicle allowances are also considered insurable and pensionable, so EI premiums and CPP contributions are applicable too.

Who Charges Automobile or Vehicle Allowance?

The officer or employee charges and earns the automobile allowance based on the kilometers covered using his or her personal vehicle during an official assignment.

The officer or employee often makes or file the claims and the employer would consider and approve the claim for payment. The employee could be a staff of government or corporate organizations.

Who Pays Automobile or Vehicle Allowance?

The employer pays the vehicle allowance.

Input Tax Credit on Automobile or Vehicle Allowance ?

An employer (office) can claim an input tax credit based on the Automobile or Vehicle Allowance paid to the employees.

It is advisable to adhere to the automobile allowance advised by the CRA to ensure that the charges are reasonable and qualify as an allowance that is not subject to income taxes, CPP contributions, or EI premiums.

You Might Like

How to File Your Canadian Tax Return Online

Wealthy vs Rich – What’s the difference?

Uber Gift Cards in Canada Review

Post comments, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Essential reads, delivered weekly

Join the Financial Literacy Train. Get the latest financial information delivered right to your inbox.

Deals and Offers

We’ve rounded up the Best life in Canada, with the best promotions, and the best sign-up bonuses, to help you maximize your benefits.

Easy Payment Processing

Simplify payments with Helcim

Create Your Online Store

Selling online should be easy

Invesment Made Simple

Build your investment portfolio and save on fees.

- Banks in Canada

- Credit Cards

- Car Insurance

- Tenant Insurance

- Investment Apps

- Payment Processing

Govt Grants & Benefits

Common issues people discover after moving into their new home, retirement planning in canada: how to secure your future, when will interest rates go down in canada analyzing the factors, credit-healthy frugal habits for millennials: navigating financial independence, first home savings account (fhsa): a tax-free path to homeownership, financial planning for canadian families during inflation, td checking account review and fees, tesla stock overview and predictions, kareena maya.

- Life in Canada

- Govt Grants and Benefits

Canada Buzz Info

- Privacy Policy

- Editorial Guidelines

- FAQ & Contact

Sign Up For Newsletter

Content updates, free guides and discounts, copyright © 2021 canada buzz. all rights reserved.

Canada Buzz is a purely informational blog. Opinions expressed on this blog are NOT endorsed by the reviewed brands. The information provided on this website does not constitute financial or professional advice. However, our team strives to bring you quality, unbiased information. What’s in it for us? One of the ways we get rewarded is via ads and affiliates. This website contains ads and affiliate links and we may receive compensation when you click any of these links.

Product News and Recommendations Senior Editor

Latest Post

Advertiser Disclosure

Canada Buzz is an advertising-supported blog. Some products and services that appear on this site are from companies from which Canadabuzz receives compensation. We may alter brand placements on our website to amplify our partners and their offers. Any time you click to our partner websites or register for a product or services through an affiliate link on our website, we may earn a commission at ZERO cost to you.

Canada Buzz is a purely informational blog. Opinions expressed on this blog are NOT endorsed by the reviewed brands. The information provided on this website does not constitute financial or professional advice. However, our team strives to bring you quality, unbiased information.

Personal Finance and Travel Rewards Expert Contributor

- Freelance writer specializing in personal finance and travel content

- 2020 Plutus Awards Finalist

Kareena Maya is a freelance writer focused on the personal finance and travel spaces. He frequently writes about credit cards, banking, student loans, insurance, travel rewards and more. His work has been featured in publications such as Forbes Advisor, Bankrate, Credit Karma, Finance Buzz, The Ascent and Student Loan Planner.

- Knowledge Base

- Tax Deductions

How to Calculate Moving Expenses

You can choose the detailed or simplified method to calculate meal expenses and vehicle expenses.

How to calculate meal expenses

If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent.

If you choose the simplified method , claim in Canadian or US funds a flat rate of $23/meal , to a maximum of $69/day (sales tax included) per person, without receipts. Although you do not need to keep detailed receipts for actual expenses if you choose to use this method, you may still be asked to provide some documentation to support your claim.

How to calculate vehicle expenses

If you choose the detailed method to calculate vehicle expenses, you must keep all receipts and records for the vehicle expenses you incurred for moving expenses or for northern residents deductions during the tax year, or during the 12-month period you choose for medical expenses.

If you choose to use the simplified method to calculate the amount to claim for vehicle expenses, multiply the number of kilometres by the cents/km rate for the province or territory where the travel began . The CRA may still ask you to provide some documentation to support your claim. You must keep track of the number of kilometres driven during the tax year for the trips related to your moving expenses.

The rates for 2022 will be available on CRA website in 2023.

I have to move from Halifax to Ottawa to take my new job. It took me 2 days to drive to Ottawa. I also lived in a motel for 30 days before I found a rental house. How do I calculate my travel and meal expense using the simplified method?

The distance is about 1,434km. The travel expenses will be 1434km x$ 0.53 /km = $760.02

Meal expense during travel is: $69/day x 2 days = $138

Meal expense from temporary living in Ottawa (max 15 days) is $69/day x 15 days = $1,035

You can also claim your hotel expense based on your receipts.

I moved from Toronto to Ottawa for my new job in Dec 2021. The employment income I earned in Ottawa was only $5,000, and my eligible moving expense is $8,000. Can I deduct the moving expenses again my other income?

No, you can only claim your moving expenses up to your net eligible income earned at the new workplace and carry forward the unused part to the future year. Therefore, you can only claim $5,000 moving of expenses in your 2021 tax return. The unused $3,000 can be claimed in your 2022 tax return.

About The Author

Related Articles

- Home office deduction

- Employment Expenses for Transportation Employees and Tradespersons

- How to claim employment expenses

- What Can be Claimed as Moving Expenses

Need Support?

Get a free quote today.

Our experts are here to help…

- Small Business Tax Preparation

- Back Tax Preparation

- 性价比最高的报税会计服务

Language selection

- Français fr

Appendix A: CRA Kilometric Rates

Effective: April 1, 2021

The kilometric rates (payable in cents per kilometre) will be used for the application of the Directive on Travel. Rates are payable in Canadian funds only. Rates are reviewed on a quarterly basis effective January 1st of every year.

- Rates are payable in Canadian funds only.

- The kilometric rate payable when a Canadian registered vehicle is driven in more than one province or in the USA shall be the rate applicable to the province or territory of registration of the vehicle.

Page details

Canada Taxi Fare Calculator 2024

How is a taxi fare calculated in canada, taxi fare (2024).

Let’s say you want to get from Toronto hotel to the airport and the ride is 5 km. You’re traveling by day, and you have 1 luggage. You total price will be 13.4 CAD .

Popular taxi routes in Canada

- North America

Taxi fare in Canada by city

Are you a taxi driver in canada.

IMAGES

VIDEO

COMMENTS

CRA Kilometric RatesThis table indicates the rates payable in cents per kilometre for the use of privately owned vehicles driven on business travel. Notes: Rates are payable in Canadian funds only. The kilometric rate payable when a Canadian registered vehicle is driven in more than one province or in the USA shall be the rate applicable to the ...

Meal expenses. If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent. If you choose the simplified method, claim in Canadian or US funds a flat rate of $23 per meal (for the 2023 tax year), to a maximum of $69 per day (sales tax included) per person, without receipts.

Appendix A: CRA Kilometric Rates. Effective: January 1, 2023. The kilometric rates (payable in cents per kilometre) will be used for the application of the Directive on Travel. Rates are payable in Canadian funds only. Rates are reviewed on a quarterly basis effective January 1st of every year.

Appendix B - Kilometric Rates - Modules 1, 2 and 3. Versions of this Page. Effective July 1, 2024. The rates payable in cents per kilometre for the use of privately owned vehicles driven on authorized government business travel are shown below: Province/Territory. Cents/km.

The Canada Revenue Agency (CRA) sets a mileage rate for business travel for automobile and bicycle use. Currently, the kilometric rate is set at $0.70/km (2024)for taxis, cars or vans leased or owned by employees.

The 2023 CRA mileage rates are an essential aspect of financial management for individuals and businesses in Canada. By understanding these rates, maintaining accurate records, and utilizing effective tracking methods, you can ensure that you're optimizing your tax deductions and reimbursements for business travel.

CRA Vehicle (Automobile) Allowance Rates for 2021. 59¢ per kilometre for the first 5,000 kilometres driven; 53¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel. CRA Vehicle (Automobile) Allowance Rates for 2020

Kilometric/Mileage Rates - Outside Canada and the U.S.A. Effective April 1, 2021. The following table reflects the kilometric/mileage rates in Canadian dollars which apply outside Canada and the U.S.A. Country. City. Calculated in Miles. Calculated in Kilometres. Tax-free. Tax-paid. Tax-free. Tax-paid. Afghanistan. Kabul. $0.87. N/A. $0.54. N/A ...

For employees who serve outside Canada or at isolated posts within Canada, these benefits address unique attributes of the communities where they work or provide reimbursement for high costs and special expenses. ... Lower Kilometric Rates; Travel Directive. Appendix B, Kilometric Rates; Appendix C, Meal Allowances, Canada and USA; Appendix D ...

Here's a breakdown of the recent revisions: 2024 Automobile Allowance Rates: - $0.70 per kilometer for the initial 5,000 kilometers. - $0.64 per kilometer beyond the first 5,000 kilometers. - In the Northwest Territories, Yukon, and Nunavut, an additional 4 cents per kilometer is permitted for travel. 2023 Automobile Allowance Rates:

As of 2024, the CRA will give back 70¢ per kilometre for the first 5,000 kilometres driven and 64¢ per kilometre after that. If you drive in the Northwest Territories, Yukon or Nunavut, CRA mileage rates are 74¢ per kilometre for the first 5,000 kilometres and 68¢ afterwards. You can check current and prior mileage rates on the CRA website.

Total kilometres you drove for business purposes. Once you have these two numbers, you simply plug them into the CRA formula for calculating your mileage deduction. You can deduct the full amount of allowable expenses for the car (for the portion of time you used the vehicle for business purposes). So, if you had $5,000 in total car expenses ...

When the CRA issues rates, the fixed rate applies to the first 5,000 kilometres driven. Variable Automobile Allowance Rate. Once you hit 5,001 kilometres, the variable rate kicks in. The variable rate is there to reflect the fuel and maintenance costs incurred during your business travels.

Automatic, accurate mileage reports. For 2024, the Department of Finance Canada made some notable changes to the automobile income tax deduction limits and mileage rates, with the initial mileage rate increasing to 70 cents per kilometre for the first 5,000 kilometers driven. Here's a complete look at how these changes will impact you.

42.03 ¢/km. 55.93 ¢/km. 42.03 ¢/km. Sept 1, 2023 - Sept 30, 2023. 42.51 ¢/km. 56.41 ¢/km. 42.51 ¢/km. Employees who currently receive a monthly automobile allowance in accordance with their collective agreement continue to receive the allowance and claim the basic rate only. The rate paid will be the rate applicable on the date of travel.

In Canada, the distance allowance is generally calculated based on a per-kilometre rate, designed to reimburse the costs associated with the ownership and operation of a personal vehicle for business reasons. Annually, the CRA issues a standard per-kilometre allowance rate that organizations adopt to compensate employees for business travel.

Appendix A: CRA Kilometric Rates. Effective: January 1, 2021. The kilometric rates (payable in cents per kilometre) will be used for the application of the Directive on Travel. Rates are payable in Canadian funds only. Rates are reviewed on a quarterly basis effective January 1st of every year.

Cents/km (taxes included) Alberta. 21.0. British Columbia. 25.5. Manitoba. 22.0. New Brunswick ... 22.5. Yukon. 34.0. Previous Index Next. Related Links. Print Full Directive Appendix A - Lower Kilometric Rates Appendix B - Non-Exclusive List of Qualified Worksites and Designated Suitable Residential Communities Appendix C - Non-Exclusive ...

CRA Automobile Allowance rates recognized for the year 2021 are stated below. CA$0.59¢ per kilometer for the first 5,000 kilometers driven. CA$0.53¢ per kilometer driven after the first 5,000 kilometers driven. However, in the Northwest Territories, Yukon, and Nunavut, there is an additional CA$0.04¢ per kilometer allowed for travel distance.

The travel expenses will be 1434km x$ 0.53 /km = $760.02. Meal expense during travel is: $69/day x 2 days = $138. Meal expense from temporary living in Ottawa (max 15 days) is $69/day x 15 days = $1,035. You can also claim your hotel expense based on your receipts. I moved from Toronto to Ottawa for my new job in Dec 2021.

A rate that does not cover the expenses incurred by the employee is not considered reasonable. Rate of the allowance for the use of a motor vehicle (per kilometre) Year. First 5,000 kilometres. Additional kilometres. 2024. $0.70. $0.64. 2023.

CRA Kilometric Rates This table indicates the rates payable in cents per kilometre for the use of privately owned vehicles driven on business travel; Province/Territory Cents/km (taxes included) Alberta: 48.5: British Columbia: 53.0: Manitoba: 49.5: New Brunswick: 52.0: Newfoundland and Labrador: 55.5: Northwest Territories: 61.5: Nova Scotia ...

Taxi fare (2024) Base fee (day) 4.4CAD. Price per KM. 1.8 CAD. Waiting time per hour. 31CAD.