Travel Insurance Market

Travel Insurance Market by Age (Millennials, Generation X, and Baby Boomers), by Income Level (Low-income travelers, Middle-income travelers and High-Income Travelers), by Coverage (Medical Coverage, Trip Cancellation Coverage, Baggage and Personal Belongings Coverage, Accidental Death and Dismemberment (AD&D) Coverage), by Days of coverage (Short-Trip Insurance, Standard Trip Insurance, Extended Trip Insurance and Multi-Trip Insurance) by End User (Pilgrim Travelers, Education Travelers, Business Travelers and Family Travelers) by Distributional Channel (Insurance Companies, Banks, Airlines, Online Platforms, Insurance Aggregators & Comparison Websites, and Travel Agents & Tour Operators) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 08-Apr-2024 | No of Pages: 409 | No. of Tables: 303 | No. of Figures: 270 | Format: PDF | Report Code : N/A

- Report Description

- Table Of Content

- Research Methodology

- Download PDF

Market Overview

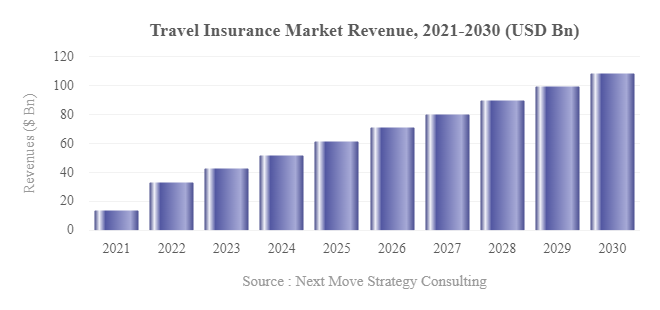

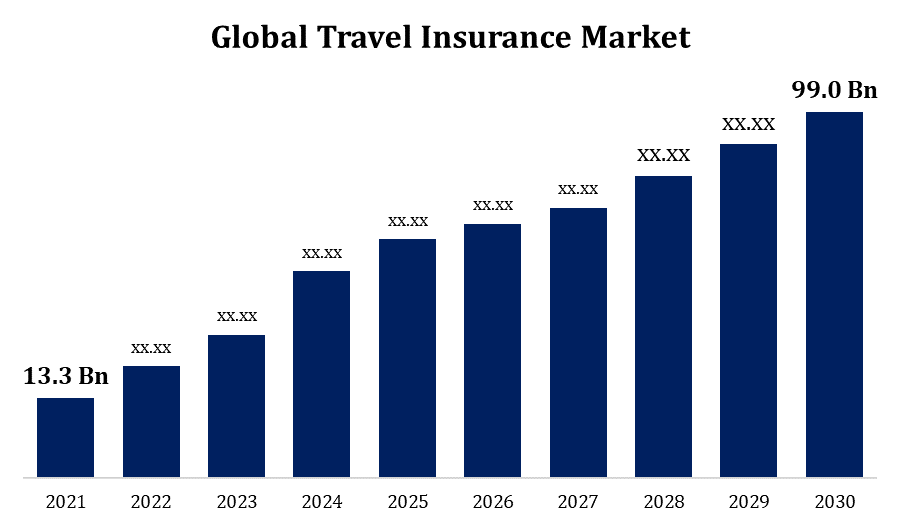

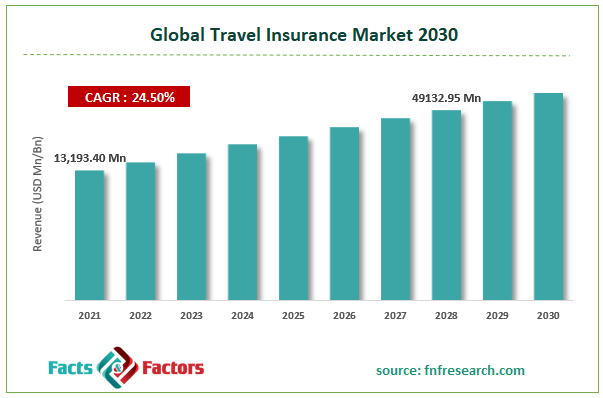

The Travel Insurance Market size was valued at USD 21.85 billion in 2023 and is predicted to reach USD 58.40 billion by 2030, with a CAGR of 14.0% from 2024 to 2030.

Travel insurance is a specialized insurance designed to offer protection and coverage to travelers against a wide range of potential risks and unforeseen circumstances that can occur before or during their journeys. It serves as a crucial tool in mitigating the financial impact of various travel-related emergencies, disruptions, and inconveniences, providing travelers with peace of mind and security throughout their trips. One of the primary advantages of travel insurance is its ability to provide financial reimbursement and assistance in the event of trip cancellations or interruptions. This coverage extends to unforeseen circumstances such as illness, injury, or emergencies, allowing travelers to recoup non-refundable expenses incurred for flights, accommodations, and other pre-paid arrangements.

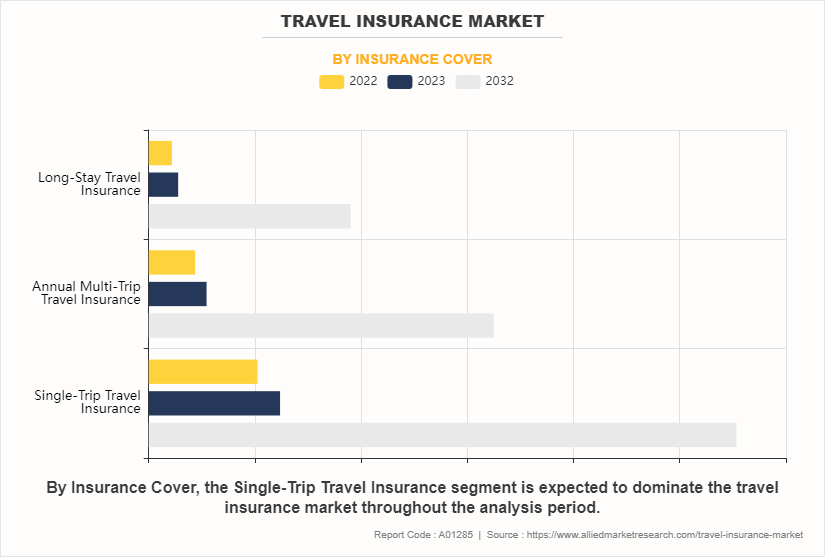

The versatility of travel insurance extends beyond individual travelers to encompass families, corporate travelers, and group tours, catering to diverse needs and preferences within the travel industry. It offers a range of policy options, including single-trip, multi-trip, and annual policies, as well as specialized coverage for specific types of travel, such as adventure sports, cruises, or business trips. Its comprehensive coverage and range of benefits make it an essential investment for travelers seeking to safeguard their trips and ensure a smooth and hassle-free travel experience.

Rising Number of Outbound Travelers Boost the Market Growth

The rising number of global travels is a significant factor driving the growth of the travel insurance market. With more individuals undertaking domestic and international trips for various purposes such as leisure, business, and exploration, there is a growing awareness of the importance of protecting these journeys against unforeseen events.

Travelers recognize the need to safeguard themselves against potential risks such as trip cancellations, medical emergencies, or lost luggage, leading to an increased demand for travel insurance. Statistics from sources such as the National Travel and Tourism Office (NTTO) and International Trade Administration (ITA) indicate a substantial rise in international air passenger travel.

For example, data shows that in March 2023, international air passenger travel reached 19.687 million, representing a significant increase of 41.7% compared to March 2022. This surge in travel activity creates a larger customer base for travel insurance providers, thereby fostering market expansion and growth opportunities.

Moreover, the growing accessibility and affordability of travel contribute to the escalating demand for travel insurance. The emergence of budget airlines and accommodation options has made travel more attainable for a broader demographic, encouraging more individuals to embark on trips.

For instance, Turkish airline 'Ajet' plans to launch budget flights across Europe, including a direct service from London to Istanbul, in March 2024. The company aims to expand its fleet to 200 aircraft and operate flights to 41 domestic and 52 international destinations within the next decade. This accessibility and affordability of travel options contribute to the increasing adoption of travel insurance among travelers.

The Growing Number of Online Platforms for Travel Insurance Drives the Industry

The expansion of online platforms has significantly impacted the growth of the travel insurance industry. With the widespread use of the internet, consumers have easy access to a variety of online channels for purchasing travel insurance. Online platforms offer convenience, flexibility, and transparency which allows travelers to compare different insurance options, review policy details, and make informed decisions.

Moreover, the rise of mobile applications dedicated to travel insurance has further democratized access to coverage. With the prevalence of smartphones and tablets, travelers have the ability to seamlessly purchase insurance directly from their handheld devices, circumventing the need for lengthy paperwork or in-person consultations.

This mobile accessibility transforms the insurance procurement process into a swift, efficient, and user-friendly endeavor, thereby enticing new customers and catalyzing the widespread adoption of insurance products. The advent of online insurance platforms such as Squaremouth, TravelInsurance.com, and InsureMyTrip has revolutionized the way travelers’ access and purchase insurance.

These platforms serve as centralized hubs where individuals can easily navigate through a diverse array of insurance plans, compare coverage benefits and prices, and ultimately select the policy that best aligns with their travel requirements. By streamlining the insurance shopping experience, these platforms not only enhance customer convenience but also foster greater market penetration and engagement.

Regulatory Challenges Hinder the Market Growth

Regulatory challenges in the travel insurance market include diverse and complex regulations imposed by governmental authorities across county. Insurance providers operating internationally face significant administrative burdens and costs in ensuring compliance with these regulations, which cover aspects such as licensing, consumer protection, sales practices, and policy terms. Meeting regulatory requirements involve establishing local entities, obtaining licenses, appointing legal representatives, and adapting products and marketing strategies to align with local laws.

Integration of Blockchain Technology Creates Ample Opportunity for the Market Growth

Blockchain technology offers a significant opportunity for enhancing transparency and security within the travel insurance industry. By leveraging decentralized digital ledgers, insurers can establish immutable records of transactions, policies, and claims, minimizing the risk of fraud and ensuring data integrity.

Smart contracts, which automate contract execution based on predefined conditions, streamline processes such as policy issuance and claims processing, reducing administrative overhead and enhancing efficiency. The transparency provided by blockchain technology empowers insurance providers to securely access and authenticate transactional data. This transparency builds a sense of trust between insurers and policyholders.

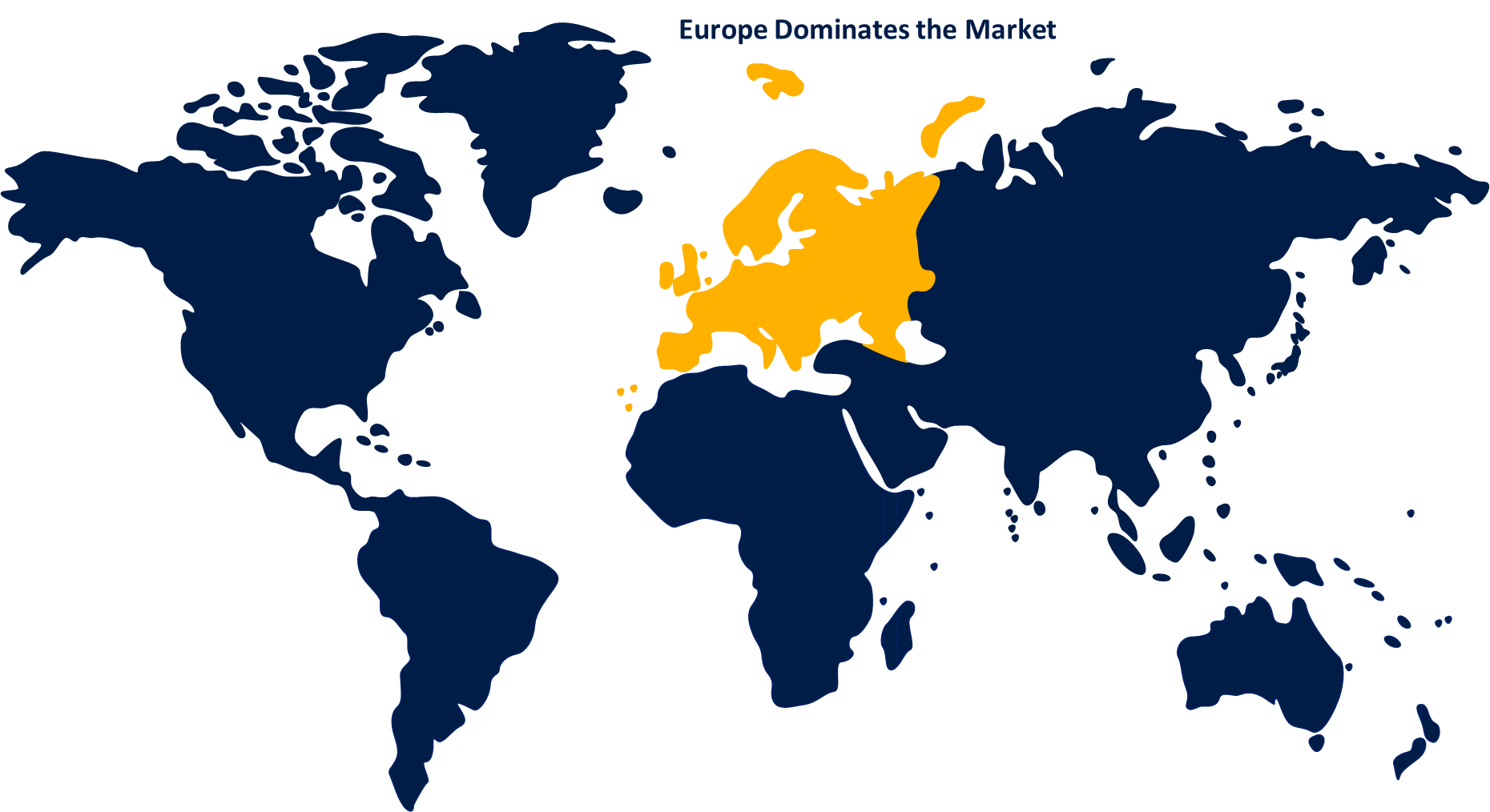

North American Region Dominates the Travel Insurance Market

The North American region holds the 41.7% share of the global travel insurance market due to rising number of people travelling from the U.S. to other international countries for career opportunities positively impacts the growth of the travel insurance industry.

According to a data published by The U.S. Department of Commerce, the U.S. positions itself at the forefront in North America in terms of outbound travelers, with approximately 80.7 million travelers recorded in 2022. Moreover, the proactive initiatives implemented by leading industry participants in the North America travel insurance market underscore a vibrant and evolving marketplace, characterized by innovation and adaptation to meet the diverse needs of travelers worldwide.

As an example, in January 2024, the partnership between AXA travel insurance and Kiwi.com offers comprehensive coverage for travelers, including medical expenses, assistance, lost baggage, liability, flight delays, and cancellations to have a secured journey through their trip in the region. It offers different insurance plans including Silver, Gold, and Platinum, each with varying levels of coverage to suit different travel needs.

Furthermore, the increasing trend of Mexican nationals venturing abroad for educational and academic pursuits boost the market growth. This demographic's rising demand for travel insurance contributes significantly to the expansion of the sector in region.

Furthermore, strategic partnerships within the industry contribute to the growth trajectory. In May 2023, Volaris, a budget-friendly Mexican airline service provider, partnered with Cover Genius to offer customers comprehensive travel protection options.

This collaboration allows Volaris customers to access a range of travel insurance coverage, including medical insurance, baggage protection, and flight cancellation insurance, at the time of booking flights. Such initiatives enhance the accessibility and awareness of travel insurance among Mexican travelers, promoting a financially secured journey during their travels.

Asia-Pacific is expected to show steady growth in the Travel Insurance market with a CAGR of 24.3%

Asia-Pacific is expected to witness an increased demand for the travel insurance market, due to substantial increase in demand among Indian travelers, particularly the elderly segment, seeking medical care and treatments abroad.

In response to this, in March 2024, the TATA AIG General Insurance Company's unveiled its new Travel Guard Plus that represents a significant development in the region. The product's comprehensive coverage, which includes both travel medical and non-medical contingencies, addresses a range of potential risks faced by travelers.

The inclusion of coverage for injuries, illnesses, disablement, and accidental death while overseas addresses the crucial aspect of medical emergencies that travelers may encounter during their trips. This aspect is particularly important given the uncertainties associated with health and medical facilities in foreign countries.

Moreover, the travel insurance market in the region is experiencing significant growth due to rising awareness regarding travel insurance among the population. A report by the major insurance firm MSIG Singapore, published in 2022, revealed that more than 80% of Singaporeans seek to purchase travel insurance for foreign travels, highlighting the growing awareness among Singaporean travelers regarding the importance of securing financial protection and security while abroad.

Furthermore, the presence of major regional and global players in the region, including Income, Seedly, and MSIG Singapore, among others, has significantly contributed to driving market growth. These established players continually engage in innovations and developments within the country, introducing new products and features to meet the evolving needs and preferences of consumers.

For instance, in November 2023, Seedly launched a new travel insurance product specifically designed to cater to a wide range of customers in Singapore, including families and adventure enthusiasts. Notably, this innovative product includes a child companion benefit, covering the expenses for an adult to travel from Singapore to accompany a child back home in the event of the insured parent being hospitalized overseas.

Additionally, customers are automatically covered for adventurous sports activities such as mountaineering, hiking, or scuba diving, without the need for any extra fees or add-ons. As major players in the market continue to innovate and refine their offerings, the travel insurance industry in the region is poised for further expansion and development, catering to the diverse needs of travelers in the region.

Competitive Landscape

Several market players operating in the global travel insurance market include Allianz Group, AXA SA, Zurich Insurance Group Limited, American International Group, Inc., Chubb Limited, Aviva PLC, Nationwide, Berkshire Hathaway Speciality Insurance, Travel Insured International, Generali Group and Others. These market players are adopting strategies, such as product launches and partnership to maintain their dominance global in the market.

For instance, in March 2024, Zurich Insurance partnered with Klook, a travel and e-commerce company, to introduce a service called FlyEasy, aiming to ease the inconvenience of flight delays for travelers by providing free access to airport lounges globally when flights are delayed for over two hours.

Also in January 2024, Aviva launched a comprehensive wellness package to enhance its group accident and travel insurance offerings, providing added value to customers. This includes mental health help, discounts on health products, support for cancer patients, and counselling. It's the first of its kind and aims to help employees with their mental health and overall wellness.

In addition, in April 2023, Generali Group launched Generali Malaysia following the acquisition of a controlling majority in AXA Affin joint ventures in Malaysia and the complete purchase of MPI Generali Insurans. The integration under a single brand, Generali Malaysia, aims to enhance customer experience and provide comprehensive protection solutions across various insurance sectors such as travel, health, and motor.

Moreover, in January 2024, Allianz Partners launched the Allyz mobile app, offering digital insurance, assistance, and travel-related services, offering customers a comprehensive suite of digital solutions for their insurance needs.

Furthermore, in October 2023, Travel Insured International partnered with Robin Assist to enhance customer claims and emergency travel assistance services. This collaboration aims to provide travelers with streamlined claims processing and comprehensive emergency assistance, ensuring a seamless and worry-free travel experience.

Key Market Segments

By age .

Millennials

Generation X

Baby Boomers

By Income Level

Low-income travelers

Middle-income travelers

High-income travelers

By Coverage

Medical Coverage

Trip Cancellation Coverage

Baggage and Personal Belongings Coverage

Accidental Death and Dismemberment (AD&D) Coverage

By Days of Coverage

Short-Trip Insurance

Standard Trip Insurance

Extended Trip Insurance

Multi-Trip Insurance

By End User

Pilgrim Travelers

Education Travelers

Business Travelers

Family Travelers

By Distributional Channel

Insurance Companies

Online Platforms

Insurance Aggregators and Comparison Websites

Travel Agents and Tour Operators

By Region

North America

France

Netherlands

Rest of Europe

Asia-Pacific

South Korea

GBA (excluding Hongkong)

Rest of Asia-Pacific

Latin America

Middle East

REPORT SCOPE AND SEGMENTATION:

KEY PLAYERS

Allianz Group

Zurich Insurance Group Limited

American International Group, Inc.

Chubb Limited

Berkshire Hathaway Speciality Insurance

Travel Insured International

Generali Group

1. INTRODUCTION

1.1. REPORT DESCRIPTION

1.2. WHO SHOULD READ THIS REPORT

1.3. KEY MARKET SEGMENTS

1.4. RESEARCH METHODOLOGY

1.4.1 MARKET SIZE ESTIMATION METHODOLOGY

1.4.1.1. TOP-DOWN AND BOTTOM-UP APPROACH

1.4.1.2. DEMAND AND SUPPLY SIDE ANALYSIS

1.4.1.3. MACRO-INDICATOR APPROACH

1.4.2 DATA COLLECTION APPROACH

1.4.2.1. PRIMARY DATA COLLECTION

1.4.2.2. SECONDARY DATA COLLECTION

1.4.2.2.1. SECONDARY DATA SOURCES

1.4.3 FORECASTING

2. MARKET DEFINITION & SCOPE

2.1. DEFINITION

2.2. SCOPE

3. IMPACT OF WAR ON THE GLOBAL TRAVEL INSURANCE MARKET

4. TRAVEL INSURANCE MARKET – EXECUTIVE SUMMARY

4.1. MARKET SNAPSHOT, 2023 - 2030, MILLION USD

5. MARKET OVERVIEW

5.1. MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1. THE RISING NUMBER OF GLOBAL TRAVELS INCREASES THE DEMAND FOR TRAVEL INSURANCE

5.1.1.2. THE GROWING NUMBER OF ONLINE PLATFORMS FOR TRAVEL INSURANCE DRIVES THE INDUSTRY

5.1.1.3. INCREASING DISPOSABLE INCOME AMONG THE CONSUMERS DRIVES THE GROWTH OF THE MARKET

5.1.2 RESTRAINT

5.1.2.1. STRICT REGULATORY COMPLEXITIES FOR INSURANCE PROVIDERS IS HINDERING MARKET GROWTH

5.1.3 OPPORTUNITY

5.1.3.1. INTEGRATION OF BLOCKCHAIN TECHNOLOGY CREATES AMPLE OPPORTUNITY FOR THE MARKET GROWTH

6. MARKET SHARE ANALYSIS

6.1. MARKET SHARE ANALYSIS OF TOP TRAVEL INSURANCE MARKET, 2023

7. GLOBAL TRAVEL INSURANCE MARKET, BY AGE

7.1. OVERVIEW

7.2. MILLENNIALS

7.2.1 MILLENNIALS MARKET, BY REGION

7.3. GENERATION X

7.3.1 GENERATION X MARKET, BY REGION

7.4. BABY BOOMERS

7.4.1 BABY BOOMERS MARKET, BY REGION

8. GLOBAL TRAVEL INSURANCE MARKET, BY INCOME LEVEL

8.1. OVERVIEW

8.2. LOW-INCOME TRAVELERS

8.2.1 LOW-INCOME TRAVELERS MARKET, BY REGION

8.3. MIDDLE-INCOME TRAVELERS

8.3.1 MIDDLE-INCOME TRAVELERS MARKET, BY REGION

8.4. HIGH-INCOME TRAVELERS

8.4.1 HIGH-INCOME TRAVELERS MARKET, BY REGION

9. GLOBAL TRAVEL INSURANCE MARKET, BY COVERAGE

9.1. OVERVIEW

9.2. MEDICAL COVERAGE

9.2.1 MEDICAL COVERAGE MARKET, BY REGION

9.3. TRIP CANCELLATION COVERAGE

9.3.1 TRIP CANCELLATION COVERAGE MARKET, BY REGION

9.4. BAGGAGE AND PERSONAL BELONGINGS COVERAGE

9.4.1 BAGGAGE AND PERSONAL BELONGINGS COVERAGE MARKET, BY REGION

9.5. ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) COVERAGE

9.5.1 ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) COVERAGE MARKET, BY REGION

10. GLOBAL TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

10.1. OVERVIEW

10.2. INSURANCE COMPANIES

10.2.1 INSURANCE COMPANIES MARKET, BY REGION

10.3. BANKS

10.3.1 BANKS MARKET, BY REGION

10.4. AIRLINES

10.4.1 AIRLINES MARKET, BY REGION

10.5. ONLINE PLATFORMS

10.5.1 ONLINE PLATFORMS MARKET, BY REGION

10.6. INSURANCE AGGREGATORS AND COMPARISON WEBSITES

10.6.1 INSURANCE AGGREGATORS AND COMPARISON WEBSITES MARKET, BY REGION

10.7. TRAVEL AGENTS AND TOUR OPERATORS

10.7.1 TRAVEL AGENTS AND TOUR OPERATORS MARKET, BY REGION

11. GLOBAL TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

11.1. OVERVIEW

11.2. SHORT-TRIP INSURANCE

11.2.1 SHORT-TRIP INSURANCE MARKET, BY REGION

11.3. STANDARD TRIP INSURANCE

11.3.1 STANDARD TRIP INSURANCE MARKET, BY REGION

11.4. EXTENDED TRIP INSURANCE

11.4.1 EXTENDED TRIP INSURANCE MARKET, BY REGION

11.5. MULTI-TRIP INSURANCE

11.5.1 MULTI-TRIP INSURANCE MARKET, BY REGION

12. GLOBAL TRAVEL INSURANCE MARKET, BY END USER

12.1. OVERVIEW

12.2. PILGRIM TRAVELLERS

12.2.1 PILGRIM TRAVELLERS MARKET, BY REGION

12.3. EDUCATION TRAVELERS

12.3.1 EDUCATION TRAVELERS MARKET, BY REGION

12.4. BUSINESS TRAVELERS

12.4.1 BUSINESS TRAVELERS MARKET, BY REGION

12.5. FAMILY TRAVELERS

12.5.1 FAMILY TRAVELERS MARKET, BY REGION

13. GLOBAL TRAVEL INSURANCE MARKET, BY REGION

13.1. OVERVIEW

13.2. NORTH AMERICA

13.2.1 NORTH AMERICA TRAVEL INSURANCE MARKET, BY AGE

13.2.2 NORTH AMERICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.2.3 NORTH AMERICA TRAVEL INSURANCE MARKET, BY COVERAGE

13.2.4 NORTH AMERICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.2.5 NORTH AMERICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.2.6 NORTH AMERICA TRAVEL INSURANCE MARKET, BY END USER

13.2.7 NORTH AMERICA TRAVEL INSURANCE MARKET, BY COUNTRY

13.2.7.1. U.S.

13.2.7.1.1. U.S. TRAVEL INSURANCE MARKET, BY AGE

13.2.7.1.2. U.S. TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.2.7.1.3. U.S. TRAVEL INSURANCE MARKET, BY COVERAGE

13.2.7.1.4. U.S. TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.2.7.1.5. U.S. TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.2.7.1.6. U.S. TRAVEL INSURANCE MARKET, BY END USER

13.2.7.2. CANADA

13.2.7.2.1. CANADA TRAVEL INSURANCE MARKET, BY AGE

13.2.7.2.2. CANADA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.2.7.2.3. CANADA TRAVEL INSURANCE MARKET, BY COVERAGE

13.2.7.2.4. CANADA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.2.7.2.5. CANADA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.2.7.2.6. CANADA TRAVEL INSURANCE MARKET, BY END USER

13.2.7.3. MEXICO

13.2.7.3.1. MEXICO TRAVEL INSURANCE MARKET, BY AGE

13.2.7.3.2. MEXICO TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.2.7.3.3. MEXICO TRAVEL INSURANCE MARKET, BY COVERAGE

13.2.7.3.4. MEXICO TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.2.7.3.5. MEXICO TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.2.7.3.6. MEXICO TRAVEL INSURANCE MARKET, BY END USER

13.3. EUROPE

13.3.1 EUROPE TRAVEL INSURANCE MARKET, BY AGE

13.3.2 EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.3 EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.4 EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.5 EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.6 EUROPE TRAVEL INSURANCE MARKET, BY END USER

13.3.7 EUROPE TRAVEL INSURANCE MARKET, BY COUNTRY

13.3.7.1. UK

13.3.7.1.1. UK TRAVEL INSURANCE MARKET, BY AGE

13.3.7.1.2. UK TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.1.3. UK TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.1.4. UK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.1.5. UK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.1.6. UK TRAVEL INSURANCE MARKET, BY END USER

13.3.7.2. GERMANY

13.3.7.2.1. GERMANY TRAVEL INSURANCE MARKET, BY AGE

13.3.7.2.2. GERMANY TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.2.3. GERMANY TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.2.4. GERMANY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.2.5. GERMANY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.2.6. GERMANY TRAVEL INSURANCE MARKET, BY END USER

13.3.7.3. FRANCE

13.3.7.3.1. FRANCE TRAVEL INSURANCE MARKET, BY AGE

13.3.7.3.2. FRANCE TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.3.3. FRANCE TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.3.4. FRANCE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.3.5. FRANCE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.3.6. FRANCE TRAVEL INSURANCE MARKET, BY END USER

13.3.7.4. ITALY

13.3.7.4.1. ITALY TRAVEL INSURANCE MARKET, BY AGE

13.3.7.4.2. ITALY TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.4.3. ITALY TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.4.4. ITALY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.4.5. ITALY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.4.6. ITALY TRAVEL INSURANCE MARKET, BY END USER

13.3.7.5. SPAIN

13.3.7.5.1. SPAIN TRAVEL INSURANCE MARKET, BY AGE

13.3.7.5.2. SPAIN TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.5.3. SPAIN TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.5.4. SPAIN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.5.5. SPAIN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.5.6. SPAIN TRAVEL INSURANCE MARKET, BY END USER

13.3.7.6. DENMARK

13.3.7.6.1. DENMARK TRAVEL INSURANCE MARKET, BY AGE

13.3.7.6.2. DENMARK TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.6.3. DENMARK TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.6.4. DENMARK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.6.5. DENMARK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.6.6. DENMARK TRAVEL INSURANCE MARKET, BY END USER

13.3.7.7. NETHERLANDS

13.3.7.7.1. NETHERLANDS TRAVEL INSURANCE MARKET, BY AGE

13.3.7.7.2. NETHERLANDS TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.7.3. NETHERLANDS TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.7.4. NETHERLANDS TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.7.5. NETHERLANDS TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.7.6. NETHERLANDS TRAVEL INSURANCE MARKET, BY END USER

13.3.7.8. FINLAND

13.3.7.8.1. FINLAND TRAVEL INSURANCE MARKET, BY AGE

13.3.7.8.2. FINLAND TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.8.3. FINLAND TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.8.4. FINLAND TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.8.5. FINLAND TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.8.6. FINLAND TRAVEL INSURANCE MARKET, BY END USER

13.3.7.9. SWEDEN

13.3.7.9.1. SWEDEN TRAVEL INSURANCE MARKET, BY AGE

13.3.7.9.2. SWEDEN TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.9.3. SWEDEN TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.9.4. SWEDEN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.9.5. SWEDEN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.9.6. SWEDEN TRAVEL INSURANCE MARKET, BY END USER

13.3.7.10. NORWAY

13.3.7.10.1. NORWAY TRAVEL INSURANCE MARKET, BY AGE

13.3.7.10.2. NORWAY TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.10.3. NORWAY TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.10.4. NORWAY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.10.5. NORWAY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.10.6. NORWAY TRAVEL INSURANCE MARKET, BY END USER

13.3.7.11. RUSSIA

13.3.7.11.1. RUSSIA TRAVEL INSURANCE MARKET, BY AGE

13.3.7.11.2. RUSSIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.11.3. RUSSIA TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.11.4. RUSSIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.11.5. RUSSIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.11.6. RUSSIA TRAVEL INSURANCE MARKET, BY END USER

13.3.7.12. REST OF EUROPE

13.3.7.12.1. REST OF EUROPE TRAVEL INSURANCE MARKET, BY AGE

13.3.7.12.2. REST OF EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.3.7.12.3. REST OF EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE

13.3.7.12.4. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.3.7.12.5. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.3.7.12.6. REST OF EUROPE TRAVEL INSURANCE MARKET, BY END USER

13.4. ASIA-PACIFIC

13.4.1 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY AGE

13.4.2 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.3 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.4 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.5 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.6 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY END USER

13.4.7 ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COUNTRY

13.4.7.1. CHINA

13.4.7.1.1. CHINA TRAVEL INSURANCE MARKET, BY AGE

13.4.7.1.2. CHINA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.1.3. CHINA TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.1.4. CHINA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.1.5. CHINA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.1.6. CHINA TRAVEL INSURANCE MARKET, BY END USER

13.4.7.2. JAPAN

13.4.7.2.1. JAPAN TRAVEL INSURANCE MARKET, BY AGE

13.4.7.2.2. JAPAN TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.2.3. JAPAN TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.2.4. JAPAN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.2.5. JAPAN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.2.6. JAPAN TRAVEL INSURANCE MARKET, BY END USER

13.4.7.3. INDIA

13.4.7.3.1. INDIA TRAVEL INSURANCE MARKET, BY AGE

13.4.7.3.2. INDIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.3.3. INDIA TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.3.4. INDIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.3.5. INDIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.3.6. INDIA TRAVEL INSURANCE MARKET, BY END USER

13.4.7.4. SOUTH KOREA

13.4.7.4.1. SOUTH KOREA TRAVEL INSURANCE MARKET, BY AGE

13.4.7.4.2. SOUTH KOREA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.4.3. SOUTH KOREA TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.4.4. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.4.5. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.4.6. SOUTH KOREA TRAVEL INSURANCE MARKET, BY END USER

13.4.7.5. AUSTRALIA

13.4.7.5.1. AUSTRALIA TRAVEL INSURANCE MARKET, BY AGE

13.4.7.5.2. AUSTRALIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.5.3. AUSTRALIA TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.5.4. AUSTRALIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.5.5. AUSTRALIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.5.6. AUSTRALIA TRAVEL INSURANCE MARKET, BY END USER

13.4.7.6. INDONESIA

13.4.7.6.1. INDONESIA TRAVEL INSURANCE MARKET, BY AGE

13.4.7.6.2. INDONESIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.6.3. INDONESIA TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.6.4. INDONESIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.6.5. INDONESIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.6.6. INDONESIA TRAVEL INSURANCE MARKET, BY END USER

13.4.7.7. SINGAPORE

13.4.7.7.1. SINGAPORE TRAVEL INSURANCE MARKET, BY AGE

13.4.7.7.2. SINGAPORE TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.7.3. SINGAPORE TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.7.4. SINGAPORE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.7.5. SINGAPORE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.7.6. SINGAPORE TRAVEL INSURANCE MARKET, BY END USER

13.4.7.8. TAIWAN

13.4.7.8.1. TAIWAN TRAVEL INSURANCE MARKET, BY AGE

13.4.7.8.2. TAIWAN TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.8.3. TAIWAN TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.8.4. TAIWAN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.8.5. TAIWAN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.8.6. TAIWAN TRAVEL INSURANCE MARKET, BY END USER

13.4.7.9. THAILAND

13.4.7.9.1. THAILAND TRAVEL INSURANCE MARKET, BY AGE

13.4.7.9.2. THAILAND TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.9.3. THAILAND TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.9.4. THAILAND TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.9.5. THAILAND TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.9.6. THAILAND TRAVEL INSURANCE MARKET, BY END USER

13.4.7.10. HONG KONG

13.4.7.10.1. HONG KONG TRAVEL INSURANCE MARKET, BY AGE

13.4.7.10.2. HONG KONG TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.10.3. HONG KONG TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.10.4. HONG KONG TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.10.5. HONG KONG TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.10.6. HONG KONG TRAVEL INSURANCE MARKET, BY END USER

13.4.7.11. GBA (EXCLUDING HONGKONG)

13.4.7.11.1. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY AGE

13.4.7.11.2. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.11.3. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.11.4. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.11.5. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.11.6. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY END USER

13.4.7.12. REST OF ASIA-PACIFIC

13.4.7.12.1. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY AGE

13.4.7.12.2. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.4.7.12.3. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COVERAGE

13.4.7.12.4. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.4.7.12.5. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.4.7.12.6. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY END USER

13.5. REST OF WORLD

13.5.1 REST OF WORLD TRAVEL INSURANCE MARKET, BY AGE

13.5.2 REST OF WORLD TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.5.3 REST OF WORLD TRAVEL INSURANCE MARKET, BY COVERAGE

13.5.4 REST OF WORLD TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.5.5 REST OF WORLD TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.5.6 REST OF WORLD TRAVEL INSURANCE MARKET, BY END USER

13.5.7 REST OF WORLD TRAVEL INSURANCE MARKET, BY COUNTRY

13.5.7.1. LATIN AMERICA

13.5.7.1.1. LATIN AMERICA TRAVEL INSURANCE MARKET, BY AGE

13.5.7.1.2. LATIN AMERICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.5.7.1.3. LATIN AMERICA TRAVEL INSURANCE MARKET, BY COVERAGE

13.5.7.1.4. LATIN AMERICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.5.7.1.5. LATIN AMERICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.5.7.1.6. LATIN AMERICA TRAVEL INSURANCE MARKET, BY END USER

13.5.7.2. MIDDLE EAST

13.5.7.2.1. MIDDLE EAST TRAVEL INSURANCE MARKET, BY AGE

13.5.7.2.2. MIDDLE EAST TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.5.7.2.3. MIDDLE EAST TRAVEL INSURANCE MARKET, BY COVERAGE

13.5.7.2.4. MIDDLE EAST TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.5.7.2.5. MIDDLE EAST TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.5.7.2.6. MIDDLE EAST TRAVEL INSURANCE MARKET, BY END USER

13.5.7.3. AFRICA

13.5.7.3.1. AFRICA TRAVEL INSURANCE MARKET, BY AGE

13.5.7.3.2. AFRICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL

13.5.7.3.3. AFRICA TRAVEL INSURANCE MARKET, BY COVERAGE

13.5.7.3.4. AFRICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

13.5.7.3.5. AFRICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE

13.5.7.3.6. AFRICA TRAVEL INSURANCE MARKET, BY END USER

14. COMPANY PROFILES

14.1. ZURICH INSURANCE GROUP LTD

14.1.1 COMPANY OVERVIEW

14.1.2 COMPANY SNAPSHOT

14.1.3 OPERATING BUSINESS SEGMENTS

14.1.4 PRODUCT PORTFOLIO

14.1.5 BUSINESS PERFORMANCE

14.1.6 SALES BY BUSINESS SEGMENT

14.1.7 SALES BY GEOGRAPHIC SEGMENT

14.1.8 KEY STRATEGIC MOVES & DEVELOPMENTS

14.1.9 PRIMARY MARKET COMPETITORS

14.2. BERKSHIRE HATHAWAY SPECIALTY INSURANCE

14.2.1 COMPANY OVERVIEW

14.2.2 COMPANY SNAPSHOT

14.2.3 OPERATING BUSINESS SEGMENTS

14.2.4 PRODUCT PORTFOLIO

14.2.5 BUSINESS PERFORMANCE

14.2.6 SALES BY BUSINESS SEGMENT

14.2.7 KEY STRATEGIC MOVES & DEVELOPMENTS

14.2.8 PRIMARY MARKET COMPETITORS

14.3. CHUBB LIMITED

14.3.1 COMPANY OVERVIEW

14.3.2 COMPANY SNAPSHOT

14.3.3 OPERATING BUSINESS SEGMENTS

14.3.4 PRODUCT PORTFOLIO

14.3.5 BUSINESS PERFORMANCE

14.3.6 SALES BY BUSINESS SEGMENT

14.3.7 KEY STRATEGIC MOVES & DEVELOPMENTS

14.3.8 PRIMARY MARKET COMPETITORS

14.4. AVIVA PLC

14.4.1 COMPANY OVERVIEW

14.4.2 COMPANY SNAPSHOT

14.4.3 PRODUCT PORTFOLIO

14.4.4 BUSINESS PERFORMANCE

14.4.5 KEY STRATEGIC MOVES & DEVELOPMENTS

14.4.6 PRIMARY MARKET COMPETITORS

14.5. GENERALI GROUP

14.5.1 COMPANY OVERVIEW

14.5.2 COMPANY SNAPSHOT

14.5.3 OPERATING BUSINESS SEGMENTS

14.5.4 PRODUCT PORTFOLIO

14.5.5 BUSINESS PERFORMANCE

14.5.6 SALES BY BUSINESS SEGMENT

14.5.7 KEY STRATEGIC MOVES & DEVELOPMENTS

14.5.8 PRIMARY MARKET COMPETITORS

14.6. AIA GROUP LTD

14.6.1 COMPANY OVERVIEW

14.6.2 COMPANY SNAPSHOT

14.6.3 PRODUCT PORTFOLIO

14.6.4 BUSINESS PERFORMANCE

14.6.5 SALES BY BUSINESS SEGMENT

14.6.6 KEY STRATEGIC MOVES & DEVELOPMENTS

14.6.7 PRIMARY MARKET COMPETITORS

14.7. ALLIANZ GROUP

14.7.1 COMPANY OVERVIEW

14.7.2 COMPANY SNAPSHOT

14.7.3 OPERATING BUSINESS SEGMENTS

14.7.4 PRODUCT PORTFOLIO

14.7.5 BUSINESS PERFORMANCE

14.7.6 SALES BY BUSINESS SEGMENT

14.7.7 KEY STRATEGIC MOVES & DEVELOPMENTS

14.7.8 PRIMARY MARKET COMPETITORS

14.8. AMERICAN INTERNATIONAL GROUP, INC.

14.8.1 COMPANY OVERVIEW

14.8.2 COMPANY SNAPSHOT

14.8.3 PRODUCT PORTFOLIO

14.8.4 BUSINESS PERFORMANCE

14.8.5 SALES BY GEOGRAPHIC SEGMENT

14.8.6 KEY STRATEGIC MOVES & DEVELOPMENTS

14.8.7 PRIMARY MARKET COMPETITORS

14.9. AXA S.A.

14.9.1 COMPANY OVERVIEW

14.9.2 COMPANY SNAPSHOT

14.9.3 OPERATING BUSINESS SEGMENTS

14.9.4 PRODUCT PORTFOLIO

14.9.5 BUSINESS PERFORMANCE

14.9.6 SALES BY BUSINESS SEGMENT

14.9.7 SALES BY GEOGRAPHIC SEGMENT

14.9.8 KEY STRATEGIC MOVES & DEVELOPMENTS

14.9.9 PRIMARY MARKET COMPETITORS

14.10. TRAVEL INSURED INTERNATIONAL

14.10.1 COMPANY OVERVIEW

14.10.2 COMPANY SNAPSHOT

14.10.3 PRODUCT PORTFOLIO

14.10.4 KEY STRATEGIC MOVES & DEVELOPMENTS

14.10.5 PRIMARY MARKET COMPETITORS

14.11. NATIONWIDE

14.11.1 COMPANY OVERVIEW

14.11.2 COMPANY SNAPSHOT

14.11.3 PRODUCT PORTFOLIO

14.11.4 BUSINESS PERFORMANCE

14.11.5 KEY STRATEGIC MOVES & DEVELOPMENTS

14.11.6 PRIMARY MARKET COMPETITORS

14.12. PRUDENTIAL PLC

14.12.1 COMPANY OVERVIEW

14.12.2 COMPANY SNAPSHOT

14.12.3 PRODUCT PORTFOLIO

14.12.4 BUSINESS PERFORMANCE

14.12.5 SALES BY GEOGRAPHIC SEGMENT

14.12.6 KEY STRATEGIC MOVES & DEVELOPMENTS

14.12.7 PRIMARY MARKET COMPETITORS

14.13. MANUFACTURERS LIFE INSURANCE COMPANY (MANULIFE)

14.13.1 COMPANY OVERVIEW

14.13.2 COMPANY SNAPSHOT

14.13.3 PRODUCT PORTFOLIO

14.13.4 BUSINESS PERFORMANCE

14.13.5 KEY STRATEGIC MOVES & DEVELOPMENTS

14.13.6 PRIMARY MARKET COMPETITORS

14.14. HSBC HOLDINGS PLC

14.14.1 COMPANY OVERVIEW

14.14.2 COMPANY SNAPSHOT

14.14.3 OPERATING BUSINESS SEGMENTS

14.14.4 PRODUCT PORTFOLIO

14.14.5 BUSINESS PERFORMANCE

14.14.6 SALES BY BUSINESS SEGMENT

14.14.7 KEY STRATEGIC MOVES & DEVELOPMENTS

14.14.8 PRIMARY MARKET COMPETITORS

14.15. BOC GROUP LIFE ASSURANCE COMPANY LIMITED

14.15.1 COMPANY OVERVIEW

14.15.2 COMPANY SNAPSHOT

14.15.3 PRODUCT PORTFOLIO

14.15.4 KEY STRATEGIC MOVES & DEVELOPMENTS

14.15.5 PRIMARY MARKET COMPETITORS

LIST OF TABLES

TABLE 1. MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

TABLE 2. GLOBAL TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 3. MILLENNIALS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 4. GENERATION X MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 5. BABY BOOMERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 6. GLOBAL TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 7. LOW-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 8. MIDDLE-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 9. HIGH-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 10. GLOBAL TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 11. MEDICAL COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 12. TRIP CANCELLATION COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 13. BAGGAGE AND PERSONAL BELONGINGS COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 14. ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 15. GLOBAL TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 16. INSURANCE COMPANIES MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 17. BANKS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 18. AIRLINES MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 19. ONLINE PLATFORMS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 20. INSURANCE AGGREGATORS AND COMPARISON WEBSITES MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 21. TRAVEL AGENTS AND TOUR OPERATORS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 22. GLOBAL TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 23. SHORT-TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 24. STANDARD TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 25. EXTENDED TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 26. MULTI-TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 27. GLOBAL TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 28. PILGRIM TRAVELLERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 29. EDUCATION TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 30. BUSINESS TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 31. FAMILY TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 32. GLOBAL TRAVEL INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

TABLE 33. NORTH AMERICA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 34. NORTH AMERICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 35. NORTH AMERICA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 36. NORTH AMERICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 37. NORTH AMERICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 38. NORTH AMERICA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 39. NORTH AMERICA TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

TABLE 40. U.S. TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 41. U.S. TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 42. U.S. TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 43. U.S. TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 44. U.S. TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 45. U.S. TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 46. CANADA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 47. CANADA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 48. CANADA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 49. CANADA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 50. CANADA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 51. CANADA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 52. MEXICO TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 53. MEXICO TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 54. MEXICO TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 55. MEXICO TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 56. MEXICO TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 57. MEXICO TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 58. EUROPE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 59. EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 60. EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 61. EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 62. EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 63. EUROPE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 64. EUROPE TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

TABLE 65. UK TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 66. UK TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 67. UK TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 68. UK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 69. UK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 70. UK TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 71. GERMANY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 72. GERMANY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 73. GERMANY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 74. GERMANY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 75. GERMANY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 76. GERMANY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 77. FRANCE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 78. FRANCE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 79. FRANCE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 80. FRANCE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 81. FRANCE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 82. FRANCE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 83. ITALY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 84. ITALY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 85. ITALY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 86. ITALY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 87. ITALY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 88. ITALY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 89. SPAIN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 90. SPAIN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 91. SPAIN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 92. SPAIN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 93. SPAIN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 94. SPAIN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 95. DENMARK TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 96. DENMARK TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 97. DENMARK TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 98. DENMARK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 99. DENMARK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 100. DENMARK TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 101. NETHERLANDS TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 102. NETHERLANDS TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 103. NETHERLANDS TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 104. NETHERLANDS TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 105. NETHERLANDS TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 106. NETHERLANDS TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 107. FINLAND TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 108. FINLAND TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 109. FINLAND TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 110. FINLAND TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 111. FINLAND TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 112. FINLAND TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 113. SWEDEN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 114. SWEDEN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 115. SWEDEN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 116. SWEDEN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 117. SWEDEN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 118. SWEDEN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 119. NORWAY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 120. NORWAY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 121. NORWAY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 122. NORWAY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 123. NORWAY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 124. NORWAY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 125. RUSSIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 126. RUSSIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 127. RUSSIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 128. RUSSIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 129. RUSSIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 130. RUSSIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 131. REST OF EUROPE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 132. REST OF EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 133. REST OF EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 134. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 135. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 136. REST OF EUROPE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 137. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 138. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 139. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 140. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 141. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 142. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 143. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

TABLE 144. CHINA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 145. CHINA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 146. CHINA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 147. CHINA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 148. CHINA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 149. CHINA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 150. JAPAN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 151. JAPAN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 152. JAPAN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 153. JAPAN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 154. JAPAN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 155. JAPAN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 156. INDIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 157. INDIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 158. INDIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 159. INDIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 160. INDIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 161. INDIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 162. SOUTH KOREA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 163. SOUTH KOREA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 164. SOUTH KOREA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 165. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 166. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 167. SOUTH KOREA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 168. AUSTRALIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 169. AUSTRALIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 170. AUSTRALIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 171. AUSTRALIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 172. AUSTRALIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 173. AUSTRALIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 174. INDONESIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 175. INDONESIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 176. INDONESIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 177. INDONESIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 178. INDONESIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 179. INDONESIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 180. SINGAPORE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 181. SINGAPORE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 182. SINGAPORE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 183. SINGAPORE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 184. SINGAPORE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 185. SINGAPORE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 186. TAIWAN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 187. TAIWAN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 188. TAIWAN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 189. TAIWAN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 190. TAIWAN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 191. TAIWAN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 192. THAILAND TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 193. THAILAND TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 194. THAILAND TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 195. THAILAND TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 196. THAILAND TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 197. THAILAND TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 198. HONG KONG TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 199. HONG KONG TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 200. HONG KONG TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 201. HONG KONG TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 202. HONG KONG TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 203. HONG KONG TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 204. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 205. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 206. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 207. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 208. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 209. GBA (EXCLUDING HONGKONG) TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 210. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 211. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 212. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 213. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 214. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 215. REST OF ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 216. REST OF WORLD TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 217. REST OF WORLD TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 218. REST OF WORLD TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 219. REST OF WORLD TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 220. REST OF WORLD TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 221. REST OF WORLD TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 222. REST OF WORLD TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

TABLE 223. LATIN AMERICA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 224. LATIN AMERICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 225. LATIN AMERICA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 226. LATIN AMERICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 227. LATIN AMERICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 228. LATIN AMERICA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 229. MIDDLE EAST TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 230. MIDDLE EAST TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 231. MIDDLE EAST TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 232. MIDDLE EAST TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 233. MIDDLE EAST TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 234. MIDDLE EAST TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 235. AFRICA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

TABLE 236. AFRICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

TABLE 237. AFRICA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

TABLE 238. AFRICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

TABLE 239. AFRICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

TABLE 240. AFRICA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

TABLE 241. ZURICH INSURANCE GROUP LTD: COMPANY SNAPSHOT

TABLE 242. ZURICH INSURANCE GROUP LTD: OPERATING SEGMENTS

TABLE 243. ZURICH INSURANCE GROUP LTD: PRODUCT PORTFOLIO

TABLE 244. ZURICH INSURANCE GROUP LTD: BUSINESS SEGMENT

TABLE 245. ZURICH INSURANCE GROUP LTD: GEOGRAPHIC SEGMENT

TABLE 246. ZURICH INSURANCE GROUP LTD: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 247. BERKSHIRE HATHAWAY SPECIALTY INSURANCE: COMPANY SNAPSHOT

TABLE 248. BERKSHIRE HATHAWAY SPECIALTY INSURANCE: OPERATING SEGMENTS

TABLE 249. BERKSHIRE HATHAWAY SPECIALTY INSURANCE: PRODUCT PORTFOLIO

TABLE 250. BERKSHIRE HATHAWAY SPECIALTY INSURANCE: BUSINESS SEGMENT

TABLE 251. BERKSHIRE HATHAWAY SPECIALTY INSURANCE: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 252. CHUBB LIMITED: COMPANY SNAPSHOT

TABLE 253. CHUBB LIMITED: OPERATING SEGMENTS

TABLE 254. CHUBB LIMITED: PRODUCT PORTFOLIO

TABLE 255. CHUBB LIMITED: BUSINESS SEGMENT

TABLE 256. CHUBB LIMITED: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 257. AVIVA PLC: COMPANY SNAPSHOT

TABLE 258. AVIVA PLC: PRODUCT PORTFOLIO

TABLE 259. AVIVA PLC: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 260. GENERALI GROUP: COMPANY SNAPSHOT

TABLE 261. GENERALI GROUP: OPERATING SEGMENTS

TABLE 262. GENERALI GROUP: PRODUCT PORTFOLIO

TABLE 263. GENERALI GROUP: BUSINESS SEGMENT

TABLE 264. GENERALI GROUP: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 265. AIA GROUP LTD: COMPANY SNAPSHOT

TABLE 266. AIA GROUP LTD: PRODUCT PORTFOLIO

TABLE 267. AIA GROUP LTD: BUSINESS SEGMENT

TABLE 268. AIA GROUP LTD: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 269. ALLIANZ GROUP: COMPANY SNAPSHOT

TABLE 270. ALLIANZ GROUP: OPERATING SEGMENTS

TABLE 271. ALLIANZ GROUP: PRODUCT PORTFOLIO

TABLE 272. ALLIANZ GROUP: BUSINESS SEGMENT

TABLE 273. ALLIANZ GROUP: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 274. AMERICAN INTERNATIONAL GROUP, INC.: COMPANY SNAPSHOT

TABLE 275. AMERICAN INTERNATIONAL GROUP, INC.: PRODUCT PORTFOLIO

TABLE 276. AMERICAN INTERNATIONAL GROUP, INC.: SALES BY GEOGRAPHIC SEGMENT

TABLE 277. AMERICAN INTERNATIONAL GROUP, INC.: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 278. AXA S.A.: COMPANY SNAPSHOT

TABLE 279. AXA S.A.: OPERATING SEGMENTS

TABLE 280. AXA S.A.: PRODUCT PORTFOLIO

TABLE 281. AXA S.A.: BUSINESS SEGMENT

TABLE 282. AXA S.A.: SALES BY GEOGRAPHIC SEGMENT

TABLE 283. AXA S.A.: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 284. TRAVEL INSURED INTERNATIONAL: COMPANY SNAPSHOT

TABLE 285. TRAVEL INSURED INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 286. TRAVEL INSURED INTERNATIONAL: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 287. NATIONWIDE: COMPANY SNAPSHOT

TABLE 288. NATIONWIDE: PRODUCT PORTFOLIO

TABLE 289. NATIONWIDE: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 290. PRUDENTIAL PLC: COMPANY SNAPSHOT

TABLE 291. PRUDENTIAL PLC: PRODUCT PORTFOLIO

TABLE 292. PRUDENTIAL PLC: GEOGRAPHIC SEGMENT

TABLE 293. PRUDENTIAL PLC: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 294. MANUFACTURERS LIFE INSURANCE COMPANY (MANULIFE): COMPANY SNAPSHOT

TABLE 295. MANUFACTURERS LIFE INSURANCE COMPANY (MANULIFE): PR0DUCT PORTFOLIO

TABLE 296. MANUFACTURERS LIFE INSURANCE COMPANY (MANULIFE): KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 297. HSBC HOLDINGS PLC: COMPANY SNAPSHOT

TABLE 298. HSBC HOLDINGS PLC: OPERATING SEGMENTS

TABLE 299. HSBC HOLDINGS PLC: PRODUCT PORTFOLIO

TABLE 300. HSBC HOLDINGS PLC: BUSINESS SEGMENT

TABLE 301. BOC GROUP LIFE ASSURANCE COMPANY LIMITED: COMPANY SNAPSHOT

TABLE 302. BOC GROUP LIFE ASSURANCE COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 303. BOC GROUP LIFE ASSURANCE COMPANY LIMITED: KEY STRATEGIC MOVES & DEVELOPMENTS

LIST OF FIGURES

FIGURE 1. SECONDARY DATA SOURCES

FIGURE 2. OVERVIEW OF THE SCOPE

FIGURE 3. MARKET SHARE ANALYSIS OF TOP PROVIDERS OF TRAVEL INSURANCE, 2023

FIGURE 4. GLOBAL TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 5. MILLENNIALS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 6. GENERATION X MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 7. BABY BOOMERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 8. GLOBAL TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 9. LOW-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 10. MIDDLE-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 11. HIGH-INCOME TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 12. GLOBAL TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 13. MEDICAL COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 14. TRIP CANCELLATION COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 15. BAGGAGE AND PERSONAL BELONGINGS COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 16. ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) COVERAGE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 17. GLOBAL TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 18. INSURANCE COMPANIES MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 19. BANKS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 20. AIRLINES MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 21. ONLINE PLATFORMS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 22. INSURANCE AGGREGATORS AND COMPARISON WEBSITES MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 23. TRAVEL AGENTS AND TOUR OPERATORS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 24. GLOBAL TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 25. SHORT-TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 26. STANDARD TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 27. EXTENDED TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 28. MULTI-TRIP INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 29. GLOBAL TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 30. PILGRIM TRAVELLERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 31. EDUCATION TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 32. BUSINESS TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 33. FAMILY TRAVELERS MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 34. GLOBAL TRAVEL INSURANCE MARKET, BY REGION, 2023-2030, MILLION USD

FIGURE 35. NORTH AMERICA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 36. NORTH AMERICA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 37. NORTH AMERICA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 38. NORTH AMERICA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 39. NORTH AMERICA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 40. NORTH AMERICA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 41. NORTH AMERICA TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

FIGURE 42. U.S. TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 43. U.S. TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 44. U.S. TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 45. U.S. TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 46. U.S. TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 47. U.S. TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 48. CANADA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 49. CANADA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 50. CANADA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 51. CANADA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 52. CANADA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 53. CANADA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 54. MEXICO TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 55. MEXICO TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 56. MEXICO TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 57. MEXICO TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 58. MEXICO TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 59. MEXICO TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 60. EUROPE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 61. EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 62. EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 63. EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 64. EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 65. EUROPE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 66. EUROPE TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

FIGURE 67. UK TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 68. UK TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 69. UK TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 70. UK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 71. UK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 72. UK TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 73. GERMANY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 74. GERMANY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 75. GERMANY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 76. GERMANY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 77. GERMANY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 78. GERMANY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 79. FRANCE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 80. FRANCE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 81. FRANCE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 82. FRANCE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 83. FRANCE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 84. FRANCE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 85. ITALY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 86. ITALY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 87. ITALY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 88. ITALY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 89. ITALY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 90. ITALY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 91. SPAIN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 92. SPAIN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 93. SPAIN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 94. SPAIN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 95. SPAIN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 96. SPAIN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 97. DENMARK TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 98. DENMARK TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 99. DENMARK TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 100. DENMARK TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 101. DENMARK TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 102. DENMARK TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 103. NETHERLANDS TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 104. NETHERLANDS TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 105. NETHERLANDS TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 106. NETHERLANDS TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 107. NETHERLANDS TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 108. NETHERLANDS TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 109. FINLAND TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 110. FINLAND TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 111. FINLAND TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 112. FINLAND TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 113. FINLAND TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 114. FINLAND TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 115. SWEDEN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 116. SWEDEN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 117. SWEDEN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 118. SWEDEN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 119. SWEDEN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 120. SWEDEN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 121. NORWAY TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 122. NORWAY TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 123. NORWAY TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 124. NORWAY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 125. NORWAY TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 126. NORWAY TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 127. RUSSIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 128. RUSSIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 129. RUSSIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 130. RUSSIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 131. RUSSIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 132. RUSSIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 133. REST OF EUROPE TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 134. REST OF EUROPE TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 135. REST OF EUROPE TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 136. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 137. REST OF EUROPE TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 138. REST OF EUROPE TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 139. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 140. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 141. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 142. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 143. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 144. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 145. ASIA-PACIFIC TRAVEL INSURANCE MARKET, BY COUNTRY, 2023-2030, MILLION USD

FIGURE 146. CHINA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 147. CHINA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 148. CHINA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 149. CHINA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 150. CHINA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 151. CHINA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 152. JAPAN TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 153. JAPAN TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 154. JAPAN TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 155. JAPAN TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 156. JAPAN TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 157. JAPAN TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 158. INDIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 159. INDIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 160. INDIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 161. INDIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 162. INDIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 163. INDIA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 164. SOUTH KOREA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 165. SOUTH KOREA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 166. SOUTH KOREA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 167. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 168. SOUTH KOREA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD

FIGURE 169. SOUTH KOREA TRAVEL INSURANCE MARKET, BY END USER, 2023-2030, MILLION USD

FIGURE 170. AUSTRALIA TRAVEL INSURANCE MARKET, BY AGE, 2023-2030, MILLION USD

FIGURE 171. AUSTRALIA TRAVEL INSURANCE MARKET, BY INCOME LEVEL, 2023-2030, MILLION USD

FIGURE 172. AUSTRALIA TRAVEL INSURANCE MARKET, BY COVERAGE, 2023-2030, MILLION USD

FIGURE 173. AUSTRALIA TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2023-2030, MILLION USD

FIGURE 174. AUSTRALIA TRAVEL INSURANCE MARKET, BY DAYS OF COVERAGE, 2023-2030, MILLION USD