U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

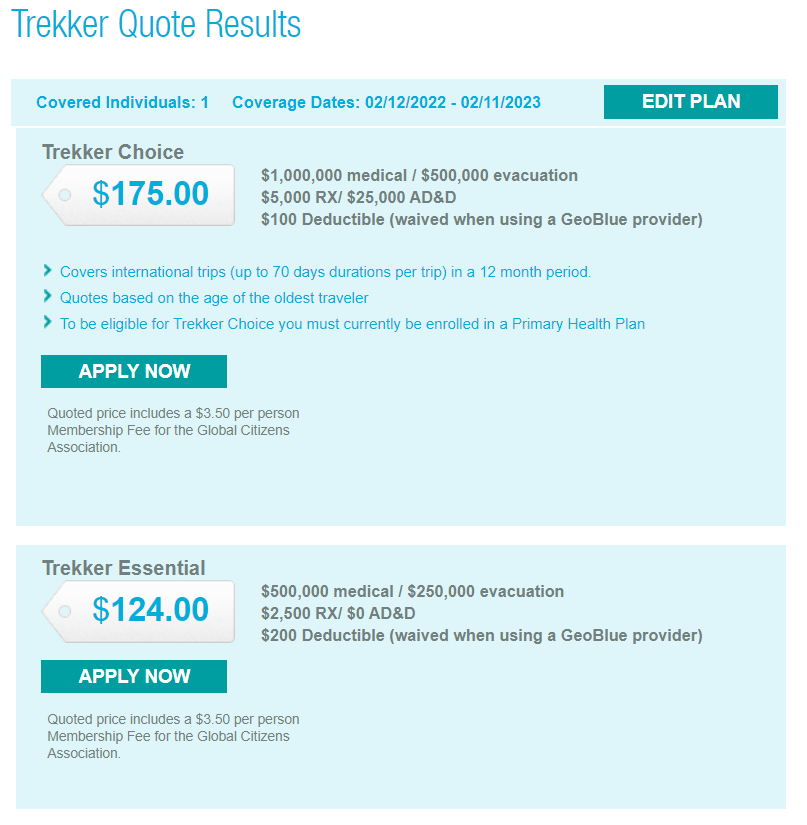

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

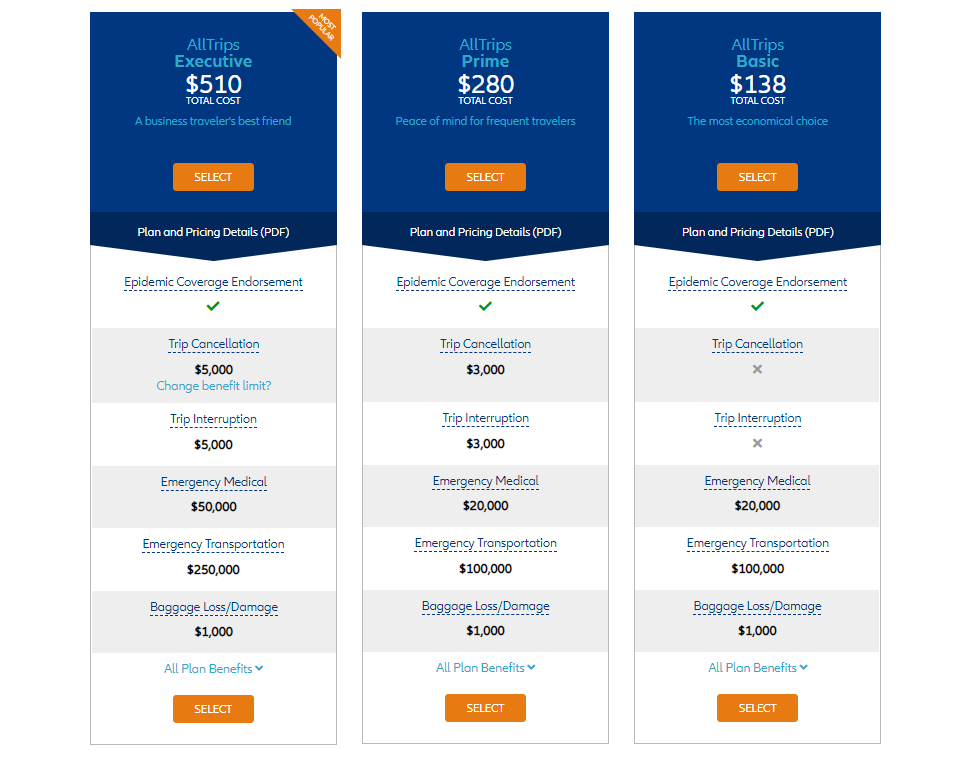

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

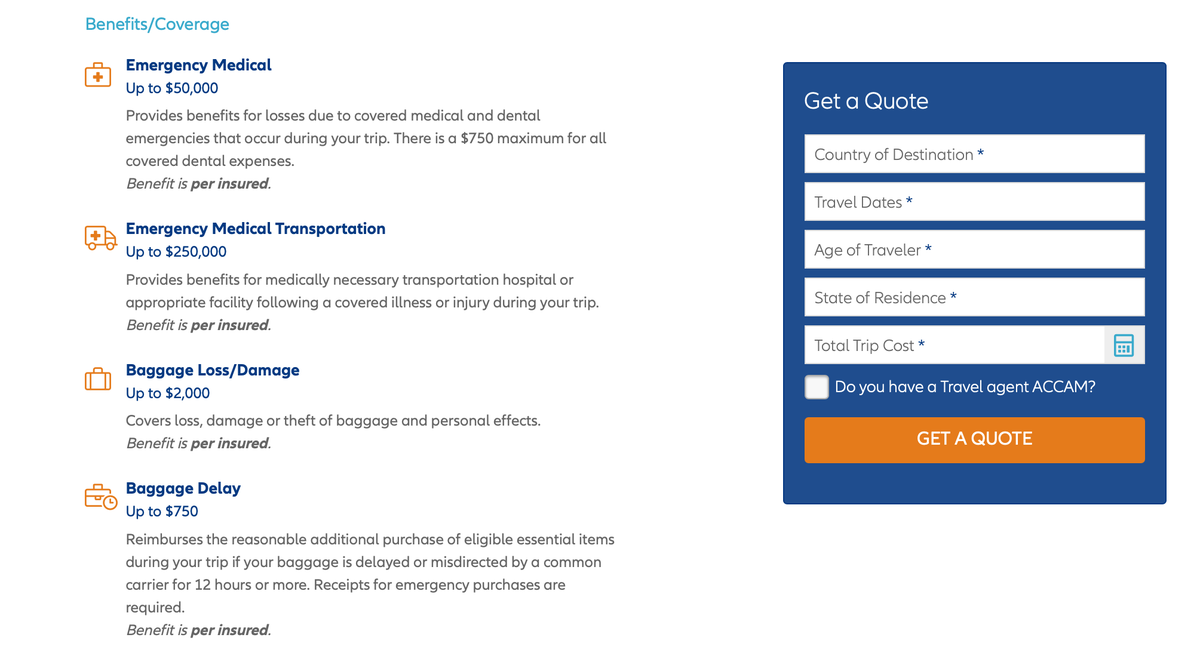

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Local Food Experiences

- Local Accommodation

- Travel Insurance

- Travel Books

- Travel Gear

Is Pay Monthly Travel Insurance Right For You? 6 Perks Of Flexible Travel Insurance

- Post category: Travel Blog / Travel Gear

Wondering if you should pay monthly travel insurance or make a large purchase upfront before your trip? This article will give you some insight into flexible travel insurance, especially the perks that come with it.

By now, most travelers surely realize how crucial coverage is when going on adventures. Not only do you get peace of mind, but protection against unforeseen circumstances or unexpected issues.

Don’t have time for a deep dive and want to get started right away? Check out my personal favorite – SafetyWing – great for short trips (you can set specific dates) and ideal for longer-term travelers like backpackers or nomads. Get a quote here.

Pay Monthly Travel Insurance Perks

✔️Ideal for those who prefer to manage their finances by spreading out costs.

✔️Ensures you remain protected throughout your travels without the need to remember renewals.

✔️Provides the flexibility to cancel your policy without penalties, making it perfect for unpredictable travel plans.

✔️Offers extensive coverage that includes medical emergencies, lost luggage, leisure sports injuries, motor accidents, emergency flights home, travel delays, and more.

Disclaimer: This site contains affiliate links that will cost you nothing extra but offer me a little commission for any purchases made. This helps me continue to offer helpful tips. Thank you for your support.

1. Budget-Friendly Payments

If you want to be covered as soon as possible but aren’t keen on a huge upfront investment, paying monthly travel insurance is a great option. For traveling, sometimes it is unavoidable that you have to pay large sums, for an expensive flight or a hefty tourist attraction.

Doing budget-friendly monthly travel insurance is a great option to keep costs low while still prioritizing safety. Paying monthly also ensures that travel insurance is more accessible to different types of travelers – which is a win in my book!

2. Continuous Coverage

We live in a fast-paced world and even when we try to slow down, things tend to fall through the cracks. When you’re traveling this can be even worse because being immersed in a new culture can take a lot of your mental space.

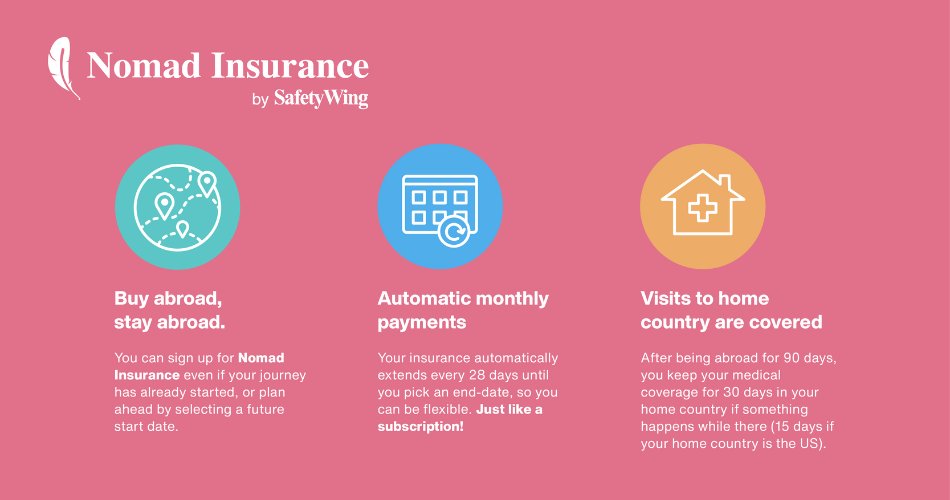

The last thing you want to worry about is whether your insurance is still covering you now that you’ve arrived in this new destination. Paying monthly travel insurance means that there are no gaps in protection.

When you have an automatic reveal of monthly travel insurance – it’s just one less thing to remember. This is most ideal for those going beyond a typical vacation stay of one or two weeks where you stay in the same place.

Usually, it suits backpackers and nomads, who stay abroad for longer periods , anywhere from 2 weeks to months or years!

3. Cancel Anytime Policy

Flexibility is freedom and freedom is flexibility… at least to me. With the rise of a nomadic life, many other feels the same.

Having a cancel-anytime policy with your monthly travel insurance is one of the most important features you should look for in a company.

Being able to cancel at any time without penalties is vital. Don’t get the risk of being locked into a policy that may no longer be needed or suitable.

4. Comprehensive Protection

When I say comprehensive – it means more than just including certain things with specific $ amounts in coverage.

Do you know that some travel insurance won’t provide coverage if you don’t have a return/round trip ticket?! Another common issue is that travel insurance companies may not cover you if you have already left on your trip.

Maybe 30 years ago that would make sense, but in this day and age, so many travelers need to purchase after leaving their country or take one-way flights. For many reasons – whether it’s a cheaper price or they need flexibility.

Having comprehensive monthly travel insurance is crucial in these situations for long-term travelers – especially because they are often more likely to book one-way and last-minute flights.

To help you as you looking for the best monthly travel insurance – keep these standard coverage features in mind. If you’re paying monthly travel insurance it should include these:

(PS, these are from my favorite insurance company – SafetyWing )

✔️ Medical Coverage While Abroad

- General Medical Treatment : Coverage includes hospital stays, nursing care, ambulance transportation, diagnostics (e.g., MRIs), extended post-hospital care, prescriptions, and emergency dental (up to $1,000).

- Coverage Limit : Up to $250,000.

- Evacuation : Coverage for evacuation to a better-equipped hospital, up to $100,000 lifetime max.

✔️ Lost Checked Luggage

- Per Item : Up to $500.

- Per Policy : Maximum of $3,000.

✔️ Injuries from Leisure Sports & Activities

✔️ motor accidents.

- Conditions : Coverage if properly licensed, wearing safety equipment, and not intoxicated.

✔️ Flights Home for Emergencies

- Coverage : Up to $5,000 for flights home due to events like a death in the family.

✔️ Travel Delay

- Meals & Accommodations : $100 per day for up to 2 days if the delay exceeds 12 hours.

✔️ Visits Back Home

- Coverage Duration : 30 days (15 days for US residents) for every 90 days of travel abroad.

✔️ Death Benefits

- Transporting Body Home : Up to $20,000.

- Local Burial : Up to $10,000.

✔️ Policy Maximum Limit

- General : Up to $250,000.

- US Residents Over 65 : Up to $100,000.

- Not Covered : High-risk or professional sports, pre-existing conditions, cancer treatment, lost or stolen personal belongings, and trips cancelled before departure.

GET YOUR FREE VOLUNTEERING QUIZ

Join my exclusive email list & receive a quiz to see if you should volunteer abroad through cultural work exchanges!

PS volunteering means you get free food & accommodation!!

By clicking to submit this form, you acknowledge that the information you provide will be processed in accordance with Maptrekking Privacy Policy.

I have successfully sent your volunteering quiz.

Can’t find it? Make sure to check your spam folder!

5. Customizable Coverage

Thankfully, when paying monthly travel insurance, you can somewhat customize your coverage! This will help you to fit your individual travel needs properly. Some that SafetyWing offers a few – one being an adventure sports add-on.

This includes things like kite-surfing, parachuting, paragliding, skydiving, scuba diving, etc. The adventure sports add-on does not include expeditions, or professional, organized or rewarded sports.

They also have an electronic add-on, for devices like laptops, tablets, and cameras, which can be applied with policies of at least 28 days.

You can get up to $1000 per stolen item and there is a yearly limit of $3000 per policy – you must also have proof of purchase, like a receipt for the device.

6. Easy Claims Process

Heaven forbid that something unfortunate happens, but in case it does, you need to know how complicated or easy it will be to file a claim with whatever insurance company that you go with.

The claims process should be easy and only take a few minutes. For SafetyWing, you will need:

- Your medical report

- Any medical invoices outlining what you paid

- Any relevant receipts

- Your bank account information

Maybe you have a unique situation and need to ask some questions. Contact SafetyWing’s 24/7 human customer support to get help. You can contact them at [email protected] .

Final Thoughts On Pay Monthly Travel Insurance

Choosing the right travel insurance is a critical part of planning any trip. Deciding between paying monthly or making a large upfront payment can significantly impact your budget and peace of mind.

Pay monthly travel insurance options offer numerous perks, especially for those who travel frequently or for extended periods. The main question to ask yourself is, would paying monthly be more convenient for your particular lifestyle?

Why SafetyWing?

For those who need a reliable option, SafetyWing is a great choice for both short trips and long-term travel. They offer customizable coverage, easy claims processes, and 24/7 customer support.

SafetyWing’s comprehensive protection includes various add-ons, such as coverage for adventure sports and electronics, ensuring that you can tailor your policy to meet your specific travel needs.

Don’t forget to check out these tips for finding working abroad travel insurance and these awesome slow travel destinations in Europe .

You Might Also Like

10 Epic Hostel Jobs In Scotland – Best Way To Get Free Accommodation In Scotland

Living Abroad At Christmas (6 Amazing Tips On How To Celebrate)

Vale La Pena Worldpackers? Lo Que Debes Saber Antes De Registrarte

- House Sitting

- Worldpackers

- Slow Travel

- Cultural Travel

- Living Abroad

- Travel Gifts

- Travel Stories

- Work With Me

- Privacy Policy

- Stuff I Love

- Start Blogging

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Buying the Best Travel Medical Insurance for You [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3376 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![pay monthly travel insurance with medical conditions Buying the Best Travel Medical Insurance for You [2024]](https://upgradedpoints.com/wp-content/uploads/2020/12/Travel-Medical-Insurance.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

What is travel medical insurance, what does travel medical insurance cover, what doesn’t travel medical insurance cover, what travel medical insurance isn’t, how does travel medical insurance work, how much does travel medical insurance cost, which company has the best travel medical insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The thought of getting sick or injured while traveling can be one of the most stressful aspects of planning a trip. Often, travelers assume that their primary health insurance will cover all costs of medical expenses on their trip, but not every health insurance plan covers every country and situation.

To ensure you have coverage if you need it, you may need to consider purchasing travel medical insurance. This can fill the gap between your regular insurance and any coverage you may have with your credit cards . We’ll break down all of the important details and tell you everything you should know about travel medical insurance.

If you are traveling domestically within your own country, you will likely be covered by your primary health insurance. If you are traveling abroad, your coverage may not extend to those other countries. This is primarily where travel medical insurance comes into play.

Travel medical insurance is a type of international insurance designed to cover emergency health care costs you might face when you are traveling or vacationing abroad.

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.

Bottom Line: Travel medical insurance is recommended by the U.S. Department of State, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO).

According to Allianz Travel, the most common overseas medical emergencies that are claimed include:

- Fractures from falls

- Cardiovascular problems such as a heart attack or stroke

- Trauma involving motor vehicles

- Respiratory problems such as a collapsed lung

So going with that first item, let’s say you’re exploring Europe and end up twisting your ankle on the beautiful, but uneven cobblestone streets in Rome. Depending on the plan you choose, you may be covered for:

- The cost of a local ambulance to transport you to the hospital

- Your emergency room co-payment

- The bill for your hospital room and board

- Any other eligible medical expenses, up to your plan limits

But there are limitations to travel medical insurance. Before you purchase a plan, it’s important to know exactly what you are buying — including which things are and aren’t included in your coverage.

Travel medical plans are designed to help in the event of an unforeseen illness or injury while traveling abroad. Travel medical insurance offers emergency medical expense coverage as well as emergency evacuation coverage. This means that the plan will reimburse you for reasonable and customary costs of emergency medical and dental care (up to the plan limits — discussed below).

It is important to look closely at all plans you are interested in since many important things are hidden in the details. You might also find it helpful to brush up on your insurance lingo before doing this.

Plan Limits

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000. This is obviously a HUGE range, so you will have to determine the correct amount of coverage based on a few key items:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country? As we discussed above, Medicare doesn’t cover you at all outside of the U.S., so this would be an instance where you might want your plan’s coverage limit to be higher.

- How long is your trip? If you’re going to be away for more than 1 to 2 months, you might want a higher plan limit to account for the greater exposure to risk.

- Do you need extra coverage due to risky activities? For example, if you expect to ski, mountain climb, or do any other risky activities where you might get injured, you might want a higher plan limit.

- What do you feel comfortable with? If you feel safer having $100,000 as opposed to $50,000, then that may be the right decision for you. This insurance plan should provide you a sense of security so you can enjoy your trip.

- Deductibles

Most medical single trip plans have some sort of deductible that you must pay before any benefits will be paid. After this, your travel medical insurance will cover any remaining costs, up to the plan’s limit.

However, you will be offered the option to increase, decrease, or remove the deductible altogether. Based on this choice, the price you pay (aka the premium) will be affected accordingly. For example, if you choose a higher deductible, your premium will decrease. If you choose a lower (or no) deductible, your premium will increase.

Length of Trip

You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types:

Single-Trip Coverage

This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip. While on your trip, you can still visit multiple countries and destinations all under the umbrella of this single trip. You will be covered for the duration of this trip under a single trip travel medical insurance plan.

Multi-Trip Coverage

Multi-trip coverage is for multiple trips and often purchased in 3-, 6-, and 12-month segments.

Long-Term Coverage

This is continuous medical coverage for the long-term traveler (think expats or people working abroad) and is typically paid on a monthly basis.

Does Travel Medical Insurance Cover COVID-19?

Many travel insurance policies offer good medical coverage, but not all plans cover expenses related to COVID-19 . If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract COVID-19.

In general, cancellations due to fear of travel are not covered. However, some plans cover you if you or your covered traveling companion were to become sick as a result of COVID-19. This means that you could still receive benefits for the losses that are covered by the plan.

Many countries around the world , such as Costa Rica and the United Arab Emirates, are even requiring travelers to hold a specific level of medical coverage to account for COVID-19-related medical care and evacuation.

In addition, “ Cancel for Any Reason ” has become a hot topic. This optional coverage is not available with all plans but lets you cancel a trip for a partial refund no matter what your reason — including unexpected travel bans, lengthy quarantine periods, or cancellations due to concerns over COVID-19.

Since travel medical insurance is meant to cover emergencies, certain types of expenses are excluded from most travel medical policies. In addition, for insurance purposes, a pre-existing condition is general defined as any condition:

- For which medical advice, diagnosis, care, or treatment was recommended or received within a defined period of time prior to your coverage date (varies from plan to plan, but is typically within 60 days to 2 years)

- That would cause a “reasonably prudent person” to seek medical advice, diagnosis, care, or treatment prior to your coverage date

- That existed prior to your effective date of coverage, whether or not it was known to you (commonly includes pregnancy)

Hot Tip: You do not need a medical examination in order to purchase travel insurance. If you have a claim, the insurance company will investigate to ensure that your claim occurred during the coverage period of your policy and wasn’t a result of any pre-existing conditions.

Here are some of the most frequent exclusions:

- Pre-existing conditions as defined above

- Routine medical examinations and care (i.e. wellness exams, ongoing prescriptions, etc.)

- Routine prenatal, pregnancy, childbirth, and post-natal care

- Medical expenses for injury or illness caused by extreme sports

- Mental health disorders

- Injury caused by the effects of intoxication or illegal drugs

- Payments exceeding the plan limit

Unless you’ve purchased a comprehensive travel insurance plan, other exclusions include claims related to:

- Trip cancellation

- Lost luggage

- Rental car damage

Be sure to read the description of coverage for any plan you’re considering before you make the purchase. While reading the entire document front to back can be tedious, it’s better to know what’s excluded before you attempt to make a claim.

Now that we’ve let you know what is and isn’t covered by travel medical insurance, we’ll also breakdown the difference between travel medical insurance and other similar options.

Comprehensive Travel Insurance

Comprehensive travel insurance plans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Some comprehensive plans also offer additional coverage for things like rental car damage, Cancel for Any Reason, or a pre-existing condition waiver.

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip.

Health Insurance

You might be thinking that already have medical insurance provided by your employer or through Medicare. However, when you travel to other countries, your primary health insurance might not go with you. Before your trip, check to see whether your domestic plan provides any coverage once you’ve left your home country since many offer limited or no coverage.

In case of a medical emergency, you will want to be able to lay your hands quickly on your travel insurance plan’s contact information for the 24-hour Emergency Assistance program as well as your policy number, so make sure to keep this information somewhere that is easily accessible. Also, be sure you know how to place a call to that number from outside the country.

This is important because you’ll be required to call your travel insurance provider and notify them that you need to be seen by a medical professional as soon as possible. Obviously, you may not be medically able to call before you seek emergency medical treatment, but you should do so as soon as you are able to.

The earlier you can call, the more likely it is that you can avoid any issues for payment of claims and you can also get help and advice from the company’s emergency assistance program.

Bottom Line: Specific details on when and how to contact your insurance provider in case of a medical emergency vary by plan and provider, so thoroughly review these details in your plan information.

For example, in the event of an emergency that requires emergency medical evacuation, your insurance provider will have to approve the evacuation and even make those arrangements for you. If you don’t call ahead to have them do this, the company may not approve the expense and you may be stuck paying for the evacuation in full.

Once you are actually at a medical facility to receive care, make sure to document the experience as thoroughly as possible. This means asking for copies of all of your records before you check out. You’ll need to provide these records to the insurance company when you eventually file your claim and having proof of treatment and costs will assist you in filing a successful claim and getting your money back as soon as possible.

Travel medical insurance plans can vary widely in price, but in general, plans cost anywhere between 4-10% of your total non-refundable trip cost. The pricing of any plan takes into consideration many things, including a few that we discussed above, to determine the cost. These include:

- Age of travelers

- Plan limits

- Supplemental plans such as “Cancel For Any Reason” coverage or coverage for pre-existing conditions

- Length of trip

In addition, if you decide that a comprehensive plan is a better choice for you, this will also increase the price.

The best travel medical insurance company for you may be determined by what type and how much coverage you’d like to have. Let’s review a few options and companies to consider.

Credit Card Coverage

Many premium cards have some medical coverage, so be sure to look over all of the best credit cards for travel insurance coverage and protection.

For example, cardholders of The Platinum Card ® from American Express may already have $15,000 of secondary medical coverage . For many, this may be enough, but for others, you may not feel comfortable at this level of coverage and want to purchase a travel medical insurance policy.

Travel Medical Insurance Policies

If you are looking to purchase a plan from a reputable company, a few options include:

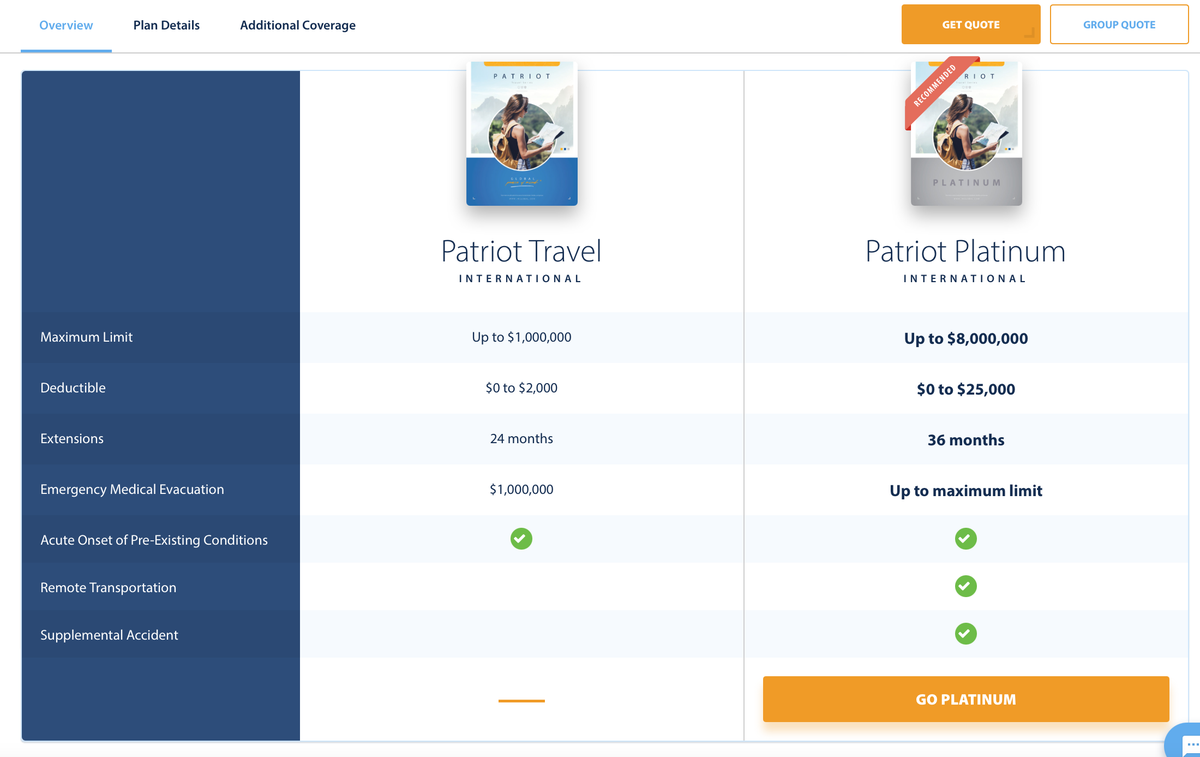

1. Patriot Travel Medical Insurance from IMG Global

For the out-of-country plans, Patriot offers:

- Short-term travel medical coverage

- Coverage for individuals, groups, and their dependents

- Daily or monthly rates

- Freedom to seek treatment with the hospital or doctor of your choice

The following plans are available based on the level of coverage that you desire and you can request a quote through their website linked above.

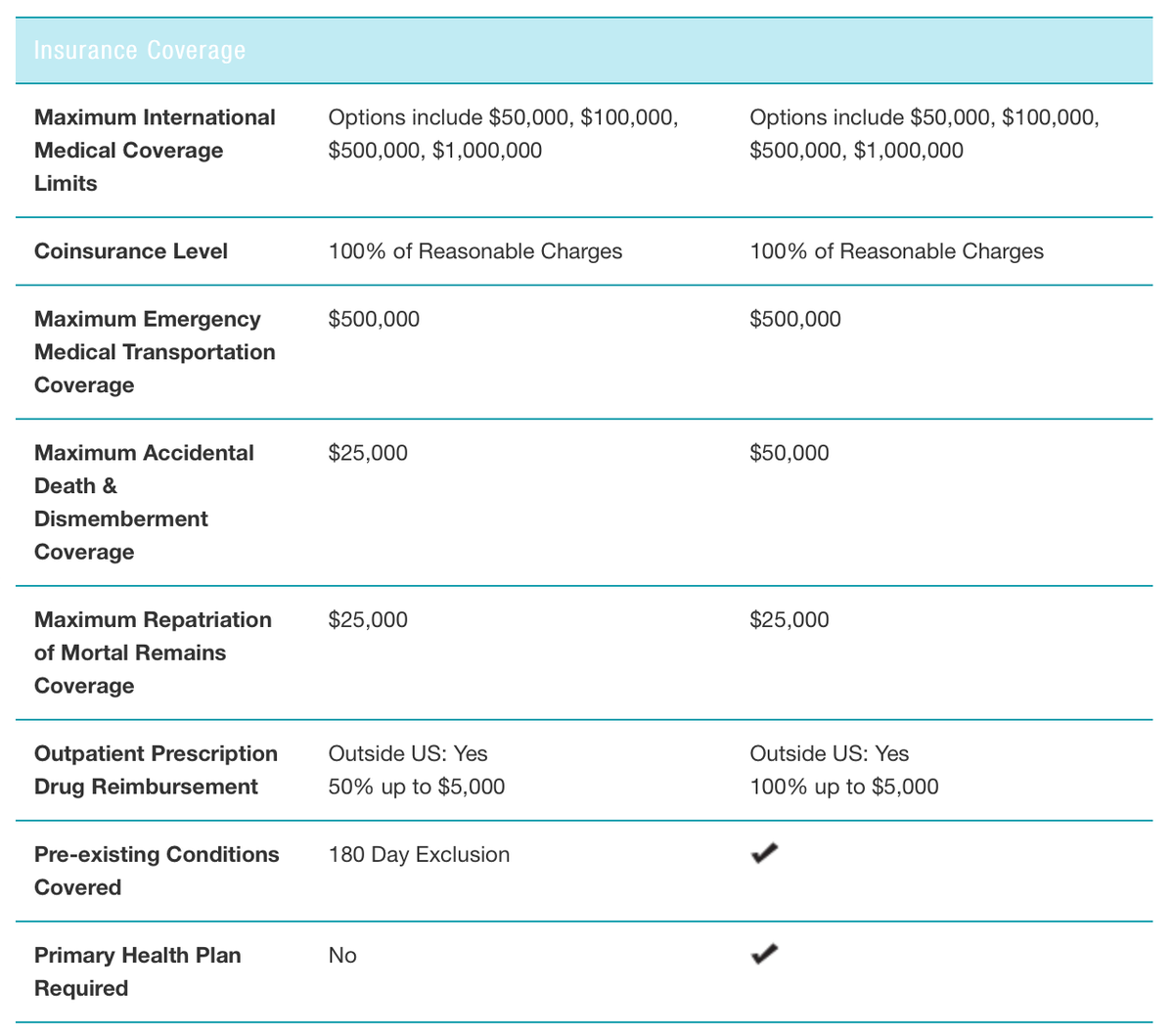

2. GeoBlue Single Trip Traveler Medical Insurance

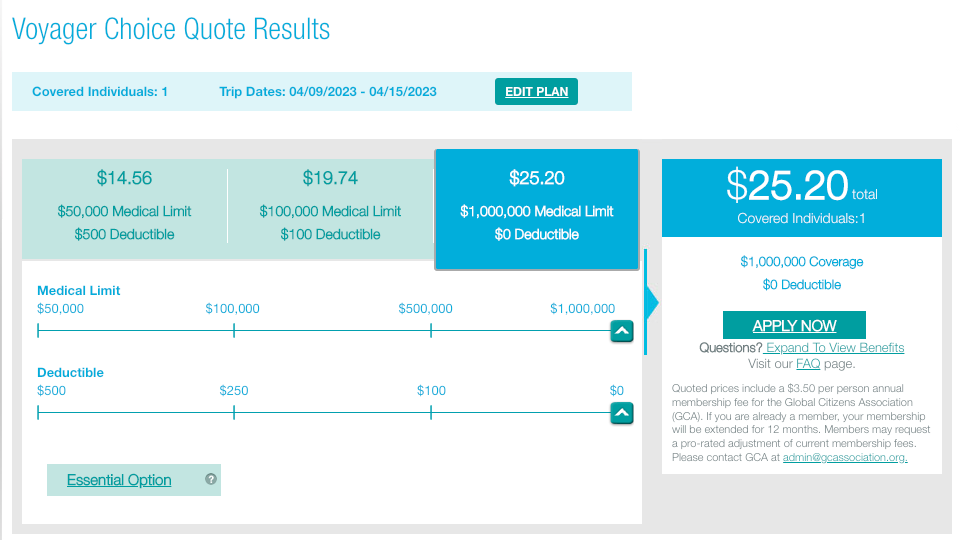

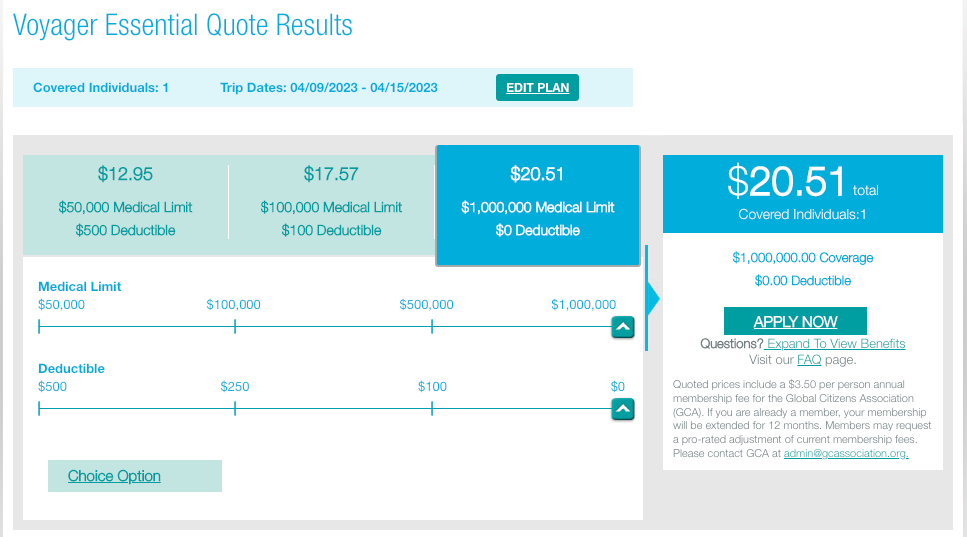

GeoBlue offers both the “Voyager Choice” and “Voyager Essential” single trip plans. Both plans allow you to choose your level of medical coverage (from $50,000 up to $1 million) and offer $500,000 in emergency medical transportation and repatriation coverage.

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

3. Allianz Travel Medical Insurance

Allianz offers an Emergency Medical plan that offers additional benefits that extend beyond simply medical coverage. This plan is a comprehensive plan that covers lost baggage and trip cancellation and delay, in addition to emergency medical coverage. See just a few of these benefits below:

In addition, many companies, such as AAA, offer travel insurance through Allianz, so you may receive a further discount if you reference your AAA policy.

Travel medical insurance can be beneficial for most travelers when traveling internationally as most primary health insurance plans won’t cover you abroad. We hope we’ve given you the tools you need to select a plan that works best for you and your travel needs.

At the end of the day, a travel medical plan is a great option if you’re traveling abroad and are not worried about covering trip costs due to a cancellation or added expenses due to a travel delay. Anyone looking for robust coverage for baggage or interruption should consider an upgrade to a more comprehensive plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

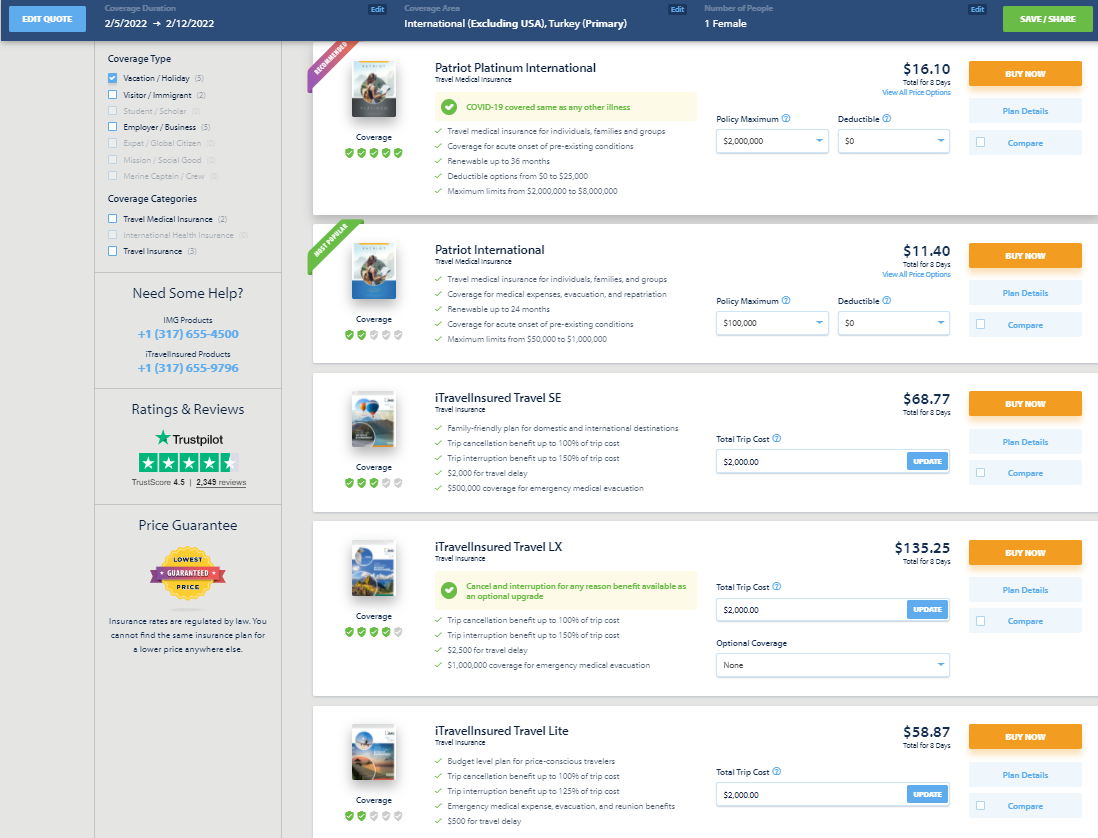

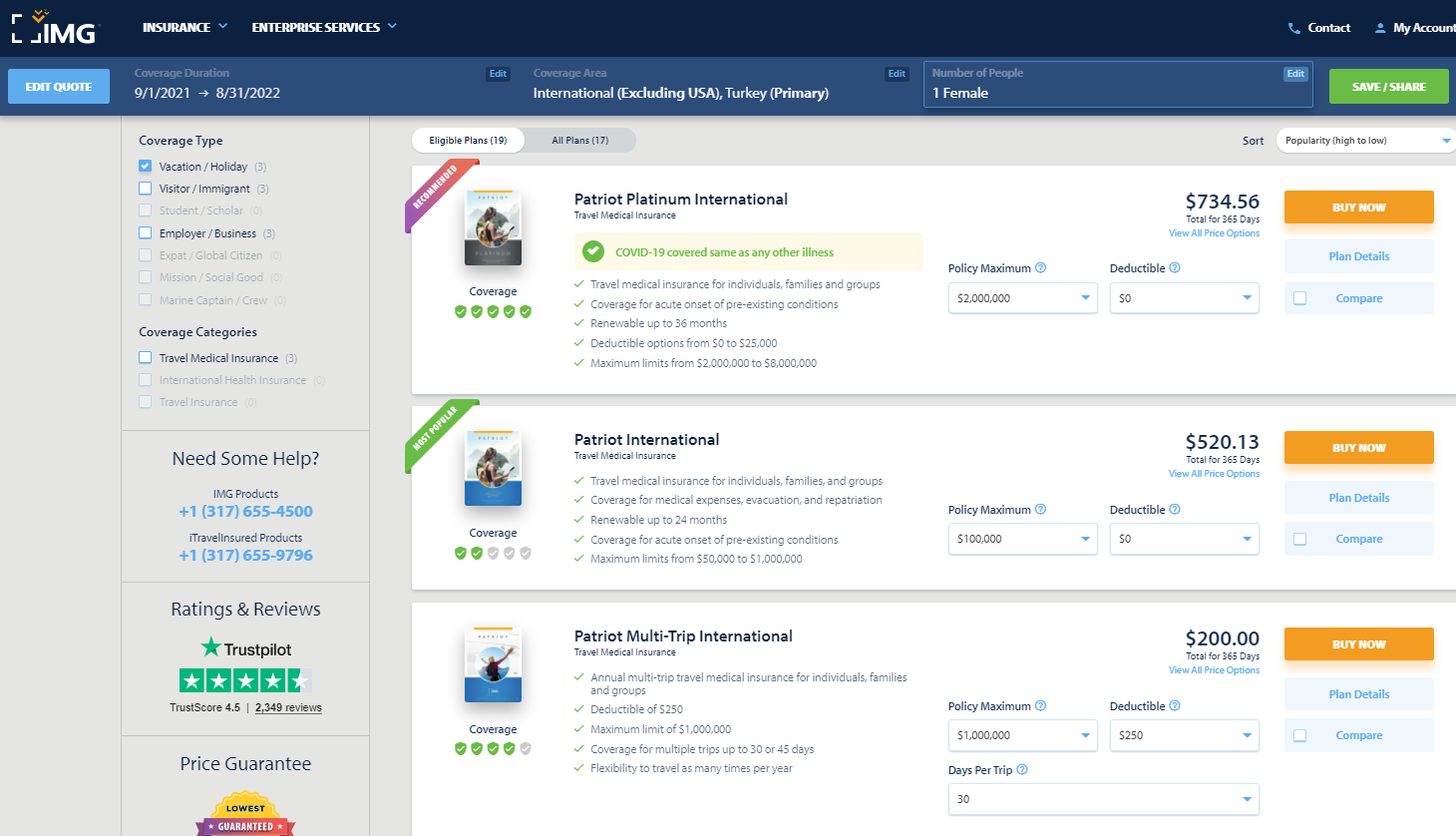

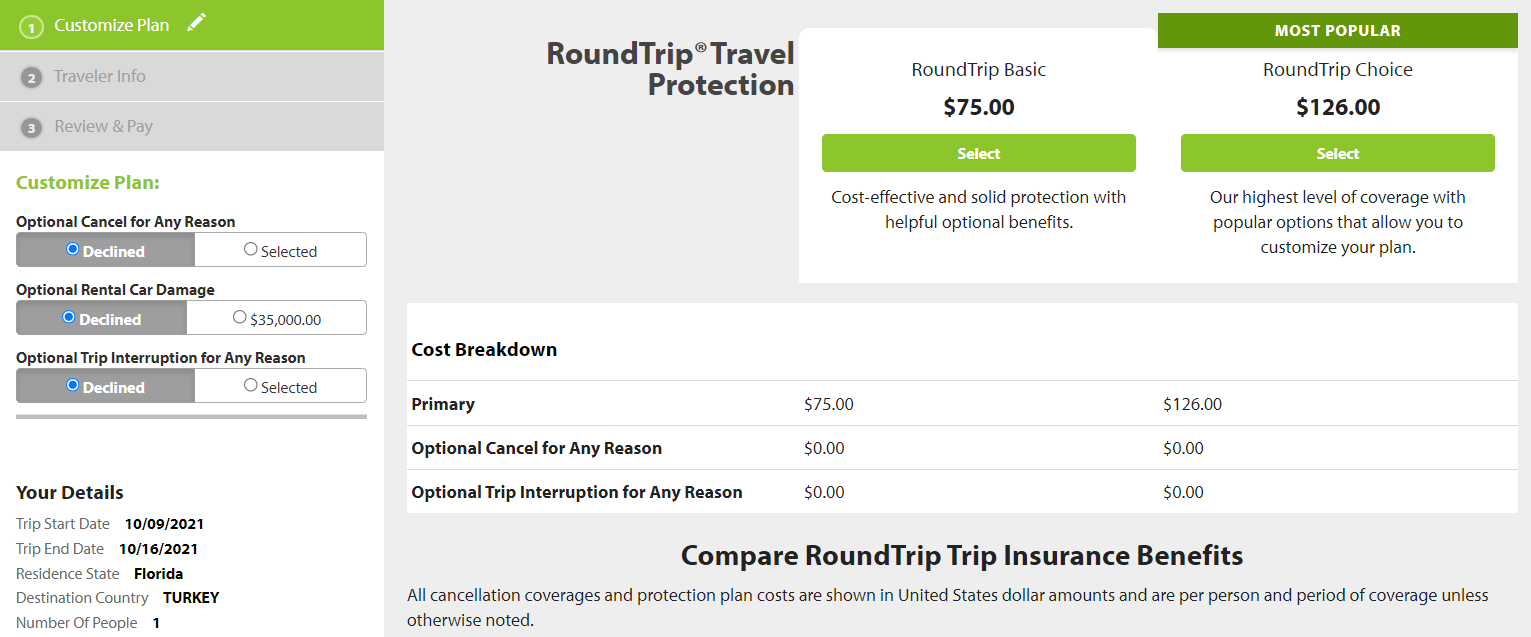

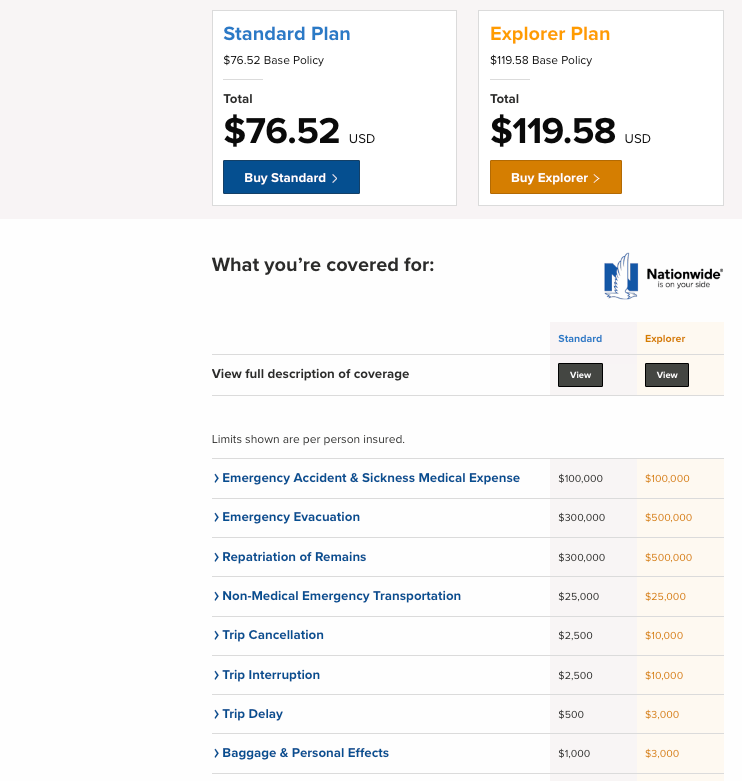

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

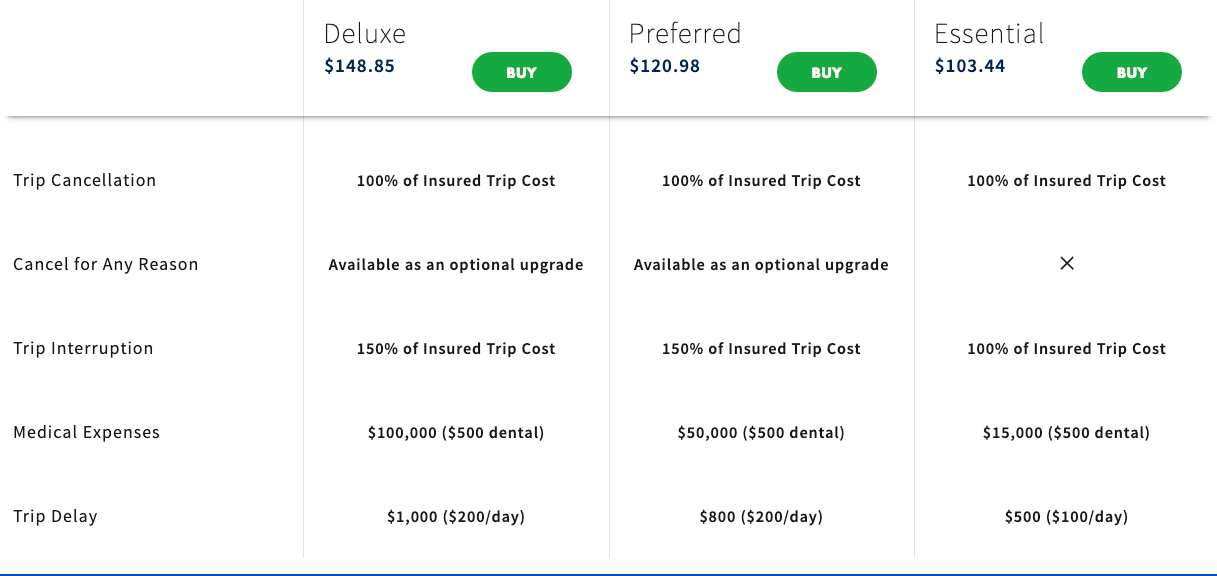

AIG Travel Guard

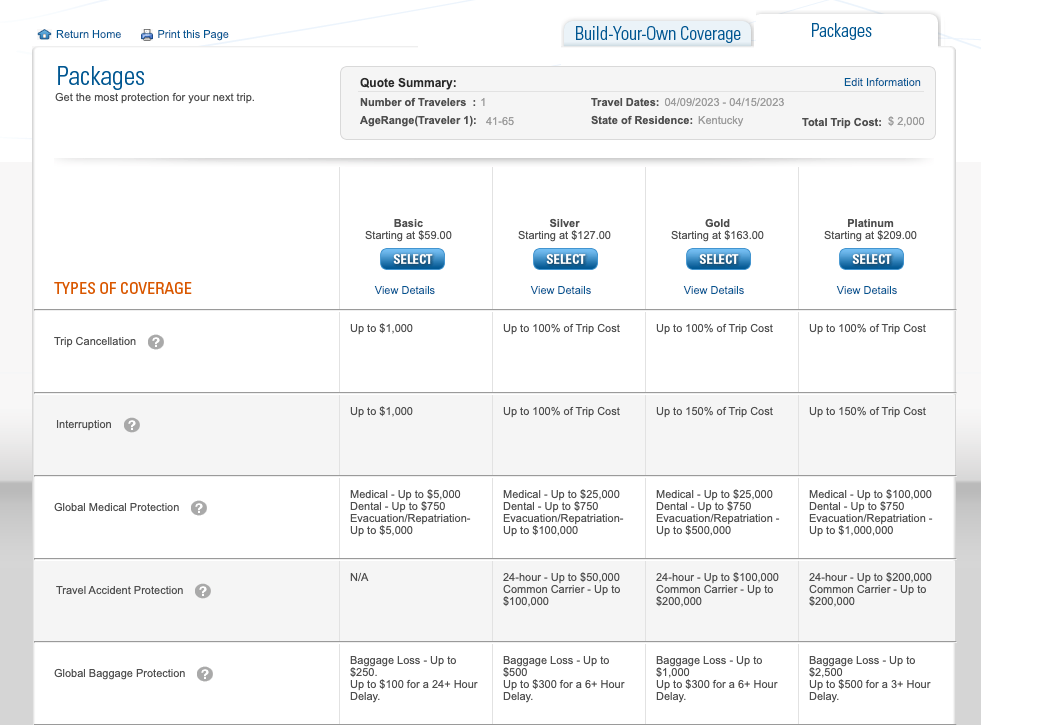

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

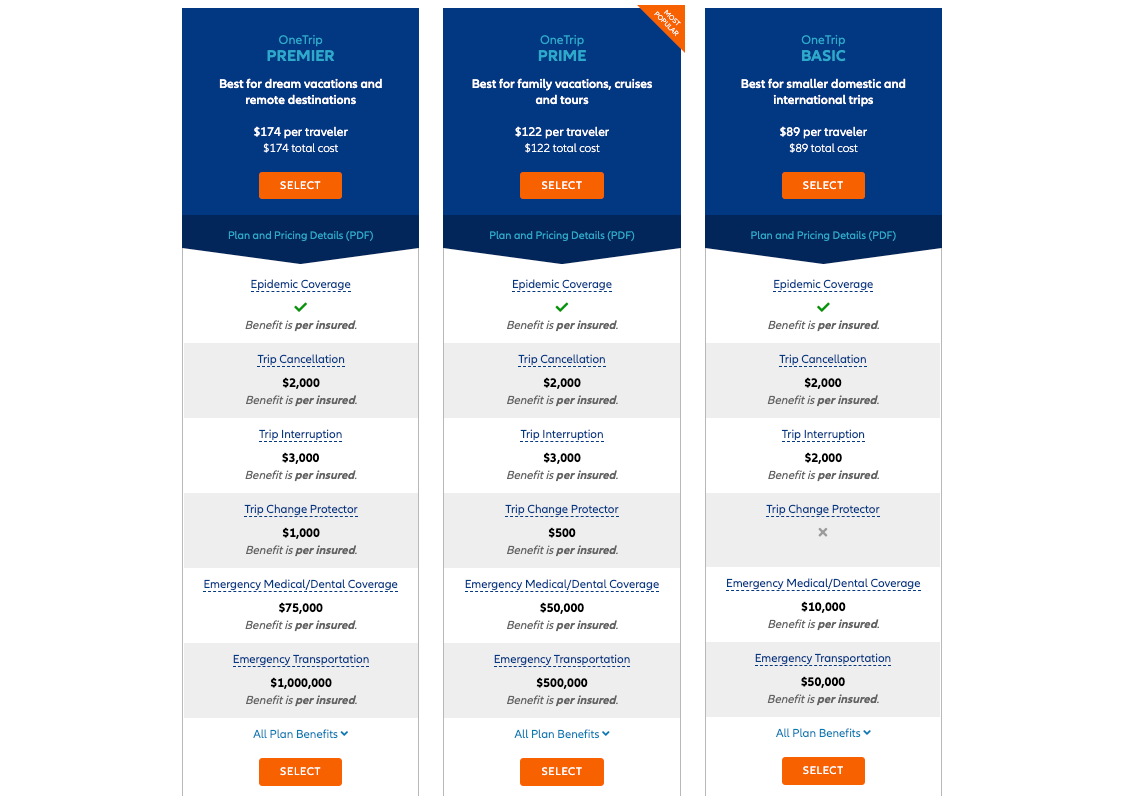

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

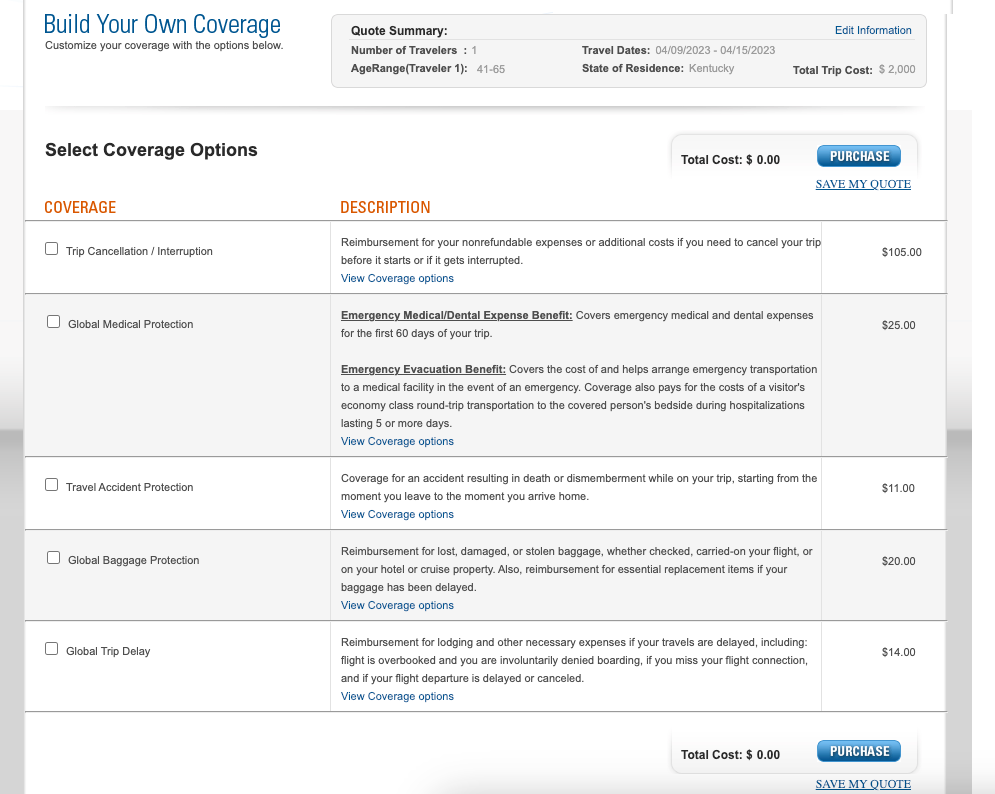

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

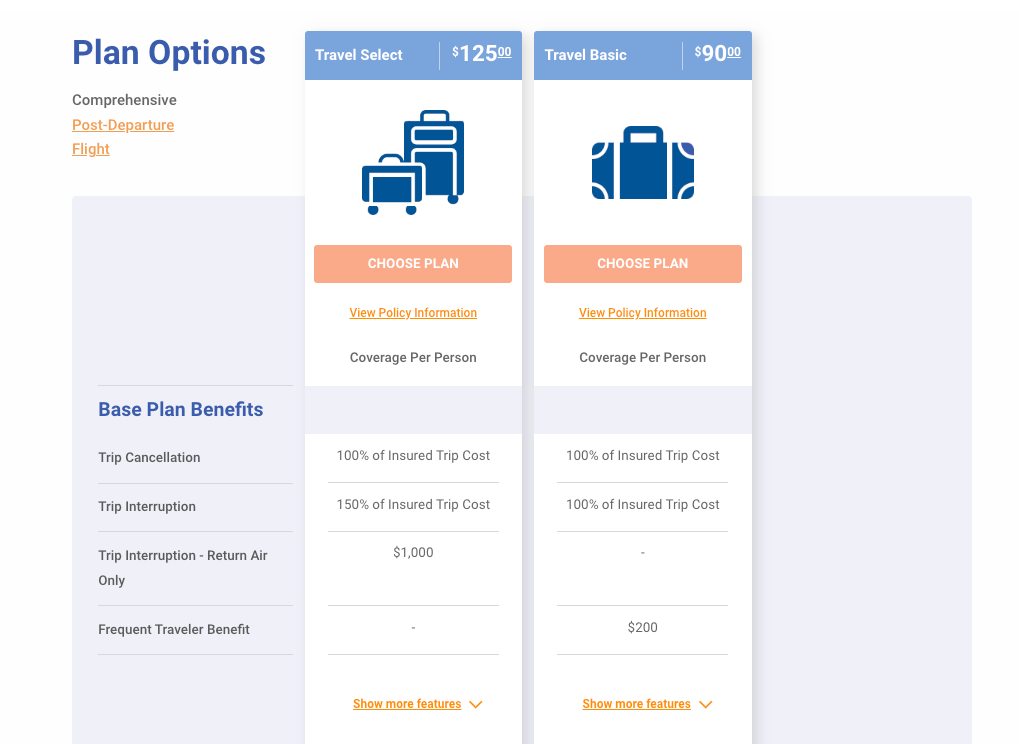

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

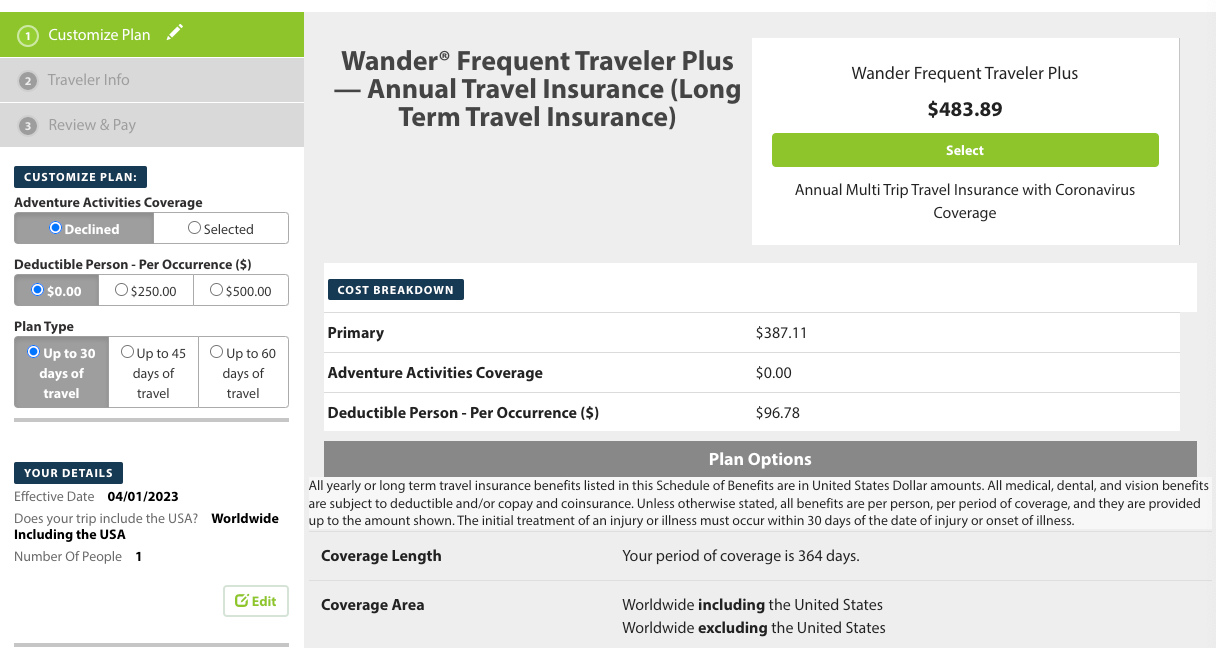

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Travel medical insurance 2024: Your emergency coverage policy

Lizzie Nealon

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:16 a.m. UTC Nov. 13, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- Travel medical insurance pays for emergency medical expenses if you get sick or injured while on a trip.

- This coverage is especially important if you are traveling outside of the country because your U.S. health insurance may provide little to no coverage abroad.

- The average price for a travel medical insurance policy is about $100 for a 20-day trip.

More than a third (39%) of travelers who have traveled internationally in the past five years have experienced medical issues abroad, according to a GeoBlue survey of 2,086 Americans conducted by Harris Poll. When asked how they’d cover medical expenses if they got sick or injured while on an international trip, nearly half (46%) of all respondents expected their domestic health insurance would cover them abroad, but that is often not the case.

Travel medical insurance can help bridge a gap in health care coverage, especially when traveling outside the U.S.

Compare the best travel insurance offers

Travel insured.

Via TravelInsurance.com’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

RoundTrip Basic

$500,000/$1 million

What is travel medical insurance?

If you get hurt or sick on a trip, travel medical insurance can help cover the cost of your emergency medical treatment. This coverage pays for ambulance services, doctor and hospital bills and prescription medicine.

Travel medical insurance is a health insurance policy that covers the cost of “reasonable and customary” emergency medical expenses that require treatment by a physician during a trip, up to your policy limit.

You can buy travel medical insurance as part of a comprehensive travel insurance plan or as a standalone policy.

How much travel medical insurance do you need?

Squaremouth, a travel insurance comparison site, recommends buying at least $50,000 in emergency medical coverage for international travel. For travelers going on a cruise or to a remote destination, the site recommends at least $100,000 in coverage.

“The most common claims we see on our travel products, both consumer-purchased travel medical insurance and employer-sponsored business travel medical insurance, are for conditions like viral infections which has been particularly high in recent years because of COVID, pain (abdominal, chest, or joint), anxiety, diarrhea, rash or cough,” said Lynn Pina, chief marketing officer of GeoBlue. “These claims typically average around $435 USD.”

Pina added, “Less frequently we see claims for broken bones, cardiac arrest or stroke with costs averaging between $15,000 and $30,000, but could range as high as $300,000 or more.”

What does travel medical insurance cover?

Travel medical insurance typically covers the following if you need emergency medical treatment while on a trip:

- Ambulance service.

- Doctor and hospital bills.

- Emergency medical expenses such as X-rays needed for a broken leg.

- Emergency dental expenses.

- Prescription medication.

Most travel medical insurance plans offer 24-hour emergency assistance. If sick or injured, you can call the helpline to facilitate emergency care and communicate with medical personnel about your condition. This is particularly helpful if you’re in a foreign country and don’t speak the language.

What does travel medical insurance not cover?

While exclusions vary by plan, most travel medical insurance policies will not cover emergency medical expenses related to:

- Extreme sports, such as skydiving and bungee diving.

- Intoxication and drug use.

- Mental or psychological disorder.

- Normal pregnancy and childbirth.

- Preventative or elective care such as a teeth cleaning or fertility treatment.

- Pre-existing conditions, except those waived under a pre-existing medical condition waiver.

- Routine physical exams or dental care.

Pre-existing medical condition exclusion waiver

Most travel insurance plans exclude coverage for pre-existing medical conditions, but this exclusion might be waived if certain conditions are met.

To qualify for a pre-existing medical condition waiver, you typically need to buy your travel insurance policy within 14 to 30 days of making your first trip deposit. You are also usually required to insure the full nonrefundable cost of your trip, and be medically able to travel at the time of your departure.

If you meet the policy’s requirements, an illness or injury that happened before the effective date of your travel insurance policy will not automatically be excluded.

Some standalone travel medical insurance policies cover pre-existing conditions without a waiver.

Types of travel medical insurance

When buying travel medical insurance, pay attention to whether the emergency medical coverage is primary or secondary, to make sure your needs are being met.

Travel insurance vs. travel medical insurance

Travel insurance can include travel medical insurance and likewise, Pina said many travel medical plans also include trip interruption and lost luggage benefits.

“Travel insurance is designed to protect against the financial loss you’d experience should you need to cancel your trip or experience an interruption in your trip,” Pina explained. “These types of plans are commonly referred to as trip cancellation plans.”

“On the other hand, travel medical insurance is a health insurance policy that provides coverage for medical expenses should you need to seek care while traveling abroad,” said Pina. “GeoBlue consumer plans offer up to $1 million in coverage for less than $2 a day (subject to age and eligibility).”

Pina added, “If your prepaid trip costs for an international trip are for items that can be rescheduled, like airline tickets, consider a travel medical plan that provides coverage for medical expenses that will not be covered by your domestic health insurance.”

How to get travel medical insurance

You can typically buy a travel medical insurance policy up to the day before your trip.

To buy travel medical insurance, follow these steps.

- Decide how much coverage you want. The top-rated plans in our best travel insurance rating provide between $50,000 and $500,000 in emergency medical expense coverage.

- Choose a plan that meets your needs. Travel insurance comparison sites like Squaremouth allow you to enter details about your trip, then show you plan options from several companies. This is an easy way to compare prices and coverage options across several companies.

- Buy a policy. You can buy a policy online.

- Read your policy documents. Most travel insurance companies have a “free look” period, which allows you to return your policy for a full refund if you change your mind within that period. Take this time to read the details of your coverage and make sure it meets your needs.

Cost of travel medical insurance

The average cost of travel medical insurance is about $5 per day , according to data from Squaremouth. This average is based on policies purchased in 2023, for an average trip length of 20 days.