- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Selecting Allianz Travel Insurance at checkout is the easiest way to protect your investment, giving you more freedom to embrace your entire travel experience.

If you've already booked your flights, you can still find a plan to protect your trip.

- Let's fly

- Explore hotels

- Travel insurance

- Pride Flight

- Featured sales

- Sign up to V-mail

- Retrieve your Travel Bank details

- Change or cancel

- Upgrade options

- Redeem travel credits

- Disruption information

- Rapid rebook

- Flights to Sydney

- Flights to Melbourne

- Flights to Brisbane

- Flights to Perth

- Flights to Gold Coast

- Flights to Cairns

- Explore all destinations

- Flights to Bali

- Flights to Fiji

- Flights to Queenstown

- Flights to Tokyo

- Travel inspiration

- Destinations

- Sydney to Melbourne

- Sydney to Brisbane

- Melbourne to Sydney

- Melbourne to Brisbane

- Brisbane to Sydney

- Adelaide to Melbourne

- Perth to Melbourne

- Sydney to Bali flights

- Melbourne to Bali flights

- Brisbane to Bali flights

- Sydney to Fiji flights

- Melbourne to Fiji flights

- Brisbane to Fiji flights

- Travel agents

- Cargo services

- Airline partners

- Specific needs and assistance

- Flying with kids

- Group travel

- Travelling with airline partners

- Carry-on baggage

- Checked baggage

- Dangerous goods

- Baggage tracking

- Connecting flights

- Airport guides

- Transfer maps

- Cabin classes

- Onboard menu

- In-flight entertainment

- Get connected

- Health onboard

- Travel and entry requirements

- About the program

- Join Virgin Australia Business Flyer

- Partner offers

- Why choose Virgin Australia

- Other solutions

- Enquire now

- Transfer credit card points

- Points earning credit cards

- Earning points

- Redeeming Points

- Buying Points

- Velocity home

- Transferring Points

- Member benefits

- Shop using Points

- Shop to earn Points

- Velocity Wine Store by Laithewaite's

- How to use Points for flights

- Status membership

- Flight status

Travel insurance offers

Get domestic and overseas cover today and travel knowing you are protected with cover-more, 24/7 emergency assistance, instant quote, easy online claims, earn velocity points.

Silver, Gold and Platinum members earn a 50%, 75% and 100% bonus Points respectively on top of the base Points earned when purchasing your travel insurance through the quote generator.

Where are you flying from?

- London Heathrow

- Manchester International

- Inverness Airport

- Cardiff Airport

- Norwich Airport

- Humberside Airport

- London City Apt

- Belfast International

- Leeds Bradford Airport

- Bristol Airport

- Teesside Airport

Fly direct from London Heathrow with Virgin Atlantic during our seasonal service.

From 27th October 2024, Virgin Atlantic will operate daily flights to the Maldives.

Book your holiday today!

From 26th October 2024, Virgin Atlantic will operate daily flights to Dubai.

Our seasonal Virgin Atlantic service with up to 4 direct flights, will operate until the 19th May 2024.

Our seasonal direct service will recommence on the 28th October 2024.

Our Virgin Atlantic service operates on Mondays, Wednesdays and Sundays.

Flights include a short touchdown in Barbados.

Our Virgin Atlantic service operates on Tuesdays, Fridays and Saturdays until 29th March 2024. From the 2nd April, this service will reduce to Tuesdays and Saturdays.

Our seasonal service will recommence on the 29th October 2024, with flights operating on Tuesdays, Fridays and Saturdays

Our seasonal Virgin Atlantic service with up to 3 direct flights, will operate until the 11th May 2024. Flights will commence from 23 May 2024 - 24th October 2024 on Thursdays and include a short touchdown.

Our seasonal direct service will recommence on the 29th October 2024.

Daily direct flights from London Gatwick to New York with our partner airline, Delta, operates between 10th April and 26th October 2024.

Our Virgin Atlantic service with direct flights, will operate on Wednesdays and Sundays until the 30th March 2024.

Our direct service will operate on Tuesdays and Thursdays from the 2nd April 2024.

Our new direct, daily Virgin Atlantic service to Toronto commences 30th March 2025

1 room / 2 adults

Please enter all child ages

There must be 1 adult per child under two years of age travelling, please adjust your passenger number

To book online please select a maximum of 9 passengers, to book 10 adults or more please call 0344 557 3978

Please note: Drivers must be over the age of 21 to hire a car unless otherwise specified. Drivers between 21 and 24 years of age may be subject to additional costs.

Holiday insurance tailored to your next adventure

We know it's hard to concentrate on Seizing the Holiday without first having peace of mind.

Whether you are taking the children or grandchildren to Disneyland, tying the knot in Vegas, or relaxing on a Caribbean cruise we've got a policy to cover you. Booking your travel insurance through Virgin Atlantic gives you the reassurance that we have you covered from the start to finish of your holiday.

Get your Travel Insurance Quote today

Single Trip - Travel Insurance

Need travel insurance for your family holiday? Our Single Trip Travel Insurance offers great value cover at an affordable price.

Single Trip - Cruise Insurance

Our specialist cruise policy offers additional benefits including: Cruise connection, Missed port, Cabin confinement, Excursions cover.

Providing peace of mind whilst on holiday:

- COVID-19 - cover for medical expenses and cancellation if you become ill or have to quarantine due to COVID-19

- Up to £15m medical assistance cover in the event of illness or an accident while away

- Up to £5k cancellation cover or if you have to cut your trip short

- Up to £2k in the event of loss, theft or damage to your personal possessions

You may also like...

Virgin Travel Insurance Review

Round-the-clock emergency assistance and unlimited cover for trip cancellations are just 2 reasons to choose virgin travel insurance..

In this guide

Compare your travel insurance quotes

Summary of virgin money's comprehensive cover policy, what cover options are available from virgin and what exactly do they provide, 1. international travel cover, 2. virgin domestic travel insurance, 3. virgin multi-trip travel insurance, looking for some extra cover for your trip additional options you may want to consider, what are the benefits and what are the drawbacks of virgin travel insurance, what is the maximum age i can still get travel cover, if something happens how do i make a claim, faqs about virgin, why choose virgin for your trip.

Destinations

Important Information

Our verdict.

- Virgin Travel Insurance is one of the few providers we found that regularly offers discounts on its products, including for existing customers. Keep an eye out for the latest deals on their website.

- This provider offers a flexibility with its travel plans, with 6 cover types including 2 for domestic travel.

- We compared 10 leading travel insurance brands and found that Virgin Travel Insurance offered comparatively limited seniors cover, with a maximum age of 74 on some of its policies (correct as of June 2021).

Virgin Money Australia has expanded its insurance portfolio and now offers comprehensive travel insurance plans for both domestic and international trips to suit a range of needs and budgets.

You can compare the features of various Virgin Travel Insurance policies by using the table below and get a free quote.

Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Who underwrites Virgin Travel Insurance?

Table updated August 2021 *Note: 'Unlimited' means that there's no capped dollar sum insured, however, other conditions and exclusions may still apply.

How can this page help me decide if Virgin Money Travel Insurance is right for me?

- What cover options are available from Virgin?

- Additional options you may want to consider

- What are the benefits and what are the drawbacks?

- How much excess do I have to pay when I claim?

- Frequently asked questions about Virgin

Whether you are a one-off or regular traveller, globetrotting around the world or keeping it local, you may be able to find suitable travel insurance cover with Virgin that you can more closely tailor with a range of extras.

If you are looking to secure a travel insurance plan for a single overseas trip, Virgin offers different levels of cover available to single travellers and family. For international travel, there are three cover levels that you can choose from:

- Comprehensive

How does each level of cover compare with another?

Table updated August 2021

Virgin Travel Insurance also provides comprehensive protection cover for applicants looking to take a trip locally in Australia. Going for a snowy adventure or hitting the golf clubs to practice your tee shot? You can take up additional sports cover to help protect yourself against loss or damage of sports equipment. Domestic cover from Virgin is available as a single or family plan.

What is covered under domestic travel insurance policies?

If you regularly travel overseas or locally, either for work or holiday purposes, you can take advantage of Virgin Multi-Trip insurance that provides cover for unlimited journeys within a 12-month period. Virgin Multi-Trip Travel Insurance cover is available as a single plan. However, if you take your spouse/de facto partner and/or children with you on these trips, they will be covered automatically.

What is covered under multi-trip travel insurance policies?

- Overseas emergency medical assistance

- Overseas emergency medical and hospital expenses

- Accidental death

- Permanent disability

- Cancellation fees and lost deposits

- Additional travel and accommodation expenses

- Travel delay expenses

- Alternative transport expenses

- Travel documents, credit card and cheques

- Theft of cash

- Loss of luggage and personal effects

- Luggage and personal effect delay expenses

- Personal liability

- Rental vehicle excess

Going away for a Ski Trip? Learn more about Ski Travel Cover

With Virgin Travel Insurance, you have the flexibility to tailor your policy of choice with additional cover options. These options will incur additional premiums:

- 24/7/365 Emergency Assistance. Virgin Travel Insurance is underwritten by Allianz who provide emergency assistance with Allianz Global Assistance.

- Claims process is quick. With Virgin Money you can access guidance for the travel insurance claims process – you call it up and the claims team can guide you through the claims process.

- Cooling off period. Virgin Travel insurance has a 14-day cooling-off period in case you change your mind or travel plans.

- No increased cover for expensive items. You cannot purchase increased cover for jewellery or Snow Sport Equipment.

- No one-way policies. Virgin Travel Insurance only covers trips that start and end in Australia.

- No already overseas option. You cannot take out cover after you have begun your trip.

- Limited seniors cover. Some Virgin Money travel insurance policies have a maximum age of 74 for policyholders.

Check if there are any active Virgin Travel Insurance coupon codes

You can make a claim by downloading a claim form and submitting your claim with the appropriate supporting documents

What documents will I need to provide with my claim?

- Police reports

- Medical reports

- Original receipts or proof of purchase and ownership

How long will it take for claim to be processed?

Questions about applying, q. who can purchase virgin money travel insurance policy.

- A. You are eligible for cover if:

- You are an Australian resident.

- You are taking out cover prior to the start of your journey.

- Your trip begins and ends in Australia.

Q. Which age group is eligible for Virgin Travel Insurance cover?

- A. The age limits will vary depending on type of cover you are looking to apply for:

- Single Comprehensive and Domestic – 16 years old and over

- Multi-Trip and Basic – 16 to 74 years old

- Essentials – 16 to 69 years old

Q. When should I buy my travel insurance policy?

- A. You may want to take out Virgin Travel Insurance cover as soon as you put down a deposit or fully paid for your trip, or up to 12 months before your departure date.

Q. When will my travel insurance cover start?

- A. Your policy will be active on the date you purchase your cover. You will receive an email confirmation and Certificate of Insurance after application.

Questions about cancelling policies

Q. can i cancel my virgin travel insurance policy.

- A. You can cancel your cover within the 14-day cooling off period and you will get a full refund of premiums paid. Conditions apply.

Questions about coverage

Q. will i be covered if i have a pre-existing medical condition.

- A. Virgin Travel Insurance Australia provides cover for pre-existing conditions specified on the policy. Conditions may apply depending on the nature of the condition.

Q. Does Virgin Travel Insurance cover one-way trips?

- A. No. For Australia, Virgin Money Travel Insurance only provides cover for trips that start and end in Australia.

- Travel with one of Australia’s largest general insurance providers. Despite being a newcomer to the travel insurance market, Virgin Money Australia is one the nation’s leading financial institutions. Virgin Travel Insurance policies are underwritten by Allianz Australia, one of the largest travel insurance groups in the country.

- Different options to suit many travellers. Virgin Travel Insurance has developed a variety of travel plans with features and benefits to suit different kinds of travellers and their needs. Looking for a basic cover? Virgin Travel Insurance offers Basic or Essentials cover for when you travel abroad. Want top level cover? The Comprehensive cover might be a suitable solution for overseas trips. Domestic travellers can also benefit from two levels of travel cover available through Virgin.

- Tailor your policy to more ideally suit your needs. You can customise your travel protection plan by adding different options to suit your needs. Depending on the type of cover that you opt for, you can choose to add sports cover, get extra cover for your valuables and luggage, or increase your rental vehicle excess.

- 24/7 emergency assistance no matter where you are in the world. With the support from Allianz Global Assistance, you can benefit from global emergency assistance with access to doctors, nurses and support staff; available 24/7 to Virgin Travel Insurance policyholders.

- 14-day cooling off period. Once you have purchased your Virgin Money Travel Insurance policy, you have 14 days to be sure that you have made the right decision. You can cancel your cover within this period and you will receive a full refund as long as you have not commenced your trip or made a claim.

- Cover for 36 pre-existing medical conditions at no extra cost. If you have a pre-existing medical condition, Virgin Travel Insurance provides cover for applicants with any one of the 36 listed on your policy at no extra cost. Virgin may offer full cover as long as you have not been admitted to a hospital for the elected condition in the 24 months prior to your policy’s commencement date. Some of the pre-existing medical conditions that Virgin travel insurance will cover include:

- Carpal Tunnel Syndrome

- Diabetes Type I and II

- Hypertension

- Hypothyroidism

- Macular Degeneration

Jessica Prasida

Jessica Prasida is a travel insurance expert for Finder. She lives and breathes travel, having worked as a travel agent and branch manager at STA Travel for over 4 years, then writing about travel insurance with Finder for another 5 years. Jess has a Bachelor of Business from the University of Technology, Sydney and a Tier 1 General Insurance qualification. See full bio

More guides on Finder

Virgin offers high quality, affordable insurance policies for your travel needs. Discover deals and offers on Virgin Travel Insurance from finder.com.au.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

18 Responses

I’m looking for travel insurance. I’m on a 12-month visa here in Australia and I’d like to get comprehensive insurance for 12 months to cover my trip to the US in April. Can I get insurance for all my stay here in Australia? I’m from Ireland and I’m 68 years, healthy no illnesses.

Thank you for getting in touch with Finder.

General eligibility requirements for inbound travel insurance include:

- You must be a non-resident of Australia travelling to Australia for a temporary period and then returning to your home country

- You must be under 81 years of age at the time the policy is issued (age limits vary between insurers)

- Your trip must include travel within Australia

- You must have purchased cover less than 12 months prior to arriving in Australia

Since you have arrived in Australia and considering getting travel insurance for your trip to the US in April, you can check some non-resident travel insurance . I suggest that you contact your chosen insurer directly to know your cover well before leaving for your trip.

I hope this helps.

Thank you and have a wonderful day!

Cheers, Jeni

Can I book travel insurance outside of Australia? I am currently working in Japan then travelling to Thailand and UK. I am an Australian citizen.

Thank you for reaching out to Finder.

I’m afraid you may not be qualified to get one from Virgin Travel Insurance. Their insurance is backed by Allianz and they require that your journey should commence and end in Australia. You may want to check travel insurance for Australian expats to check your options. The page also discusses the types of cover that may be available for expatriates, coverage FAQs, etc.

Hope this helps and don’t hesitate to contact us back if you require further assistance.

Kind Regards, Mai

Hi, does this insurance cover cruises in Europe – italy/croatia/greece?

Hi Rosemary,

Thank you for leaving a question.

Yes, Italy, Croatia and Greece are covered by Virgin International Travel Insurance. Hope this helps!

Cheers, Reggie

What about disaster insurance cover for Bali?

Thank you for your inquiry.

Based on the Product Disclosure Statement of Virgin Travel Insurance, there is coverage when it comes to natural disasters when the natural disaster will affect your mode of transport. You may want to refer to our guide to Virgin travel insurance to know which cover options are available.

We also have a dedicated page for travel Insurance for Indonesia . Please make sure to read the eligibility criteria, features, and details of the policy, as well as the relevant Product Disclosure Statement of the policy before making a decision and consider whether the product is right for you. If necessary, speak to the insurance brand to verify any details.

I have cover 22/5 to 6/6 had slight accident left paperwork at home.can you provide claim number. Cut to eyebrow going to emergency hospital

Hi Shirley,

Thanks for your question.

If you would like to make a claim with Virgin Travel Insurance, you will need to contact them directly or download a claim form from their website and submitting your claim with the appropriate supporting documents which includes police reports, valuations, medical reports, and original receipts or proof of purchase and ownership.

Please make sure to revisit the eligibility criteria, features, and details of the policy, as well as the relevant Product Disclosure Statement of the policy before making a claim.

I hope this was helpful, Richard

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Sold and serviced by Agent USD i

You are seeing this because you have clicked on a link that is being serviced by Agent USD. If you don't know them or want to opt-out, click here .

- +18877996677

Additional Terms & Conditions

Virgin voyages additional terms and conditions .

Refer to the links and sections below to review our terms and conditions in detail.

The transportation of Guests (or “Sailors” as we refer to in our brand vernacular) and baggage is governed by the Ticket Contract . Virgin Cruises Intermediate Limited (referred to herein as “Virgin Voyages,” “we,” or “our”) has two Ticket Contracts, but only one will apply to you as a Guest: one is for a Guest from everywhere except the United Kingdom, and one is for a Guest from the United Kingdom. In addition, there are other terms and conditions that apply (hey, it’s a complex operation to have an amazing adventure with 2,700 Guests!) -- please see the links below. We urge you to read them, as you’re agreeing to be bound by them when you book a cruise with Virgin Voyages (a “ Voyage ”).

- Ticket Contract for All Guests except those from UK and EEA

- Ticket Contract for UK Guests Only

- Ticket Contract for EEA Guests Only

- Offer Terms & Conditions

- Website Terms & Conditions

- Data Privacy Terms & Conditions

Booking a Voyage on one of our ships constitutes acceptance of the items listed above (but as for the Ticket Agreement, only the one applicable to you), which include these Additional Terms and Conditions. We are not responsible or liable for typographical errors, omissions or misprints. We further reserve the right to correct or change these Additional Terms & Conditions, the Ticket Agreements, or website, with or without notice. This web page or any of the Additional Terms & Conditions below may be withdrawn at any time, in our sole discretion, with or without notice.

In the case of any conflict between these Additional Terms & Conditions and the relevant Ticket Contract, the relevant Ticket Contract will prevail.

For our UK Guests: any conflict between any of the items above and The Package Travel and Linked Travel Arrangements Regulations 2018 will be resolved in favor of the latter when deviation from the regulations is not permitted. Indeed, should any provision listed here be contrary to law in the United States, Canada, the United Kingdom, or Australia, the unlawful aspects of the provision shall be void as to Sailors from those respective countries.

Our Voyages are adult-only, so Guests must be at least 18 years old to sail with us.

Booking Policies

- These are our standard booking policies. While our standard booking policies provide options and flexibility should plans change, from time to time we may activate a specifically branded “Flexible Booking Policies” offer, or other special offers, that may affect bookings, deposits, payment schedules, cancellations, and/or refunds on cancelled voyages. Click here (or the Offer Terms & Conditions link above, which takes you to the same place) to see if Flexible Booking Policies or another special offer is in effect at the time you book.

- The minimum age to book a Voyage is 18 years old.

- A deposit is required to confirm a reservation in the amount of 20% of the total Voyage fare, excluding add-on components and ancillary purchases made prior to sailing, and taxes and fees.

- Bookings can be held for 24 hours without deposit up to 45 days prior to the sail date. Bookings made within 44 days or less of the sailing date require full payment at time of booking (and will not be held for 24 hours).

- Online direct bookings will require a credit card at the time of booking, but the deposit will not be charged until 24 hours have elapsed after the booking.

- Beyond 121 days or more from the sailing date, Guest or Guest’s travel agent has 7 days from the initial booking date as a grace period to cancel the reservation and will receive a full refund of the deposit if cancelled within the grace period.

- After the 7-day grace period, the deposit is 100% non-refundable.

- The 7-day grace period does not apply to bookings made at 120 days or less of the sail date, since full payment of the Voyage fare is required at this time.

Shore Excursions

Please visit this link for more information regarding Shore Things terms & conditions.

Fares and Fees

Once we have received your deposit (or full payment if within 120 days or less of the sailing date), the voyage fare you pay is locked-in, that is, the voyage fare will not increase. If you buy add-on components, such as flights and/or hotels and/or transfers, additional fees associated with these services will apply as well as any applicable governmental taxes and fees. All assessed government or quasi-government taxes and fees are subject to change without notice at any time, and we reserve the right to add a surcharge for these taxes and fees whether you have a confirmed booking under deposit or have made a final payment. That said, we will not add a fuel surcharge should fuel prices rise. All rates and information presented herein were in effect at time of printing and are subject to change with or without notice. Please note, Sailors from outside the United States may incur foreign transaction fees charged by their credit card company when making a booking within Virgin Voyages.

- Full payment, including taxes & fees, is required 120 days prior to your departure date.

- 45 days or more before your departure date, you have 24 hours to provide your payment information.

- 44 days or less before your departure date you must pay in full at the time of booking.

Payment Options

- From time to time, Virgin Voyages offers guests the option to pay a 20% deposit at the time of booking (“Pay 20% Now”), with the remaining balance due 120 days before your embarkation date.

- By selecting “Pay 20% Deposit,” you expressly agree and authorize Virgin Voyages to charge you twenty percent (20%) of the total voyage amount via the preferred payment option selected on the following page. Virgin Voyages will notify you of the amount charged at check out.

- For those guests who save a credit card on the Virgin Voyages website or mobile app during the booking process, you authorize Virgin Voyages to charge the saved credit card on file the remaining balance for your voyage due 120 days before your embarkation date. The remaining balance will be charged 120 days before your embarkation date.

- In the event that you purchase add-ons to your reservation and are given the option to pay later, such add-ons may be included in the payment made 120 days before the embarkation date of your voyage. You will be notified at the time of booking the balance due and the date your saved credit card will be charged.

- In the event that you make a modification to your booking, such as upgrading your cabin, such modifications will require payment at time of modification and will not affect the balance due 120 days before your embarkation date unless there is a remaining balance related to the modification.

- For those guests that change their saved credit card or add a saved credit card on the website following the completion of their reservation, the new saved credit card may be charged the balance due 120 days before your embarkation date.

- For those guests who do not save a credit card or who use a third-party payment option, you will not be automatically charged 120 days before your embarkation date. Guests are solely responsible for paying the remaining balance 120 days before your embarkation date. Failure to do so may result in cancellation of the booking.

- If Virgin Voyages is unable to collect your payment for any reason, Virgin Voyages will notify you and request immediate payment be made. Failure to do so may result in cancellation of your booking.

- Canceling a booking at least 121 days before your embarkation date will cancel Auto Pay. All cancellations are subject to the cancellation and refund policy found in Virgin Voyages’ Ticket Contract.

- Availability of this option is based on the time of booking and subject to the Virgin Voyages’ Ticket Contract.

- All Payment options are subject to the cancellation and refund policy found in the Virgin Voyages’ Ticket Contract.

- By selecting “Pay in Full,” you agree and authorize Virgin Voyages to charge you one hundred percent (100%) of the total voyage amount via the preferred payment option selected.

- From time to time, Virgin Voyages offers a “Book Now. Pay Later” option or monthly payment option. These options are provided through Uplift (or its affiliate) and are subject to Uplift’s terms and conditions. By selecting this option, you agree that you are signing a new agreement with Uplift and that Virgin Voyages is in no way liable for the relationship between you and Uplift.

- From time to time, Virgin Voyages offers a “Hold” option to allow you time to determine whether to book a voyage. Unless specified otherwise, the “Hold” option is free of charge and will remain in effect for 24 hours following the request to Hold. Reservations on Hold that are not paid for by one of the options provided above within the 24-hour period provided will be automatically canceled.

Cancellation Policy

If you or anybody travelling with you wishes to cancel either your/their holiday, you must contact Shoreside Sailor Services if booking direct (through our Contact Us page is best, or call in US 1-954-488-2955; if in the UK call +44-20-3003-4919), or your travel agent or tour operator, and give notice of the cancellation. The Voyage will only be cancelled on the date we receive the notice of cancellation.

- You have the most flexibility outside of 120 days prior to your departure date. If you're booking at this time, you have a 7-day grace period to request a full refund on your deposit and any other payments made. Refunds will be issued to your original form of payment.

- After the grace period (but still before the 120-day mark), you can receive a full refund on any payments, not including your deposit. For your deposit, you can request a Future Voyage Credit at this time.

- From 119 days up to 45 days from your departure date, your available options are:

- Receive a “Future Voyage Credit” in the amount paid that can be applied to a new sailing up to 1 year after the original Voyage date.

- Change to a new Voyage date up to 1 year after original Voyage date.

- Change names on the reservation; permissible up to 48 hours before your Voyage sailing date.

- Submit an insurance claim if travel protection (aka travel insurance) was purchased.

- At 44 days from your departure date, all funds paid are final. But you do have the option to transfer, sell, or otherwise have someone go in your place up to 48 hours before your Voyage.

Note: the date of departure means the date the arrangements you have booked through us start. So if you booked a flight or hotel add-on to your Voyage, it is the day the first add-on begins. Conversely, It may be your Voyage sail date if that is the only thing you booked with us. The sail date is the date the ship, on the Voyage portion of your holiday, departs the port of embarkation. Individual cancellation policies apply at the Guest level for any individual cancellation within a cabin.

Depending on the reason for cancellation, you may be able to reclaim any unrefunded money (less any applicable excess) under the terms of your travel insurance policy. Claims must be made directly to your insurance company. As always, we recommend you purchase our Voyage Protection.

Where any cancellation reduces the number of full paying party members below the number on which the price, number of free places and/or any concessions agreed for your booking were based, we will recalculate these items and re-invoice you at the applicable higher price. Cancellations shall be deemed effective at 11:59 p.m. local east coast United States time on the date Guest communicates such cancellation. Per person taxes and fees will be refunded to the credit card on file.

We may have special and/or limited booking or cancellation policies in place for limited times, so click here or the “Offer Terms and Conditions” link below.

Guest Changes

Virgin Voyages grants leeway to Guests to reschedule his or her Voyage up to 45 days of the originally-scheduled Virgin Voyages-arranged itinerary starts - meaning at 45 days before your departure date, there is flexibility, but at 44 days before your departure date, the deal is final (except we do permit you to transfer your voyage-only to someone up to 48 hours before the voyage sail date). We may have special offers in place, so click here or the “Offer Terms and Conditions” link above (both link to the same place). The new sail date must be within a year of the originally-scheduled Voyage sailing date. Per Guest taxes and fees will be collected or refunded to the original credit card(s) on file if the taxes and fees on the new sailing date differ from the original. A cabin category may be changed up to 45 days of Voyage sail date, though cabin upgrades may be made inside 45 days of Voyage sail date and are subject to availability. For an up-category change, applicable fare increase is due at time of change. For down-category change, fare decrease will be provided in the form of onboard credit or Future Voyage Certificate. No change fees will be charged for Voyage date or cabin changes. If 3 or 4 Guests are booked in a triple- or quadruple-occupancy cabin and 1 or 2 Guests cancel, we retain the right to move remaining Guests to a smaller cabin (triple- or double-occupancy) in the same category.

Itinerary Changes

In the event of strikes, lockouts, labor issues, riots, health emergencies, weather conditions, mechanical difficulties or a variety of other reasons, Virgin Voyages has the right to cancel, advance, postpone or substitute any scheduled sailing or itinerary without prior notice. Virgin Voyages shall not be responsible for failure to adhere to published arrival and departure times for any of its ports of call. Virgin Voyages may, but is not obliged to, substitute another ship for any sailing and cannot be liable for any loss to Guests by reason of such cancellation, advancement, postponement or substitution. Reservations are subject to change or cancellation in the event of a full-ship charter, and in such event, Virgin Voyages shall refund all passage moneys paid by a Guest. Additional rights may apply to our U.K. Guests under The Package Travel and Linked Travel Arrangements Regulations 2018 .

Guests with Special Needs

Whenever possible, Virgin Voyages will work to accommodate Guests with special needs. However, the following conditions apply:

- Due to the risks inherent in travel by sea, if a Guest has any special medical, physical or other requirements, the Guest, the Guest’s travel agent, or any person booking on Guest’s behalf is requested to inform us at the time of booking of any special need or other condition for which Guest or any person in Guest’s care may require medical attention or accommodation during the Voyage, or for which the use of a wheelchair or service animal is contemplated or necessary.

- Guests requiring the use of service animals (US) or assistance dogs (UK and EU) are asked to notify us not less than 21 days prior to the Voyage.

- Notice of any of the above items may be made online at booking to our Shoreside Sailor Services by clicking here or calling in the US or Canada 1-954-488-2955 or if in the UK, +44-20-3003-4914.

- If any such special need or condition arises after a Guest has booked a Voyage, the Guest is requested to report it to Shoreside Sailor Services as soon as Guest becomes aware of it.

- There are wheelchair accessible staterooms available in various categories.

- Not all areas or equipment on the vessel are suitable for access to disabled Guests or Guests with reduced mobility. But if you need help, we’ll do our utmost to provide it.

- Guest acknowledges and understands that certain international, foreign or local safety requirements, standards, and/or applicable regulations involving design, construction or operation of the vessel, docks, gangways, anchorages or other facilities on or off the vessel may restrict access to facilities or activities for persons with mobility, communication, or other impairments or special needs.

- In limited situations where Guest would be unable to satisfy certain specified safety and other criteria, even when provided with appropriate auxiliary aids and services, we reserve the right to refuse permission to participate in all or part of the Voyage.

- Virgin Voyages has the right to refuse or revoke passage to anyone who, in its judgment, is in a physical or mental condition unfit for travel or who may require care beyond that which Virgin Voyages can provide. Virgin Voyages reserves the right to deny participation in certain activities based on past or present medical conditions. For questions about whether our Voyage experience is right for you, please contact our Shoreside Sailor Services by clicking here or if in the US or Canada calling 1-954-488-2955 and if in the UK +44-20-3003-4914.

- Virgin Voyages similarly reserves the right to refuse or revoke passage to anyone who has failed to notify it of their specific needs with regard to accommodation; seating or services required from it or the terminal operator; their need to bring medical equipment; their need to bring a service animal on board the ship; or of any other known disabilities that require special assistance, special services, or privileges; who in the Carrier’s and/or Master’s opinion is unfit or unable to travel; or anyone whose condition may constitute a danger to themselves or others onboard on the grounds of safety.

- Guests are under no obligation to identify themselves solely because they have a disability when they seek no special assistance, special services, or privileges. Guests may consider self-identifying their disability where notice to the vessel crew would prevent misunderstanding of a Guest’s particular impairment or disability.

- Where necessary in order to comply with applicable safety requirements, we may require a Disabled Person or Person with Reduced Mobility to be accompanied by another person who is fit and able to assist them in day to day activities.

Medical Services

Our ships have at least one physician and four nurses on board for each Voyage. While our ships comply with all U.S. Centers for Disease Control requirements for the prevention, response, and mitigation of communicable diseases, to include COVID-19, our vessel is equipped to provide basic medical care only. Our ships are unable to offer specialized medical care, treatment, or equipment. Guests requiring such specialized care, or Guests experiencing a medical emergency, may be evacuated to shore at their expense. Further, your vessel may not be able to immediately evacuate a Guest in an emergency situation due to the ship’s location relative to the nearest evacuation-capable platform.

Damage Caused to the Vessel

Each Guest shall be liable to and reimburse Virgin Voyages for all damage to the vessel and its furnishings, equipment and property caused by any willful or negligent act or omission by a Guest. A Responsible Adult, i.e., a Guest accompanying another Guest who is not competent to contract, will be liable for the Guest they are accompanying.

Smoking Policy

Smoking areas are provided around the ship. A Guest found smoking anything, to include “vapes,” in their room (including balcony) or other non-designated areas onboard, agree to a $500 fee to be added to their onboard account, and may be disembarked from the Voyage, which may be at a port of call. Virgin Voyages will have no further responsibility toward Guest in this instance; the cost of return to the port of embarkation or Guest’s home will be borne by the Guest. If an Under-21 Adult is disembarked for a violation of this policy, the Responsible Adult will be disembarked as well.

Your Travel Agent

Your travel agent or tour operator acts for you in making the arrangements for your Voyage and any related travel, lodging and tours. Virgin Voyages cannot be responsible for the financial condition or integrity of any travel agent utilized by you. Virgin Voyages is not responsible for any representations or conduct of your travel agent, including, but not limited to, failure to remit your deposit or other funds to Virgin Voyages, for which you shall at all times be liable to Virgin Voyages, or any failure to remit a refund from Virgin Voyages to you.

Safety and Security Ashore

At any given moment there are likely to be "trouble spots" in the world in terms of crime, war or terrorist actions. Accordingly, it may be necessary to change the published Voyage or shore excursion itinerary. Any such changes are for your safety and beyond Virgin Voyages’ control. While we seek to provide reasonable protection for your comfort and safety on board our vessels, we cannot guarantee freedom from all risks associated with war, terrorism, crime, or other potential sources of harm. Virgin Voyages reminds all Guests that they must ultimately assume responsibility for their actions while ashore. The U.S. Department of State and U.K. Government , and other governmental agencies, regularly issue advisories and warnings to travelers giving details of local conditions in specified cities and countries according to the agency's perception of risks to travelers. Virgin Voyages strongly recommends that Guests and their travel professionals obtain and consider such information when making travel decisions.

Safety and Security Afloat

The safety and security of our Guests and vessel are paramount. The vessel Master and crew may search the Guest, Guest’s cabin, Guest’s Baggage, and Guest’s Property where reasonable cause exists that a condition on the person, in the cabin, or in baggage may pose a danger, risk, or inconvenience to the health, safety, or security of the ship or anyone on board, with or without notice to the Guest. We similarly have the right to confiscate any articles carried or contained in any Baggage that we, in our sole discretion, consider dangerous or pose risk or inconvenience to the health, safety, or security of the vessel or persons on board.

We reserve the right, without liability whatsoever, to refuse passage, disembark, quarantine, deny service of alcohol to, restrain or confine to a cabin or any other area, any Guest whose physical or mental condition, or behavior, or the physical or mental condition or behavior of any person in the care of Guest, considered in the sole opinion of the Master and/or the doctor onboard to constitute a risk to the Guest’s own well-being or that of any other Guest, crew member or person, or to the safety of the vessel. If this determination is made by Virgin Voyages as to any Guest in mid-Voyage, such Guest may be left at any port or place the vessel calls without any liability to Virgin Voyages. Virgin Voyages shall not be required to refund any portion of the fare paid by any Guest who must leave the vessel prematurely for any of the reasons set forth in this paragraph or who voluntarily disembarks or leaves the vessel for any other reason, nor shall it be responsible for lodging, medical care expenses, meals, return transportation or other expenses incurred by such Guest. For a list of prohibited items, see our FAQ section -- click on "What items are prohibited from being brought on board?” We will report incidents of illegal activity or behavior to the appropriate law enforcement authorities ashore. Unruly, abusive or aggressive behavior toward other Guests or crew will not be tolerated and may be grounds for disembarkation as well.

Photography and CCTV Cameras

For the safety and security of Guests, we use closed circuit television (“CCTV”) or other surveillance means onboard the ship. We also deploy body cameras on our Security Team members. The body cameras record interactions with Guests and crew to ensure the protection of our Guests, crew, and Security Team members. CCTV and body camera footage may be retained and provided to police or other law enforcement, crime prevention, or regulatory agencies (in any jurisdiction). Further, we use photographers and videographers to capture images of our Guests during their Voyage with or without enhancements for sale to those captured in the imagery. They are happy to take reasonable steps to avoid filming you where you indicate that this is your preference but you may be included unless you tell us otherwise. We are unable to guarantee that you will not be included in video footage and photographs on an incidental basis. We may desire to use such imagery/footage in our marketing or promotional materials in print, on television, on our website, on our social media sites, or other media. We will seek your express consent before doing so. Notwithstanding, where permitted by law, by boarding our vessel, you grant us permission to photograph, film and/or record you by any means. Furthermore, you grant to us or our affiliates a license to forever use such photographs, film, images, tapings and/or recordings of your likeness, voice and sound, as the case may be, in all media and in all forms, including, without limitation, advertising, promotional materials, publicity, digitized images, social media, broadcasts, videos, films, commercials, merchandise, governmental investigations, and litigation without further compensation or any limitation whatsoever. Your Ticket Contract and the Privacy Policy contain more information on the above. Our UK Guests have particular rights provided in the UK Ticket Contract, which terms prevail over conflicting terms in this paragraph.

Sailing Day Embarkation Policies

Arrival at the Terminal

- For your comfort and convenience, we recommend that Guests arrive at your selected arrival slot noted on your Voyage documents. Because of security regulations, Guests may not be allowed to enter the terminal prior to the scheduled embarkation time and may want to avoid waiting in potentially inclement weather as the waiting area outside and inside the terminal may be limited.

Boarding the Ship

- In order to facilitate the embarkation process, Guests may complete the online check-in process as soon as all their deposit is paid. We ask that all Guests complete the online check-in as soon as possible. Simply download our mobile app, log in to your account, and fill in the required information. Guests will be asked to access the Safety Brief via the Virgin Voyages mobile app or the in-cabin tablet once onboard the ship. All Guests must be checked-in and onboard the ship no later than one hour prior to the departure time noted on their Voyage documents or may not be permitted to sail. Any late-arriving Guest may join the ship at an approved port of call in the scheduled itinerary. Such a Guest will be responsible for all applicable fees and travel expenses to that subsequent port of call.

Note to Travel Agents

Reservations may be booked directly by travel agents or tour operators using our FirstMates.com website. For assistance, please call 1-800-430-5308, or in the UK +44-20-800-3688912.

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

If you are unsure whether this review should be removed, please see our policy on reporting reviews .

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

Virgin Money: Travel Insurance reviews

100% increase in 5 star reviews, 67% decrease in 1 star reviews, latest highest rating:.

Latest lowest rating:

About the Travel Insurance

Review virgin money: travel insurance now, virgin money travel insurance reviews ( 92 ), virgin travel insurance, great value for money compared to other travel insur..., this is like not taking any insurance.

If you think your cover you are so wrong .

Showing 4 of 92

Do you have a different Virgin Money product?

There's still more to see!

Join smart money people.

Keep up to date on ratings of your favourite businesses. Find out about our awards and write new reviews with ease

News, guides and insight from our team

(2).png)

UK money news stories - 24 July 2024

Your Money, Your Voice: Have your say

Our latest research - customers see little impact of FCA's Consumer Duty one year on

Consumer credit awards winners 2024

Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

Our Top Picks

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Van Insurance

Solar Panels

Get solar panels for your home.

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

Virgin Money Travel Insurance Review: Is it Right for You?

- All plans include Baggage and SAFI

- Can buy direct or through comparison sites

- No compensation for any air miles, cruise miles or holiday points used to pay any part of a trip

- No cruise specific cover (e.g., Cabin confinement, Emergency airlift to hospital, Missed port, Unused excursion)

Editor's Rating

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

Find Cheap Travel Insurance in Your Area

Protect your holiday today. Quick quotes from 20 insurers.

Virgin Money offers solid value across a number of travel insurance plans that cater to a range of needs, from those on a budget up through premium holiday cover. All plans include the three critical aspects of holiday cover: Cancellation, Emergency Medical and Baggage. Plus, you'll get cover for Delayed Departure and Scheduled Airline Failure on most plans, and Winter Sports included on most Annual, Multi-Trip policies. Read our review to learn about features and prices of Virgin Money travel insurance—plus we'll explain the main differences between buying direct from the Virgin Money site versus buying through a comparison site, to help you decide where to buy.

- Virgin Money Overall Review

- Virgin Money Price Comparison

- How Virgin Money Plans Differ on Comparison Sites

- Virgin Money Features, Policy Limits and Coverage Options

Virgin Money Policy Wording

There is no "best" travel insurance—the best for you will depend on factors like price points and features that you might find valuable. Please use the information in this review to help you narrow your choices.

Virgin Money Travel Insurance Review: What You Need to Know

Virgin Money offers a series of holiday cover plans for reasonable prices, to suit those wanting a budget plan with just £1,500 of Cancellation and £1,000 of Baggage all the way up to those with more luxury holidays needing up to £7,500 for Cancellation and £3,000 of Baggage cover per person.

The cheapest Virgin Money travel insurance is the "Economy" plan, which is only available through comparison sites . The top-tier plan is the "Gold" plan, and this is only available directly from Virgin Money. Here's a high-level overview of their plans:

What's included?

Trip Cancellation, Emergency Medical, Legal Assistance, Personal Accident and Personal Belongings/Baggage are included on all policies—as is Scheduled Airline Failure . But end supplier failure is only on Premium and Gold plans (the top tier from comparison sites and direct).

Even the lowest tier plan includes some Missed Departure and Baggage Delay cover. However, there's no protection against natural disasters such as tsunamis, earthquakes, landslides, volcanic eruptions (including volcanic ash clouds), hurricanes, etc.

Like many other travel cover plans, kids basically go free (up to 3 children under the age of 18, per insured adult).

For those heading to the slopes, Winter Sports is optional now (they used to include it on annual plans). In terms of other travel insurance add-ons , cruise-specific cover is not an option on Virgin Money travel insurance, so if you're going on a cruise you may want to consider other holiday cover providers for access to features like Cabin Confinement, Unused Excursions and Missed Port.

Pre-Existing Conditions: As part of the online application you'll be asked a series of brief medical questions. If you have a medical condition, Virgin Money may be able to offer cover for some pre-existing medical conditions , for which you'll probably be required to pay a higher premium. Pre-existing conditions are only covered if they've been fully declared, accepted and paid for.

Covid: Virgin offers pretty good Covid benefits. Here's a sample of what's covered, extending Cancellation and Curtailment cover.

Cancellation:

- You, Your Relative, a member of Your household or travelling companion or a friend with whom You had arranged to stay has a diagnosis of COVID-19 within 14 days of Your booked departure date, as certified by a Medical Practitioner following a medically approved test showing a positive result for COVID-19.

- You being denied boarding on Your prebooked outbound travel due to You contracting COVID-19, as certified by a Medical Practitioner following a medically approved test showing a positive result for COVID-19 or having a confirmed temperature above 38 degrees Celsius.

Curtailment:

- Death of Your Relative or a member of Your household living in the United Kingdom contracting COVID-19, as certified by a Medical Practitioner following a medically approved test showing a positive result for COVID-19 or having a confirmed temperature above 38 degrees Celsius.

- The hospitalisation as a result of COVID-19 for treatment with mechanical ventilation, of Your Relative or a member of Your household living in the United Kingdom.

How do Virgin Money Travel Insurance Prices Compare?

Virgin Money travel insurance premiums are in line with market averages. Only Virgin's top-tier Black plans cost more than the average cost of holiday cover (shown by yellow bars in the charts below), whether you're travelling to geographies like Europe or America . Given that Baggage and Travel Delay are covered on all plans, we think Virgin Money offers solid value for money.

However, insurance quotes can vary significantly from day to day and according to each individual's details, so please just use this data for general educational purposes only about the travel insurance market; your quotes may reflect a large degree of variation.

Buying Direct vs Using a Comparison Site

There are two ways to buy a Virgin Money travel insurance policy: direct from Virgin Money or via a comparison site like MoneySuperMarket. Broadly speaking, the cheapest plan is Economy, which is only available from comparison sites; the plan with the highest cover is the Gold plan, only available from Virgin Money direct.

There are pros and cons to both sources in terms of features and price points. We'll try to explain the differences to help you understand whether buying direct or through an aggregator (e.g., a comparison site) better suits your individual needs.

If the lower limits of the Economy or Standard plan are good enough for your needs then you can probably save money buying through the comparison site because our research revealed that the cost of Virgin Money's "cheapest" cover from each source can easily be 40% to 50% cheaper when buying through the comparison site —that is, Economy plans are consistently cheaper than Red plans.

Benefits of Buying via Comparison Site

If you're after a budget travel insurance plan, the cheapest holiday cover from Virgin Money is the Essential Plus plan, which is available only on comparison sites. Depending on details like geographic cover, you'll probably find cheaper plans on comparison site, but for a given level of cancellation cover, you might get higher limits in some other areas. For example, Red (direct) has £3,000 of cancellation as does Premium (comparison site), but Premium has higher limits for emergency medical, personal accident, personal possessions, financial failure, missed departure and more. But Red has higher travel delay benefits. And the excess is twice as much on the Premium plan. Also, direct plans include some level of gadget cover (and you can buy more), but comparison site plans only cover gadgets if you buy the add on. So there are trade offs.

Types of Virgin Money Travel Insurance Policies

Virgin Money offers five tiers of travel insurance—Economy, Standard, Premium, Red, Silver and Gold. The first three (Economy, Standard, Premium) can be purchased on a comparison site; Red, Silver and Gold are available direct from Virgin Money. All policies include Emergency Medical, Baggage and Cancellation/Curtailment.

Winter Sports cover can be added to Single Trip plans for an additional cost but is INCLUDED in Annual, Multi-Trip plans.

The upper age limits vary depending on whether you buy direct or through an aggregator site. Plans bought from comparison sites have lower upper age limits, so people in their 70s or above may have better success buying direct.

Age Limits When You Take Out a Virgin Money Travel Insurance Policy

While you can take as many trips as you want each year with a Virgin Money Annual, Multi-Trip policy, there are limits on trip length, depending on your age.

Virgin Money Trip Lengths for Annual Policies Vary According to Policy Type

- Economy: 31 days

- Standard: 31 days

- Premium: 45 days

- Red: 31 days

- Silver: 45 days

- Gold: 94 days

Single trips are limited to 90 days, unless agreed by them in writing.

Cover Limits

Here is a quick, high-level recap of what's on offer from comparison sites and direct:

For further information, please review the policy documents. If you would like us to go into more depth here, please let us know in the comments section at the bottom of this review!

Gadget and Valuables Extension:

Direct plans receive some level of gadget cover (e.g. for loss up to £500 for Red and Silver and £750 for Gold); plans bought from a comparison site don't include gadget as standard. But prior to leaving your home area, if you pay the appropriate extra premium Virgin Money can extend your cover to:

Unauthorised usage is limited to £1,000 for all options.

Notable Features

Here are some highlights of features available on Virgin Money travel insurance policies. Standard features like Medical and Personal Liability are also included on Virgin Money policies, limits for which can be found below in the Policy Limits section . For more complete details like inner limits and exclusions, please refer to the policy documents .

Bottom Line: We like that all Virgin Money plans include Baggage, which is the most common reason to claim on holiday cover. A range of reasonably-priced plans mean there's cover for a variety of customer profiles, from those heading on a cheap and cheerful holiday in the sun to those who have more at risk for a premium holiday.

- Virgin Money Policy Wording for Comparison Sites

- Virgin Money Policy Wording for Direct Sales

Erin Yurday is the Founder and Editor of NimbleFins. Prior to NimbleFins, she worked as an investment professional and as the finance expert in Stanford University's Graduate School of Business case writing team. Read more on LinkedIn .

- 4.8 out of 5 stars**

- Quotes from 20 providers

Our Top Insurance Picks

- Cheap Travel Insurance

Cheap Travel Insurance by Destination

- Travel Insurance to Australia

- Travel Insurance to Ireland

- Travel Insurance to Canada

- Travel Insurance to Turkey

- Travel Insurance to India

Articles on Travel Insurance Costs

- Average Cost of Travel Insurance

- Average Cost of Travel Insurance to USA

- Cost of Travel Insurance with Pre-Existing Medical Conditions

- Average Cost of Travel Insurance to India

- Average Cost of Travel Insurance to Ireland

Recent Articles on Travel Insurance

- Travel Insurance with Optional Gadget Cover

- Top Tips for Travel Insurance with Medical Conditions

- Can Travel Insurance Help if Natural Disaster Strikes?

- Should You Buy Travel Insurance from a Comparison Site?

- Should You Buy Single-Trip or Annual Multi-Trip Travel Insurance?

Travel Insurance Guides

- Do I Need Travel Insurance? 3 Key Questions

- Will Your Travel Insurance Claim be Rejected? Boost Your Odds with These Tips

- 7 Things Your Travel Insurance May Not Cover

- Travel Insurance Guide

Travel Insurance Reviews

- AA Travel Insurance Review

- Admiral Travel Insurance Review

- Aviva Travel Insurance Review

- AXA Travel Insurance Review

- Cedar Tree Travel Insurance Review

- CoverForYou Travel Insurance Review

- Coverwise Travel Insurance Review

- Debenhams Travel Insurance Review

- Direct Line Travel Insurance Review

- Holidaysafe Travel Insurance Review

- Insure & Go Travel Insurance Review

- Sainsbury's Bank Travel Insurance Review

- Tesco Travel Insurance Review

- Travelinsurance.co.uk Travel Insurance Review

- Zurich Travel Insurance Review

Reviews of Travel Insurance for Pre-Existing Conditions

- Fit2Travel Travel Insurance Review

- Free Spirit Travel Insurance Review

- goodtogoinsurance.com Review

- JustTravelcover.com Insurance Review

- OK To Travel Insurance Review

- Saga Travel Insurance Review

- Virgin Money Travel Insurance Review

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

Free COVID-19 insurance with Virgin Atlantic flights

Virgin Atlantic customers can book with confidence this year thanks to the introduction of free COVID-19 insurance on all new and existing bookings.

The policy, which applies automatically to all flights booked with Virgin Atlantic, is designed to complement existing travel insurance and provide additional peace of mind for upcoming trips – whether customers have already booked or are planning a getaway.

The Virgin Atlantic COVID-19 Cover means that if customers become ill with COVID-19 while travelling, all the related costs are covered. It doesn’t matter how long their trip is, or if they’re visiting another destination on the same overseas trip.

Customers booked to travel from 24 August 2020 until 31 March 2021 will automatically receive the new COVID-19 Cover.

The cover is provided by Allianz Assistance and covers emergency medical and associated expenses while abroad totalling £500,000 per customer – the highest value of policy offered by an airline to date, with no excess payment required.

The policy also covers expenses incurred up to £3,000 if a customer is denied boarding on either their departure or when returning from their destination – or has to quarantine due to positive or suspected COVID-19 during a trip.

Virgin Atlantic COVID-19 Cover joins the airline’s flexible booking policy to give as much choice as possible to customers as they make their future travel plans. Customers booking with the airline have the option to make two date changes to their flights, with rebooking available up until 30 September 2022.

Virgin Atlantic also recently announced that Flying Club members can now earn tier points on redemption flights .

Visit Virgin Atlantic to find out more.

Everything to Look For In a Travel Insurance Policy

W hile buying travel insurance makes every trip cost slightly more than it otherwise would, this coverage can also lead to considerable financial savings. If you become injured in a remote location and require emergency transportation, you come down with a sudden illness or flight cancellations leave you stuck somewhere for days, benefits in these plans can pay for medical expenses, incidental expenses like meals and hotel stays and more.

But, with so many travel insurance providers and plans to choose from, nailing down the right coverage with adequate policy limits is no easy feat. You also may not need all the benefits most travel insurance plans offer, or you may need more coverage than average to account for additional risks you have or the high cost of certain types of trips.

What Does Travel Insurance Include?

If you're on the hunt for travel insurance, working with an experienced travel agent can help you narrow coverage options to find the right fit. You should also understand the types of coverage these plans tend to include, when they apply and what they are made to protect against.

Common benefits found in travel insurance plans include the following:

Trip Cancellation Insurance

Trip cancellation coverage can kick in when a trip must be canceled for reasons beyond your control, such as the death of an immediate family member or a natural disaster making future travel impossible. This coverage typically applies to up to 100% of prepaid travel expenses, although a fixed dollar amount in coverage can also apply.

Trip Interruption Insurance

Trip interruption insurance comes into play when a trip comes to an end after it already begins. Coverage can apply when a trip is interrupted for a covered reason, such as the traveler having an accident or becoming ill during vacation. Coverage is typically for more than 100% of prepaid travel expenses since it reimburses travelers for prepaid expenses and additional costs required to return home.

Trip Delay Coverage

Travel delay insurance applies when a trip delay leaves travelers incurring additional costs. Delays typically need to be for at least three hours, six hours or longer depending on the plan, and this coverage pays for incidental expenses and hotel stays while consumers wait to depart.

Emergency Medical Coverage

Emergency medical coverage is crucial for overseas trips where American health insurance policies and government-sponsored health plans like Medicare don't apply. This coverage can pay for hospital stays, emergency medical treatment, prescription medication, X-rays and more when someone becomes sick or injured away from home.

Emergency Medical Evacuation

Evacuation coverage pays for transportation to the nearest hospital in the event of an emergency, whether it needs to happen in an ambulance, a helicopter or another mode of transportation. This coverage can also pay for transportation back to your home country so you can rest and recover.

Lost Luggage Reimbursement

This coverage reimburses travelers when their luggage and its contents is lost or stolen while in the care of a common carrier like an airline or cruise line. Coverage typically has a dollar limit that varies by policy.

Baggage Delay Insurance

Baggage delay insurance can pay for incidental expenses that occur when luggage is delayed by a common carrier for a certain period of time, usually at least six or 12 hours. This coverage can pay for items travelers need to buy while they wait, including clothing, charging cords for electronics, toiletries and other essentials.

Additional Travel Insurance Benefits

Most travel insurance policies also come with concierge services or access to a 24/7 hotline travelers can call into for emergency help. There are also additional benefits you can purchase for even more coverage, including these optional coverage options.

Cancel for any reason (CFAR) coverage: Optional cancel for any reason (CFAR) coverage helps travelers get reimbursed for some of their prepaid travel expenses when they cancel a trip for any reason at all. Adding this protection leads to higher insurance premiums, but the additional peace of mind can be worth it.

Pre-existing medical conditions waiver: Pre-existing medical conditions can be covered with some policies if certain conditions are met, such as the traveler buying coverage within 15 or 21 days of making an initial trip deposit. Coverage for pre-existing medical conditions varies by company and policy, so make sure to check requirements if you need this protection.

Rental car protection: You can also get rental car insurance with most travel insurance policies, although availability and coverage limits vary.

How to Find the Right Travel Insurance Coverage

The benefits listed above are the main types of coverage you can get with travel insurance , but remember that policies, included coverage, limits and exclusions vary from one company to the next.

This can be both a blessing and a cruise. While having more policies and coverage types to choose from lets you tailor coverage to your exact needs, it can make the process of buying travel insurance seem overwhelming.

Our advice? Look for plans that offer the most amount of coverage you can afford, especially when it comes to travel health insurance and emergency medical evacuation coverage. Also make sure you get coverage for pre-existing medical conditions if you need it, and that you understand any exclusions that apply. And if you feel too overwhelmed to shop around and read over various policies and their details, reach out to an experienced travel agent for help.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Virgin Voyages Travel Insurance - 2024 Review

Virgin voyages travel insurance - review.

- Strong Insurance Partner

- Easy To Buy At Check Out

- Poor Medical And Evacuation Cover

- Few Cancellation / Interruption Reasons

Sharing is caring!

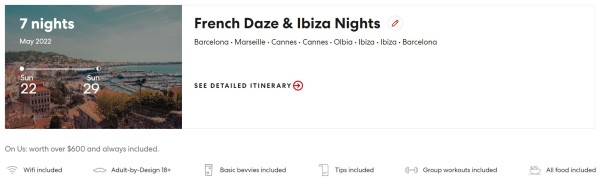

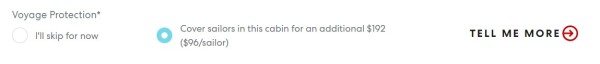

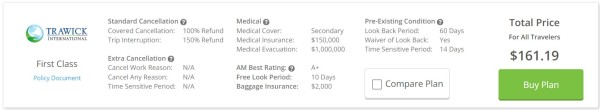

Virgin Voyages offers cruises to adults aged 18 and up (no children allowed) that feature high tech amenities, low environmental impact, and complimentary drinks and dining. Although Virgin Voyages offers a variety of cruises, cabin types, and dining options, they only offer a single option for travel insurance, which is their Voyage Protection plan.