UNCLASSIFIED

- Trip Entry Find the official distance between two locations.

- Interfacing

DTOD Version 37

Effective 10/15/2023

SDDC would like to welcome you to the new DTOD website.

Commercial Freight

DTOD assists commercial partners with mileage reporting to fulfill the DOD's need for commercial freight lines in support of US Military assets.

Convienent mileage calculations for permanent change of station or temporary duty for soldiers and commands.

DTOD TEAMS Transition

The DTOD website has transitioned from ETA to TEAMS

Please login here or at https://eta-teams.transport.mil

All existing ETA accounts have been migrated to TEAMS.

If you experience an issue with your TEAMS account please contact the SRC

DTOD version 37

The DTOD website version 37 is now live.

Support for FIPS codes within DTOD will be supported until

no longer required.

The Defense Table of Official Distances (DTOD) is the official source for worldwide distance information used by the Department of Defense (DoD). DTOD provides vehicular land distances for all DoD personal property, all DoD freight, and PCS/TDY travel needs. It generates point-to-point distances and routes for origin/destination pairs of locations. The DTOD website’s distance calculation and mapping functions provide road segment and cumulative distances over the network of truck-usable highways and roads in North America, South America, Europe, Africa, Oceania, and Asia.

You must have an approved DoD DTOD account, managed by SDDC's (TEAMS), to calculate distances and view maps and directions.

- Interfacing

DTOD 24 Hour HelpDesk

1-800-462-2176

- SRC Self-Service Website

- Send Us Your Feedback

- Cover Letters

- Jobs I've Applied To

- Saved Searches

- Subscriptions

- Marine Corps

- Coast Guard

- Space Force

- Military Podcasts

- Benefits Home

- Military Pay and Money

- Veteran Health Care

- VA eBenefits

- Veteran Job Search

- Military Skills Translator

- Upload Your Resume

- Veteran Employment Project

- Vet Friendly Employers

- Career Advice

- Military Life Home

- Military Trivia Game

- Veterans Day

- Spouse & Family

- Military History

- Discounts Home

- Featured Discounts

- Veterans Day Restaurant Discounts

- Electronics

- Join the Military Home

- Contact a Recruiter

- Military Fitness

Figuring Your PCS/OCONUS Travel Expenses

For a PCS move, you may be reimbursed for travel and transportation expenses incurred during the allowable travel days en route from the old duty station to the new. However, if the travel lasts a total of 12 hours or less, you may not be eligible for reimbursement of travel expenses.

Reimbursement of en route travel expenses is calculated using the Standard CONUS per diem rate. Current per diem rates are defined in the Joint Travel Regulation (JTR), Volume 2 or Department of State's Foreign Per Diem Rates Home Page .

The per diem rate consists of a lodging allowance, and a meals and incidentals (M&IE) allowance. Reimbursement for lodging may not exceed the actual lodging cost up to the maximum lodging allowance. When lodging is obtained from friends or relatives, reimbursement for the lodging portion is not authorized. M&IE is a fixed amount. The M&IE rate, or a fraction of it, is payable without itemization of expenses or receipts.

During the en route travel, you're in a duty status with no charge to your leave account. However, leave may be used in conjunction with the en route travel when approved by the supervisor and documented on the official travel orders.

Transportation expenses for you and your dependents will also be paid. When travel from the old duty station to the new one is via a privately owned vehicle (POV), a mileage allowance for the use of one POV to the port by the most direct route is authorized. You’re responsible for costs for any indirect route for personal reasons. If commercial transportation is used, the costs of the transportation plus reasonable taxi fares to and between terminals are allowed.

Dependent means the following:

- Children of the employee or the employee's spouse who are unmarried and under the age of 21.

- Children of the employee or the employee's spouse who are unmarried and who, regardless of age, are physically or mentally incapable of self support.

Also included is:

- Any illegitimate child, stepchild or adopted child or any grandchild of the employee or the employee's spouse who satisfies the criteria above.

- Any legal ward who satisfies the criteria above. A legal ward is generally defined as an unmarried person who (1) has been placed in the custody of the employee or the employee's spouse by a court of competent jurisdiction either permanently or for a period which lasts at least 12 months from the date of the order, (2) is dependent upon the employee or the employee's spouse for over one-half of the person's support, and (3) resides with the employee or the employee's spouse.

- Any dependent child who is under a legal guardianship of the employee or the employee's spouse and who also satisfies the criteria above. A guardian is an individual who is given the authority by a court of competent jurisdiction to take care of the person, property, and rights of another person. In this case, the person is a dependent child.

- Any child born after the employee's effective date of transfer when travel of the expectant spouse is prevented at the time of transfer because of the advanced stage of pregnancy or other reasons acceptable to the agency.

Procedures for filing En Route Travel

- To file an En Route travel voucher, submit the following:

- DD Form 1351-2 Travel Voucher or Subvoucher (PDF) .

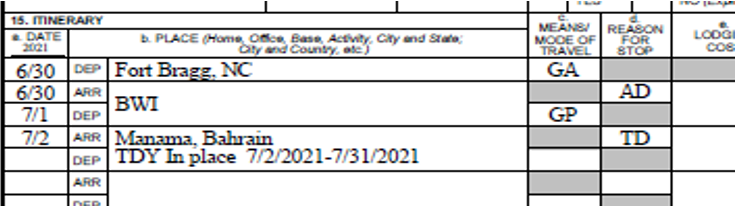

- Provide a detailed itinerary in block 15 showing daily travel, and the cities and states where lodging was obtained.

- Be sure to sign and date. Don’t write below signature block.

- Three copies of Travel Orders including amendments.

- Original and three copies of lodging receipts (claim lodging separately from lodging taxes).

- Copy of advance DD Form 1351, Travel Voucher (PDF) .

To get more PCS tips or information, visit Military.com's PCS/Home Buying Guide .

You May Also Like

Election Day is right around the corner. Are you ready to vote?

A St. Bernard mix named Bear, who had been missing for 2 years, is on the way to being located with his service member's...

HomeSafe Alliance, the Defense Department's overarching contractor for privatized household goods moves, will start arranging...

Here are the 2024 PCS and TDY/TAD privately owned vehicle mileage reimbursement rates.

PCS and Relocation Resources

- PCS Podcast

- Basic Allowances for Housing

- Base Guides

Select Service

- National Guard

Money Topics

- Find a VA Lender

- Home Ownership

- Military PCS and Relocation

- Retirement Central

- Personal Finance

Get the Finance and Discounts Newsletters

Get the scoop on discounts, pay, benefits, and our latest award-winning content. Right in your inbox.

View more newsletters on our Subscriptions page.

Verify your free subscription by following the instructions in the email sent to:

PCS Most Popular Articles

- Military and Overseas Absentee Voting: What You Need to Know Ahead of the Election

- Military Family Had to Move Before Finding Lost Dog. Two Years Later Came Tears of Joy

- Troops at 16 More Bases Will Do Local Household Goods Shipments Through New Private Manager

- 2024 Mileage Rates for Official Travel

- 5 Reasons to Pay Attention During the Military's Financial 'Touchpoint' Training

Pay News & Advice

- Unemployment Rate for Female Veterans Spikes to 7% in Latest Jobs Report

- More Options, Better Predictability: What Military Households Want from Their Retirement Plans

- Are You Ready for the Hottest Job Market of the Year? Our Newest Master Class

- The Best Discounts on Cars and Motorcycles for Service Members and Veterans

- Military Families Less Likely to Dip into Retirement Savings, Survey Says -- with One Big Exception

Family Relocation Tips

The creep of PCS anxiety is setting in. The torturous inner dialogue within ourselves is, “Do I look, or do I wait?”

Here are five great tips for ways military families can tackle their next PCS and still be smart about money.

Relocation can be a challenge, not only for you, but for your whole family. If you or your family is struggling to adjust to...

Whether you're an old pro or new to the military moving game, there's stuff to learn about PCSing. Here's our easy PCS 101...

Featured VA Loan Articles

IRRRL stands for Interest Rate Reduction Refinancing Loan,also known as a "Streamline" or a "VA to VA" loan.

These VA Home Loan FAQs ensures Military.com members are fully prepared to take advantage of this exclusive benefit.

A distinct advantage of using your VA loan is that you may not have to pay some of the additional fees normally paid at...

Official websites use .mil

Secure .mil websites use HTTPS

1-888-332-7411 Frequently Asked Questions

- 2021 Active Duty Pay Days

- 2021 Reserve Military Pay Days

- Understanding Your Pay

- Special & Incentive Pays

- Pay/Special Pay/Allowance Tables

- Adoption Reimbursement

- DoD Savings Deposit Program

- Family Separation Allowance

- Special Leave Accrual - AC

- Special Leave Accrual - RC

- A little about pay deductions

- Pay Allotments

- Servicemember's Group Life Insurance

- Family Servicemember's Group Life Insurance

- Federal/State Tax Withholding

- Travel Pay Information

- Army Active Duty PCS

- Army Active Duty TDY

- Army Reserve Duty TDY

- Contingency Travel

- COVID-19 Army PCS Stop Movement

- Evacuations

- International Military Training

- Check Voucher Status

- Process Steps

- Where to Submit Claim

- SmartVoucher

- Travel Voucher Direct

- Regulations

- Defense Travel System

- Customer Service

- General Info

- Navy SDC Instructions

- Air Force/Space Force SDC Instructions

- Marine SDC Instructions

- Wounded Warrior Pay Support

- Family Support Debit Card

- Disability Pay Estimator

- Need a tax statement?

- SITW Exemptions_CO

- CZTE for Sinai Peninsula

- FITW changes for Puerto Rico

- TSP Options for Active Duty Army, Navy, Air Force & Space Force

- TSP Option for Army, Navy & Air Force Reserve, National Guard

- TSP Spillover Contributions

- Military Employment Verification

Army TDY Frequently Asked Questions

- What version of the DD1351-2 Travel Voucher Form should I use? When completing you travel voucher, please use the DD 1351-2 dated May 2011. The date can be found in bold on the bottom left of the document. No other version of the DD 1351-2 will be accepted.

- How do I fill out my travel voucher? Page 2 of the DD Form 1351-2 has instructions on completing the form. For a step-by-step guide to help fill the form out, click here . The numbers listed in the instructions correspond to the numbers shown in the blocks on the DD 1351-2. Alternatively, you can also use the SmartVoucher tool online at: https://smartvoucher.dfas.mil/voucher/ . The SmartVoucher makes it easier to complete travel vouchers by guiding you step-by-step through a series of questions to create a completed DD Form 1351-2 travel voucher. Based on your responses, you’ll also receive a list of required documents to gather and submit alongside your DD Form 1351-2. As a reminder, don't forget to print and obtain required signatures on the DD Form 1351-2 before submitting. Note: SmartVoucher is not for those using DTS (Defense Travel System) for their travel vouchers.

- Military Temporary Duty (TDY) travel

- Civilian Temporary Duty (TDY) travel

- Civilian Relocation (PCS) travel

- Military TDY travel and Civilian TDY travel can use SmartVoucher to guide individuals through a series of questions to complete a DD 1351-2. Don't forget to print the form to get the required signatures before submitting.

- Not for those using DTS (Defense Travel System) for their travel vouchers.

- What documents are required when filing a travel claim? For a list of required documents, please see ‘Document’ under the appropriate TDY travel type here . It’s important to keep in mind that the different types of TDY Travel orders each have its own characteristics and document submission requirements. Your TDY will be outlined in your travel orders, which will contain your authorized entitlements to include: transportation mode, duration of TDY, lodging, meal rate and any other authorized miscellaneous expenses. When submitting your TDY Travel Voucher, it’s important to make sure that all necessary documentation is included with your voucher. This will help ensure that your voucher is processed and paid accurately and quickly. For additional information, the Joint Travel Regulations (JTR) are for members of the Uniformed Services of the United States and DoD civilian employees and civilians who travel using DoD funding. The JTR contains regulations related to per diem, travel and transportation allowances, relocation allowances, and certain other allowances. TDY grants authorization for you to perform work away from the permanent duty station.

- May I submit my Temporary Duty (TDY) claim via email? Once you have completed your voucher and gathered all required documents, please see ‘Submission Instructions’ listed under the appropriate TDY travel type here . It’s important to keep in mind that the different types of TDY Travel orders are not the same and each have its own characteristics and submission requirements. While email is often an available submission method, you may have other submission methods available to you as well.

- What happens if I submit my voucher more than once? It is recommended that you only submit your claim once. If a claim is submitted multiple times, the potential for duplicate payments increases resulting in the traveler being placed in a debt status. Once your submission has been logged into our payment system you will receive notification that the claim has been received. To check the status of your voucher , click here . Please note: this feature is only available on a CAC enabled computer.

- What if my voucher is incomplete or incorrect? If all the necessary documentation is not present at the time of processing, then the claim cannot be fully paid. Therefore, using all the available documentation provided, the claim may be partially paid. Upon payment, an explanation is annotated on the advice of payment (AOP) to inform the traveler why the full entitlement was not paid. Resubmit the claim with the missing documentation and/or addressing the explanation that was noted on the AOP and the remainder of the claim will be paid. In the event the incomplete or incorrect information makes the claim unpayable in its entirety, the claim will be returned with an explanation annotated as to why the claim could not be paid. Resubmit the claim with the missing documentation and/or addressing the explanation that was noted on the AOP and the claim will be paid.

- What is an accrual/partial payment? When your TDY is expected to last 31 days or more, this is considered a long term TDY. When on long-term TDY you can submit a travel claim for each 30 day period, known as an accrual/partial payment. Each accrual request should indicate the 30 day period being requested. A final settlement is required upon completion of travel and any travel advances received will be collected.

- May a traveler be reimbursed for baggage fees? Yes, a traveler may be reimbursed for accompanied baggage fees and excess accompanied baggage fees if the cost of these fees is authorized or approved on a temporary duty (TDY) order. For excess accompanied baggage, the authorizing or approving official must decide if the baggage is required for official duty and unavailable at the TDY location. See the JTR, par. 020207-C1 and C2 . To determine if baggage fees may be claimable as part of your TDY, please see ‘Transportation Allowances’ listed under the appropriate TDY travel type here .

- Why was lodging not paid even though I submitted a receipt? Receipts are required for lodging regardless of amount per DODFMR 7000.14R Vol 9, chp 8. The receipt must show when specific services were rendered or articles purchased and the unit price. Express checkout receipts from hotels do not show that all items charged were paid in full. Without proof of payment, the document is simply a bill.

- Does the Government meal rate or proportional meal rate apply on the first and last days of travel? No, the Government meal rate or proportional meal rate does not apply on the first and last days of travel.

- Am I eligible for a travel advance? How do I request an advance? Your orders must state that you are a non-charge card-holder or travel circumstances prohibit the use of a charge card. Complete the DFAS form 9114 and submit with a copy of your orders. You may request an advance any time prior to travel but an advance can only be processed 10 days prior to departure. IMPORTANT: Advances are limited to 80% of lodging, meals, and miscellaneous expenses. Email a copy of your Travel Orders and a TDY Travel Advance Request Form to: [email protected]

- Can the Customer Service Representative (CSR) correct my Bank information? No. Military members as well as civilian employees should log in to myPay and update their Travel pay bank information in order to ensure funds are deposited properly. Any banking updates made via myPay may take up to 48-72 hours to take effect, so please allow time for this information to update before submitting your claim for payment. For travelers other than military members and civilian employees, please submit a voided check and/or a SF1199 with your travel claim. Upon receiving the claim, the bank information will be updated by Travel Pay personnel.

- Are communication services such as long distance telephone calls home while on official TDY reimbursable? Communication services are covered in the incidental expenses portion of per diem rate and are not reimbursable separately. Gov’t owned/leased services should be used for official communications. Expenses, such as cell phone or prepaid minutes use, necessary for official TDY travel are mission-related expenses and not payable under JTR authority. To determine your reimbursable expenses, please see ‘Per Diem’ and ‘Misc Reimbursable Expenses’ listed under the appropriate TDY travel type here.

- Is a Service member required to stay in Government quarters at an Integrated Lodging Program (ILP) site? A Service member must use adequate and available Government quarters when assigned to a U.S. installation. See the JTR, par. 020303-B for more information. If Government quarters are inadequate or unavailable at ILP sites, a DoD Service member must use DoD Preferred Lodging. The DTMO publishes a list of ILP sites.

- What is the difference between centrally billed account (CBA) and individually billed account (IBA)? A CBA is when the traveler makes their airfare reservations through a contract travel office (CTO), but they do not have to personally purchase that ticket. The CTO charges the airfare costs to a CBA and submits a claim for reimbursement to Commercial Pay for direct reimbursement. An IBA is when a traveler makes their airfare reservations through a CTO and they had their government issued travel charge card charged for the amount of the ticket. The traveler now has an out- of -pocket expense that they can claim on their travel voucher. All travel orders are required to state whether transportation tickets were personally purchased by the traveler through an individually billed account (IBA) or if they were purchased by the government through a centrally billed account (CBA). If the orders do not state which method was used, then the expense is not reimbursable until purchasing the ticket by IBA is authorized. This can be accomplished with an amended order authorizing IBA or an Approving Official (AO) can authorize use of IBA after the travel has been performed by Signing and dating in AO blocks 21a and 21d on 1351-2 and writing in block 22 or block 29 “IBA is authorized.”

- How do I record transportation tips? Taxi or transportation tips are reimbursable but not as separate reimbursable expenses. Add the cost of the tip into the taxi or other transportation fare for reimbursement. Per JTR Table 2-13 “If a traveler claims any mandatory or customary transportation tips for a taxi or limousine service, then he or she may include up to 20% of the fare (the maximum allowed amount for a tip) as part of the total fare amount claimed. The tip is not separately reimbursable.” To determine your reimbursable expenses, please see ‘Transportation Allowances’, ‘Per Diem’, and ‘Misc Reimbursable Expenses’ listed under the appropriate TDY travel type here.

- What is the local area and is there a set radius or maximum number of miles? The local area is not a set radius or a maximum number of miles. See the JTR, Section 0206 for information on the authority to establish the local area. The authority who sets the local commuting area of the PDS or TDY must not establish an arbitrary distance that is based on radius. See 59 Comp. Gen. 397 (1980) . For the Washington, DC area, see DoD Instruction 4515.14, “Washington Local Commuting Area.”

- What is the current Privately Owned Vehicle (POV) mileage rate for Temporary Duty (TDY) and In and Around mileage reimbursement? The current rate is updated annually and can be found at http://www.defensetravel.dod.mil within the Travel & Transportation Rates tab.

- I drove my Privately Owned Vehicle (POV) to the Temporary Duty (TDY) location, but was not fully paid the mileage and lodging costs I incurred on the way. Why? On occasion, TDY orders may state POV is limited to constructive cost of travel (CCT), which means mileage and lodging incurred on the way to the TDY point is limited to the cost of a government contracted airline ticket for the same route. In some cases, it may have been cheaper for the Government to fly you to the TDY point as opposed to the mileage and lodging costs actually incurred.

- How is travel distance and time calculated when traveling by POV on TDY? A traveler who is authorized TDY travel by POV is allowed one day of travel for every 400 miles between authorized points. See the JTR, par. 020302-A. If the POV use is for the traveler's convenience, the traveler is authorized only 1 travel day for each leg.

- How much per diem is allowed for a particular Temporary Duty (TDY) location? Visit the following web site for per diem rates: http://www.defensetravel.dod.mil . Under Travel Regulations and Allowances, select per diem. Under quick links select per diem rates query.

- What per diem rate does a Service member receive if the Service member uses commercial lodging instead of available Government quarters? When Government quarters are available on the U.S. installation where a Service member is on temporary duty, but the Service member chooses to use commercial lodging, lodging reimbursement is limited to the cost of the Government quarters. See the JTR, Table 2-14, item 6. Per diem may not be limited based on the presence of nearby Government quarters on another installation or facility.

- How much incidental expenses are reimbursed as part of the Meal and Incidentals (M&IE)? For Temporary Duty (TDY) locations within the continental United States (CONUS), an incidental expense of $5.00 is reimbursed daily. If ordered to a military installation outside the continental United States (OCONUS) where adequate government quarters are available, an incidental expense of $3.50 is reimbursed daily.

- Does a traveler receive a different M&IE rate for the first and last days of travel? Yes, a traveler receives 75 percent of the applicable M&IE rate for the day of departure from the permanent duty station and the day of return to the permanent duty station. See the DTMO website for current per diem rates.

- I am a reservist on Temporary Duty (TDY). My orders state that duty is inside of commuting distance and that government meals and quarters are not available. Will I be paid per diem? No. When your command has determined that duty is being performed within the normal commuting area of your permanent duty station (PDS), per diem is not payable.

- I am on Temporary Duty (TDY) en route to my next permanent duty location. Where and how do I file my monthly accruals? If you are on extended TDY (anything over 30 days) while on Permanent Change of Station (PCS) orders, you may submit an accrual for the TDY portion only to DFAS-Rome TDY. To file monthly accruals, you must file a travel claim DD Form 1351-2 with all orders and receipts. This can be submitted via email to: [email protected] . Once the TDY is complete, you will need to see your gaining Army Military Pay Office (AMPO) for your PCS entitlements.

Your version of Internet Explorer is out of date. It has known security flaws and can cause issues displaying content on this page, and other websites.

Learn how to update your browser

- Organization

- Quality of Life

- Army Worldwide

- Press Releases

- Soldier Features

- Publications

- Under Secretary

- Chief of Staff

- Vice Chief of Staff

- Sergeant Major of the Army

- Public Affairs

- Social Media Guide

Joint Travel Regulations

By Crystal Washington July 26, 2021

- Share on Twitter

- Share on Facebook

- Share on Reddit

- Share on LinkedIn

- Share via Email

From the Defense Travel Management Office (DTMO) website: The Joint Travel Regulations (JTR) implements policy and law to establish travel and transportation allowances for Uniformed Service members (i.e., Army, Navy, Air Force, Marine Corps, Coast Guard, National Oceanic and Atmospheric Administration Commissioned Corps, and Public Health Service Commissioned Corps), Department of Defense (DoD) civilian employees, and others traveling at the DoD’s expense.

The Per Diem, Travel, and Transportation Allowance Committee (PDTATAC) has oversight of the JTR. The Defense Travel Management Office serves as the administrative staff for the PDTATAC by developing, administering, and maintaining the JTR.

Joint Travel Regulations (dod.mil)

RELATED STORIES

- June 15, 2024 Army names the M-SHORAD after Vietnam War Medal of Honor recipient

- March 28, 2024 Army Exceptional Family Member Program Central Office will better support Soldiers and families

- March 26, 2024 Army recognizes leaders in energy and water management for FY 2023

- January 3, 2024 Army awards contract for HADES prototyping efforts

- April 12, 2022 U.S. Army STAND-TO! | Army Organic Industrial Base Modernization Implementation Plan

Social Sharing

- DTS is Operational Updated: 09/06/2024

- Authentication

- Document Signing

- Reporting Services

- Import/Export Services

- Receipt Services

- Travel Office Data Sync

- Ext: Air Availability (Google ITA)

- Ext: Accounting/Disbursement (GEX)

- Ext: Hotel/Car Availability (Sabre/Worldspan)

- Ext: Mileage Calculations (DTOD)

- Ext: Defense Lodging System (DLS)

- Ext: Archiving Services (DMDC)

Activate account

It looks like this is your first time logging into DTS. Your user account needs to be activated before you can create travel documents.

Defense Travel System

Your travel management hub for dod trips.

Military members and DoD Civilian personnel can book official travel and manage travel expenses.

How It Works

Book your travel.

with all the reservations you need, estimate expenses, and request advanced payments

Receive Approvals

for your travel plans and known expenses before and after you travel

Keep Records Up to Date

with your travel plans and expenses before and during your trip

Input Final Expenses

and attach receipts and records when you return from your trip

Get Reimbursed

back to your bank account, Government Travel Charge Card (GTCC), or both

DoD Travel News

- Safeguarding Against Common Disruptions during Official Travel

- Major Changes to Temporary Quarters Subsistence Expenses Allowance

- Updated CDC Pet Dog Importation Regulation Goes into Effect August 1

- DoD Approves Reimbursement for Transportation or Shipment of Breast Milk During PCS

- Travelers MUST Re-Book Certain Rental Car Reservations Immediately

DTS Notices

There are no DTS Notices available.

Travel Resources

Learn how to use the DTS system through online videos and more

Instant message with a real person Mon - Fri 8am - 6pm ET

Save time at the airport and find out how you can participate for free

Access the Joint Travel Regulations and other travel policies

Need More Assistance?

Services for You

Official websites use .mil

Secure .mil websites use HTTPS

- Login to DTS

- Per Diem Rate Lookup

- Frequently Asked Questions

Related Resources

- Per Diem Files

- CONUS Meals & Incidentals Breakdown

- Foreign Meals & Incidentals Breakdown

Per diem is a set allowance for lodging, meal and incidental costs incurred while on official government travel. Calculation of travel per diem rates within the Federal government is a shared responsibility of the General Services Administration (GSA) , the Department of State (DoS) , and the Defense Travel Management Office (DTMO). DTMO publishes revised per diem rates in the Federal Register via a Civilian Personnel Per Diem Bulletin. Please see the Federal Register to access previously published Civilian Personnel Per Diem Bulletins.

First & Last Day of Travel

On the day of departure from the permanent duty station and on the day of return, a traveler receives 75 percent of the applicable M&IE rate regardless of departure or return time. Exemptions or waivers to this rule are not permitted.

The M&IE rate for the day of departure from the permanent duty station is the locality rate at the temporary duty location. The M&IE rate for the day of return to the permanent duty station is the M&IE rate at the last temporary duty location.

The 75 percent rule also applies to the day of departure from a previous permanent duty station and the day of arrival to a new permanent duty station in certain instances, depending on whether the traveler is a civilian employee or a Service member. See JTR Section 0503 for more information on per diem for Service members, and Section 0539 for more information on per diem for civilian employees.

The Government meal rate or proportional meal rate does not apply on the first and last days of travel.

If a traveler has a stopover when traveling to or returning from the temporary duty location, the traveler receives the M&IE rate for the stopover point. If return travel to the permanent duty station requires more than one day, and additional stopovers are required, per diem for the last day of travel is based on the M&IE rate at the last stopover location.

Rate Review

If the per diem rate for a location is too low, Military Advisory Panel (MAP) or Civilian Advisory Panel (CAP) members, DoS Office of Allowances, GSA Office of Government-Wide Policy, or an appropriate Federal Agency Travel Manager may request a rate review. Responsible Agencies should email non-foreign OCONUS rate review requests to [email protected] . U.S. Government personnel should contact their appropriate Federal Agency Travel Manager to request a rate review for a CONUS or foreign location. Responsible Agencies should follow the instructions provided on the GSA or DoS websites.

An out of cycle Rate Review Request should include:

- A letter on agency letterhead with a signature. The letter should identify the location, the insufficiency of the local per diem rate, the number of Government employees or Uniformed Service personnel impacted, and the number of times AEA was used in the previous year by travelers to the location.

- A complete Hotel and Restaurant Report (DS-2026) providing up-to-date price data from the location.

- Documentation verifying all price data reported in the attached DS-2026.

Rate review requests must be submitted in coordination with the agency or component’s chain-of-command. Submit the rate review request via one of the following:

- Uniformed Services. Local commanders must forward all rate review requests to the Service’s Military Advisory Panel (MAP) member for submission to the DTMO PRB for review. See MAP member contact information .

- DoD Civilian Employees. DoD component heads must forward all rate review requests to the appropriate Civilian Advisory Panel (CAP) member for submission to the DTMO PRB for review. See CAP member’s contact information .

- DoS Employees. The DoS Office of Allowances is responsible for submitting all non-foreign OCONUS rate review requests originating in the DoS to the DTMO PRB for review.

- GSA Employees. The GSA Office of Government-wide Policy is responsible for submitting all non-foreign OCONUS rate review requests originating in GSA to the DTMO PRB for review.

- All other Government Employees. Federal Agency Travel Managers are responsible for submitting all other non-foreign OCONUS rate review requests to the DTMO PRB for review. Email requests to [email protected] .

For more information, review further guidance on per diem reporting procedures and responsibilities [PDF, 4 pages] . For additional questions, email the DTMO Policy and Regulations Team .

If an authorizing official (AO) knows that lodging or meal costs during travel will be lower than usual due to prearrangements, special discounts, or other reasons, the AO may request a reduced per diem rate. A reduced per diem rate must be authorized before travel begins.

Requests for reduced per diem are submitted to the appropriate Military Advisory Panel (MAP) or Civilian Advisory Panel (CAP) representative. Requests must include the established lodging and meal costs, the traveler’s name, travel dates, the TDY location, the point of contact’s name and phone number for the request, and the recommended reduced per diem rate.

IMAGES

VIDEO

COMMENTS

Mileage Rates - Defense Travel Management Office

How Far Can We Drive Each Day of our PCS?

2024 Mileage Rates for Official Travel

One travel day is allowed for each 350 miles using the most direct route. If the additional distance is over 50 miles after dividing the total mileage by 350, one additional travel day is allowed. When the total official distance is 400 or fewer miles, 1 day of travel time is allowed. No per diem is allowed for travel less than 12 hours.

Defense Table of Official Distances: DTOD

permanent change of station (pcs - Army Garrisons

receive $151.00 per travel day. If traveling by "convoy", a second driver counts as a family member. Family member(s) 12 years or older receive $113.25 and family member(s) under 12 receive $75.50 per travel day. See chart below. ** Per Diem is based on 350 miles per day for the official distance; is paid for each authorized travel day(s) or ...

PER DIEM, TRAVEL, AND TRANSPORTATION ALLOWANCE COMMITTEE ... Mileage Rates

A traveler who is authorized PCS travel by POV is allowed one day of travel for the first 400 miles between authorized points. For any distance greater than 400 miles, the traveler is allowed another day of travel for every additional 350 miles. See the JTR, par. 050205. Other Mileage Rate

-The mileage rate is $0.18 per mile, per authorized vehicle. -The TDY mileage rate is $0.585 per mile. -Authorized travel days are computed by official mileage. The first day of travel is 400 miles, each additional day is 350 miles. PER DIEM is a flat rate paid to the service member and a percentage paid to dependents for meals and lodging in ...

Created Date: 6/10/2022 2:54:17 PM

Service Member PCS Travel Time Computation when ...

The mileage rate is $0.22 per mile, per authorized vehicle. The TDY mileage rate is $0.625 per mile. Authorized travel days are computed by official mileage. The first day of travel is 400 miles, each additional day is 350 miles. PER DIEM is a flat rate paid to the service member and a percentage paid to dependents for meals and lodging in route.

For a PCS move, you may be reimbursed for travel and transportation expenses incurred during the allowable travel days en route from the old duty station to the new. However, if the travel lasts a ...

Army TDY Frequently Asked Questions

Frequently Asked Questions. Choose a topic to view answers to common questions related to DoD travel policies and programs. Access more than 800 additional FAQs [login required] in the TraX Knowledge Center.

According to the Defense Travel website's FAQs, "A traveler who is authorized PCS travel by POV is allowed one day of travel for the first 400 miles between authorized points. For any distance greater than 400 miles, the traveler is allowed another day of travel for every additional 350 miles. See the JTR, par. 050205.".

How to Calculate Local POV Mileage Allowances

You're only supposed to drive 350-400 miles per day, that is how they determine your travel days. You will get the per diem for each of those days as long as you don't sign in early (ie take 6 days to arrive instead of 8). For my last PCS they didn't want any hotel receipts, I camped half the nights, and I was paid the full per diem. Need more ...

The Per Diem, Travel, and Transportation Allowance Committee (PDTATAC) has oversight of the JTR. The Defense Travel Management Office serves as the administrative staff for the PDTATAC by ...

-The mileage rate is $0.21 per mile, per authorized vehicle. -The TDY mileage rate is $0.67 per mile. -Authorized travel days are computed by official mileage. The first day of travel is 400 miles, each additional day is 350 miles. PER DIEM is a flat rate paid to the service member and a percentage paid to dependents for meals and lodging in route.

Defense Travel System

Per Diem - Defense Travel Management Office